The US stock market has long been a beacon for investors worldwide, reflecting the economic health and growth potential of one of the world’s most powerful economies. As we look ahead to 2025, what does the current outlook for the US stock market suggest? This article delves into the key factors influencing the market, providing insights for investors to consider in the coming years.

Economic Recovery and Growth

One of the primary drivers of the US stock market is the overall economic recovery and growth. The post-pandemic era has seen a strong rebound in various sectors, with the tech industry leading the charge. Companies like Apple, Amazon, and Google have continued to post impressive growth figures, contributing significantly to market performance.

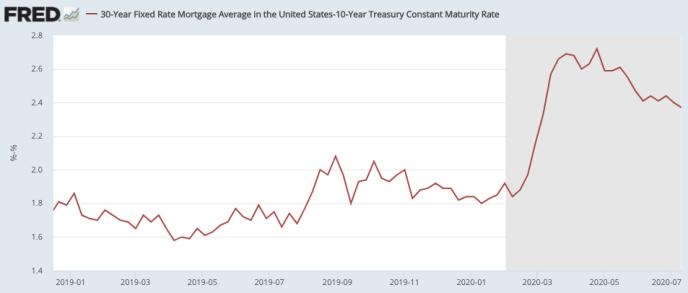

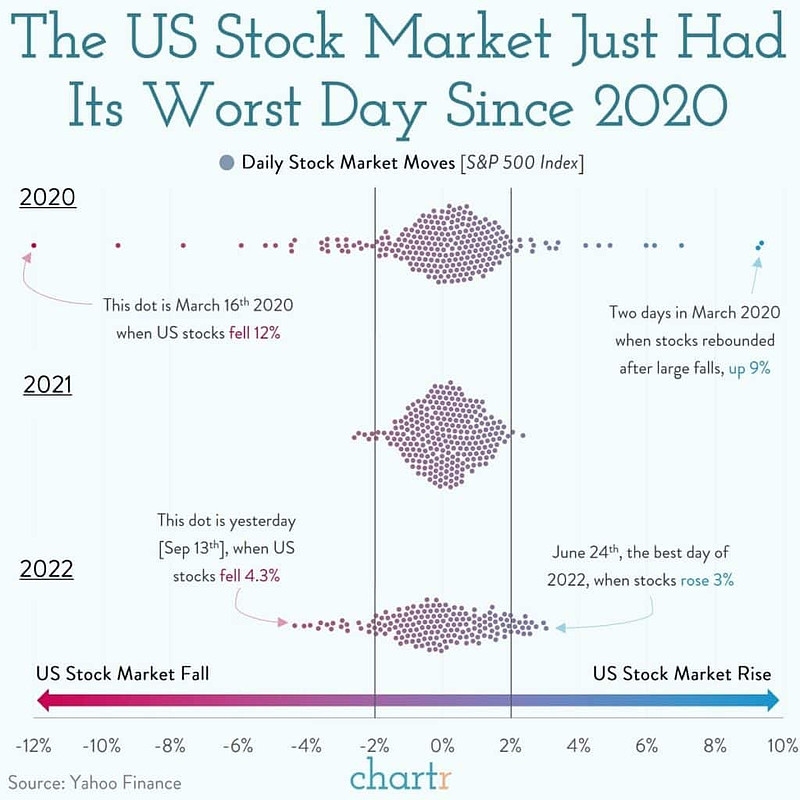

Interest Rates and Inflation

Interest rates and inflation remain critical factors to watch. While the Federal Reserve has been raising rates to combat inflation, investors are closely monitoring the balance between controlling inflation and avoiding a recession. A gradual increase in interest rates is expected, but any sudden shifts could cause market volatility.

Sector Performance

Several sectors are poised to perform well in the coming years, including technology, healthcare, and renewable energy. The tech industry, in particular, is expected to see continued growth as innovation and digital transformation remain key trends. Additionally, the healthcare sector is benefiting from an aging population and increasing demand for medical services.

Global Economic Factors

The global economy also plays a significant role in the US stock market. Geopolitical tensions, trade wars, and economic fluctuations in other regions can impact US stocks. As such, investors should stay informed about global events and how they might affect the market.

Impact of Technology and Automation

The rise of technology and automation continues to reshape various industries, leading to both opportunities and challenges for investors. Companies that embrace technological advancements are likely to see strong growth, while those lagging behind may face increased competition and market pressure.

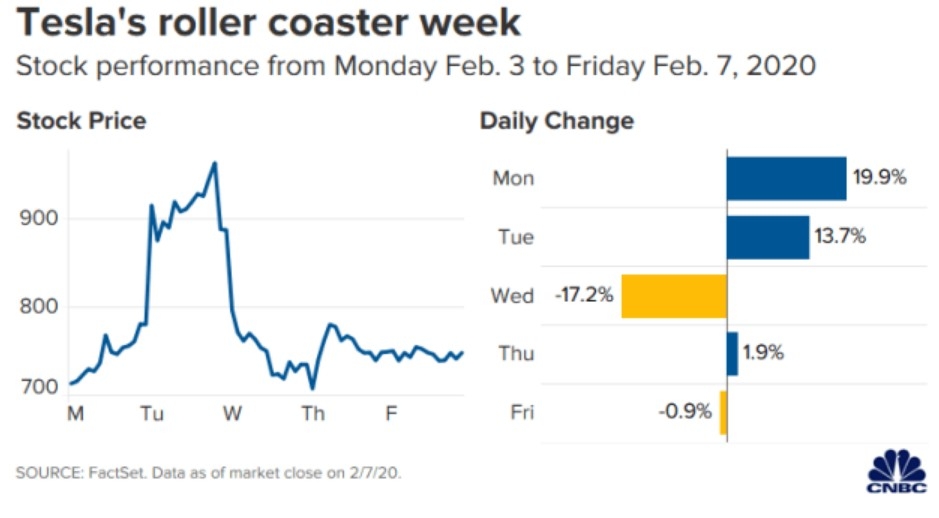

Case Study: Tesla, Inc.

Tesla, Inc. is a prime example of a company that has leveraged technology and innovation to achieve remarkable success. As an early adopter of electric vehicles (EVs), Tesla has become a market leader in the rapidly growing EV sector. The company’s impressive financial performance and continuous innovation have made it a favorite among investors, contributing to its significant market capitalization.

Conclusion

The current outlook for the US stock market in 2025 suggests a promising future, driven by economic recovery, technological advancements, and innovation. However, investors must remain vigilant about interest rates, inflation, and global economic factors that could impact market performance. By staying informed and adapting their investment strategies accordingly, investors can navigate the evolving landscape and capitalize on the opportunities that lie ahead.