In today's rapidly evolving technology landscape, understanding where and how to invest in major players is crucial for any investor. One such company that has made significant strides in the semiconductor industry is SK Hynix. But can you buy SK Hynix stock in the US? Let's dive into this question and explore the ins and outs of investing in this global tech giant.

Understanding SK Hynix

SK Hynix is a leading global manufacturer of DRAM and NAND flash memory chips. The company, headquartered in South Korea, has a strong presence in the global market, with a significant share in the semiconductor industry. Its products are used in a wide range of devices, from smartphones and computers to data centers and automotive electronics.

Investing in SK Hynix Stock in the US

So, can you buy SK Hynix stock in the US? The answer is yes, you can. SK Hynix is listed on both the South Korean Stock Exchange (KRX) and the New York Stock Exchange (NYSE). This dual listing makes it accessible to U.S. investors looking to invest in one of the world's largest semiconductor companies.

To buy SK Hynix stock in the US, you have a few options:

Direct Purchase on the NYSE: If you have a brokerage account, you can directly purchase SK Hynix stock on the NYSE under the ticker symbol SHIXY.

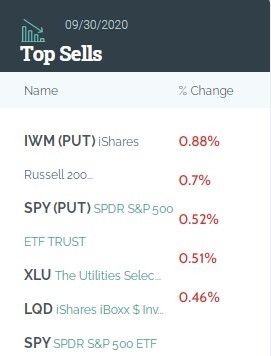

Through an ETF: Some exchange-traded funds (ETFs) focus on the semiconductor sector and may include SK Hynix or its equivalent. Investing in such an ETF can be a way to gain exposure to the company without having to buy individual stocks.

Through a Mutual Fund: Similar to ETFs, some mutual funds may also have exposure to SK Hynix or similar companies. This is another way to indirectly invest in the company.

Considerations Before Investing

Before diving into SK Hynix stock, it's important to consider a few factors:

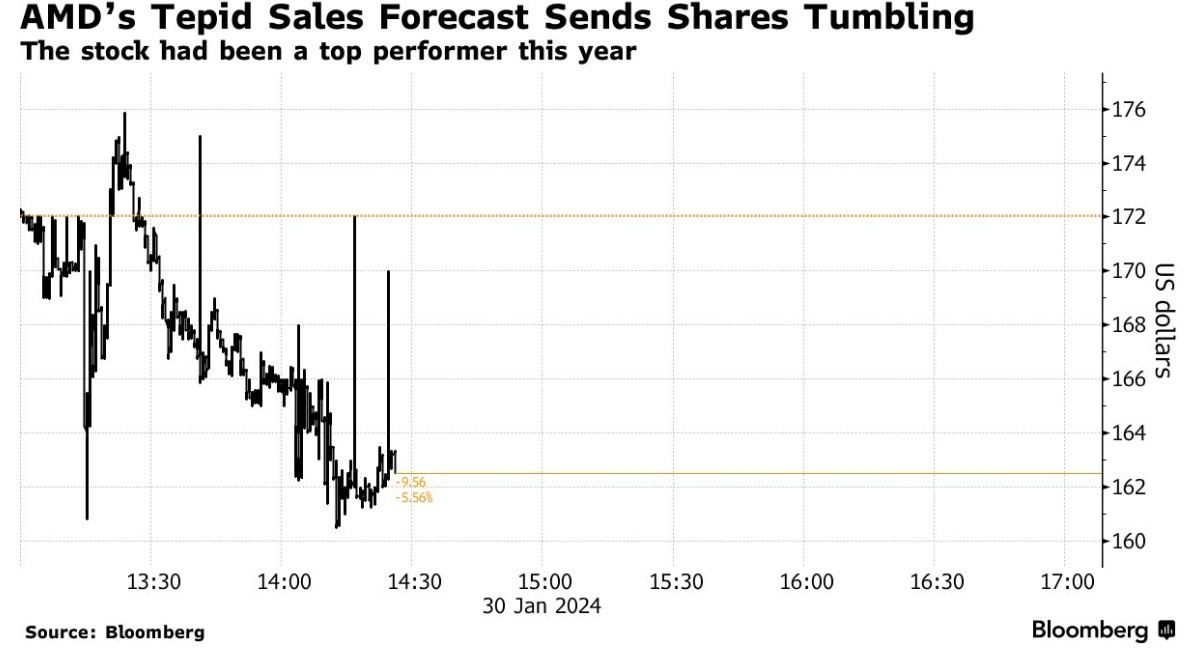

Market Volatility: The semiconductor industry is known for its volatility. Prices can fluctuate widely based on supply and demand dynamics, technological advancements, and global economic conditions.

Regulatory Risks: As a company operating in the global market, SK Hynix may be subject to various regulatory risks, including trade policies and export controls.

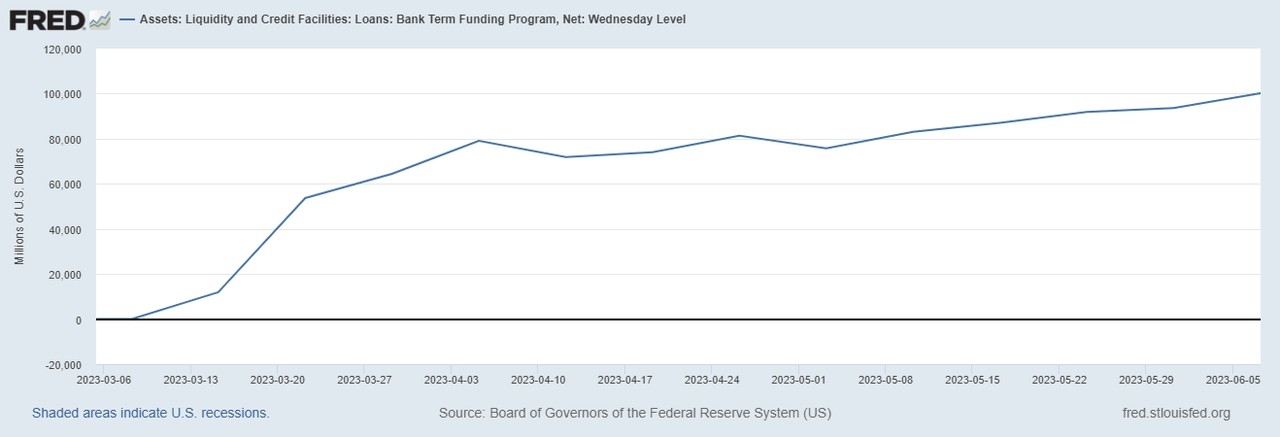

Economic Factors: The global economy, particularly in regions like China and the US, can significantly impact the semiconductor industry and, by extension, SK Hynix's performance.

Case Study: Apple and SK Hynix

A prime example of the interplay between SK Hynix and global economic factors is the relationship with Apple. Apple is one of SK Hynix's major customers, and the demand for Apple's products often correlates with SK Hynix's sales. During the COVID-19 pandemic, when demand for Apple's products surged, SK Hynix's sales and profits also saw significant growth.

In conclusion, investing in SK Hynix stock in the US is possible through various means, including direct purchase on the NYSE or through ETFs and mutual funds. However, it's crucial to be aware of the risks and market dynamics before making any investment decisions.