The stock market is a dynamic and unpredictable place, and the recent trend of US stock futures dropping has investors on edge. But what does this mean for those looking to invest or already holding stocks? In this article, we'll delve into the reasons behind the decline and what it could mean for the future of the market.

Understanding the Decline

The decline in US stock futures can be attributed to several factors. One of the primary reasons is the increasing concerns about the global economy. As the COVID-19 pandemic continues to impact various parts of the world, businesses are facing unprecedented challenges, leading to a decrease in demand and, consequently, a drop in stock prices.

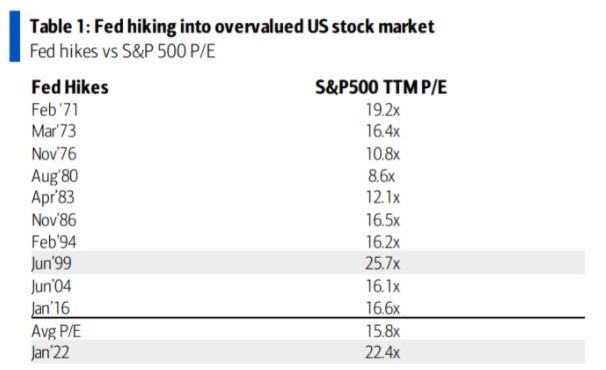

Inflation and Interest Rates

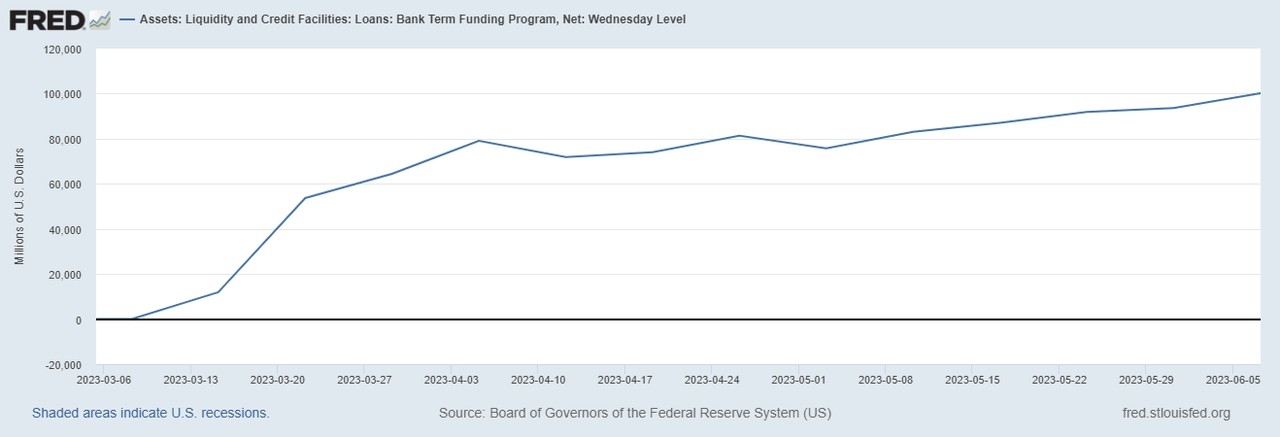

Another factor contributing to the decline is the rising inflation and interest rates. The Federal Reserve has been raising interest rates to combat inflation, which has led to higher borrowing costs for businesses and consumers. This, in turn, has caused investors to become more cautious and sell off their stocks, leading to a drop in stock futures.

Geopolitical Tensions

Geopolitical tensions, particularly those involving major economies such as China and the United States, have also played a significant role in the decline of US stock futures. These tensions have raised concerns about trade wars and other economic disruptions, leading to uncertainty in the market.

Impact on Investors

So, what does this mean for investors? If you're considering investing in the stock market, it's important to understand that the current decline in stock futures is a sign of caution and uncertainty. While it's difficult to predict the future of the market, it's essential to do thorough research and consider the following factors:

- Diversification: Diversifying your portfolio can help mitigate the risks associated with the stock market. By investing in a variety of assets, you can reduce the impact of a decline in any single stock or sector.

- Long-term Perspective: The stock market is known for its volatility, and short-term fluctuations can be misleading. It's important to maintain a long-term perspective and avoid making impulsive decisions based on short-term trends.

- Risk Management: Understanding your risk tolerance and managing your investments accordingly is crucial. This includes setting realistic goals and not investing more than you can afford to lose.

Case Studies

To illustrate the impact of stock futures dropping, let's consider a few case studies:

- Tesla: The electric vehicle manufacturer saw its stock futures drop significantly after reporting lower-than-expected earnings. This decline was attributed to concerns about the company's ability to meet its production targets and rising costs.

- Apple: The tech giant's stock futures also experienced a decline after the company reported lower-than-expected revenue for the first time in 13 years. This decline was attributed to slowing demand for its products and concerns about the global economy.

Conclusion

The recent trend of US stock futures dropping is a sign of caution and uncertainty in the market. While it's difficult to predict the future, investors should remain vigilant and consider the factors mentioned above when making investment decisions. By doing so, they can navigate the challenges of the stock market and potentially benefit from future opportunities.