In today's fast-paced financial world, investors are constantly seeking ways to analyze market trends and make informed decisions. One powerful tool that has gained significant attention is the US dollar stock graph. This article delves into the intricacies of this graph, explaining its significance, how to interpret it, and providing real-world examples to illustrate its application.

Understanding the US Dollar Stock Graph

The US dollar stock graph is a visual representation of the relationship between the US dollar and the stock market. It is used to analyze how the value of the US dollar affects the performance of stocks. This graph typically includes two lines: one representing the US dollar index and the other representing the stock market index.

How to Interpret the Graph

The US dollar stock graph can provide valuable insights into market trends and potential investment opportunities. Here's how to interpret it:

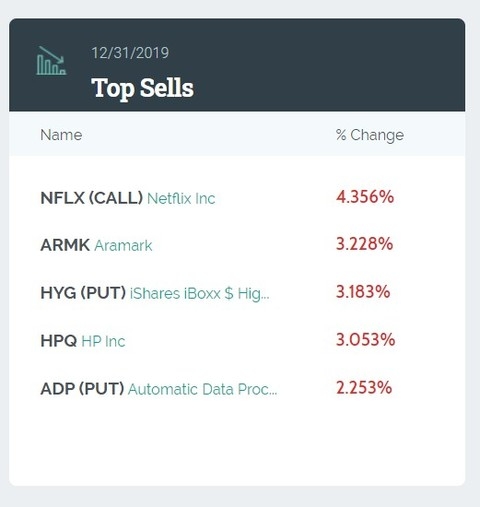

Trend Analysis: Look for patterns and trends in the graph. For instance, if the US dollar index is rising while the stock market index is falling, it may indicate a bearish market sentiment.

Correlation: Analyze the correlation between the two lines. If they move in the same direction, it suggests a positive correlation, while moving in opposite directions indicates a negative correlation.

Support and Resistance: Identify key levels of support and resistance on the graph. These levels can indicate potential entry or exit points for investors.

Real-World Examples

Let's examine a few real-world examples to better understand the US dollar stock graph:

2008 Financial Crisis: During the 2008 financial crisis, the US dollar index surged as investors sought safe-haven assets. At the same time, the stock market experienced a significant decline. This demonstrates the inverse relationship between the US dollar and the stock market during times of market turmoil.

2020 COVID-19 Pandemic: In early 2020, the US dollar index surged as the pandemic took hold. However, as the global economy recovered, the stock market began to recover as well, leading to a divergence between the two lines. This example highlights the importance of considering various factors when analyzing the US dollar stock graph.

Key Takeaways

- The US dollar stock graph is a valuable tool for analyzing market trends and potential investment opportunities.

- Understanding the correlation and trend analysis of the graph can help investors make informed decisions.

- Real-world examples demonstrate the effectiveness of the US dollar stock graph in predicting market movements.

By familiarizing yourself with the US dollar stock graph and its interpretation, you can gain a deeper understanding of the market dynamics and make more informed investment decisions.