In the United States, the stock market and the presidential election are two of the most influential forces shaping the country's economic landscape. The interplay between these two elements is a critical factor for investors, businesses, and the general public. This article delves into the relationship between stocks and the US election, exploring how political shifts can impact the market and vice versa.

Understanding the Stock Market's Response to the US Election

The stock market's reaction to a US election can be quite volatile. Historically, there have been various trends that investors and analysts have observed. For instance, during the past few elections, the stock market has experienced both gains and losses.

Historical Trends

- Presidential Election Year Gains: Generally, the stock market tends to perform well during presidential election years. This can be attributed to the anticipation of potential tax cuts, deregulation, and other policies that could boost the economy.

- Midterm Elections: Midterm elections, on the other hand, often lead to market uncertainty and volatility. This is due to the possibility of political gridlock and policy changes that could affect the market.

The Impact of Policy Changes

One of the primary reasons why the stock market reacts to the US election is the potential for policy changes. For example, during the 2016 election, President Donald Trump's victory led to a significant rally in the stock market. This was largely due to his promises to cut taxes, reduce regulations, and invest in infrastructure.

Case Study: The 2016 Election

In the 2016 election, Donald Trump's victory sparked a surge in the stock market. The S&P 500 index, for instance, gained nearly 25% from Election Day to the end of the year. This was driven by optimism over his economic policies, including tax cuts and infrastructure spending.

Political Gridlock and Market Volatility

However, political gridlock can also lead to market volatility. For example, during the Obama administration, the stock market experienced several periods of volatility due to political disagreements and policy debates.

The Role of Interest Rates

Another factor that can impact the stock market during the US election is interest rates. The Federal Reserve's monetary policy can significantly influence the market, and changes in interest rates can lead to market fluctuations.

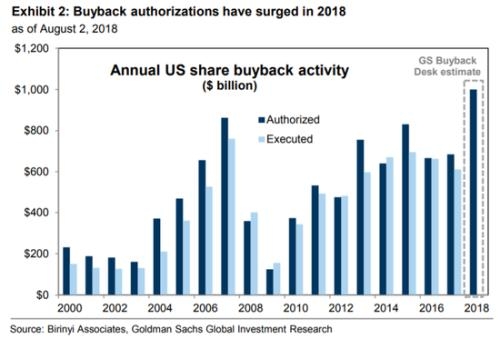

Case Study: The 2018 Midterm Elections

In the 2018 midterm elections, the stock market experienced increased volatility. This was due to the possibility of political gridlock and policy changes. Additionally, the Federal Reserve's decision to raise interest rates contributed to market uncertainty.

Conclusion

The relationship between stocks and the US election is complex and multifaceted. Political shifts can significantly impact the market, while the market's reaction can also influence political decisions. As investors and businesses navigate the ever-changing landscape, understanding this relationship is crucial for making informed decisions.