In today's fast-paced financial world, futures on US stocks have become an essential tool for investors and traders looking to gain exposure to the stock market. Whether you're a seasoned professional or a beginner, understanding how to trade futures on US stocks can provide you with significant advantages. This article delves into the basics of futures trading, key factors to consider, and real-world examples to help you navigate this exciting market.

Understanding Futures on US Stocks

Futures contracts are agreements to buy or sell a specific asset at a predetermined price on a specified future date. In the context of US stocks, futures are financial instruments that allow investors to speculate on the future price of a particular stock without owning the actual stock. This is particularly beneficial for traders who want to leverage their investments or hedge against potential market downturns.

Key Factors to Consider When Trading Futures on US Stocks

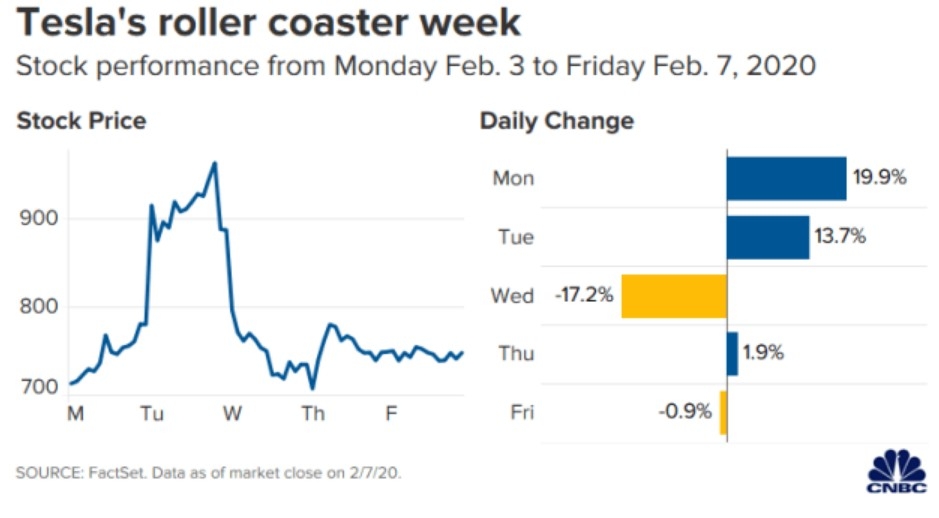

Market Volatility: The stock market is inherently volatile, and futures trading can amplify this volatility. It's crucial to understand the risks involved and only invest what you can afford to lose.

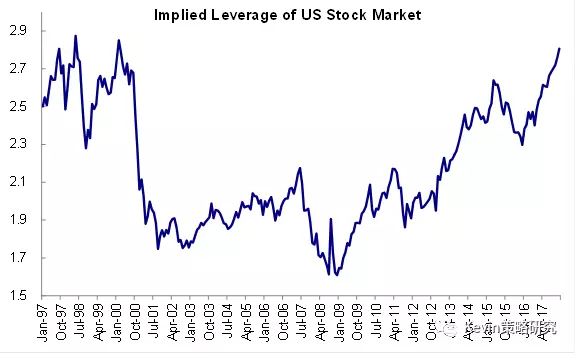

Leverage: One of the most appealing aspects of futures trading is leverage. Leverage allows you to control a larger position with a smaller amount of capital. However, it also means that losses can be magnified, so it's essential to manage your risk effectively.

Time to Expiration: Futures contracts have a specific expiration date, after which they become void. It's important to be aware of the expiration date and manage your positions accordingly.

Market Hours: Futures on US stocks trade during specific hours, typically from 8:30 a.m. to 4:30 p.m. Eastern Time. Understanding these hours can help you plan your trading activities more effectively.

Regulatory Compliance: Futures trading is regulated by the Commodity Futures Trading Commission (CFTC). It's crucial to familiarize yourself with the rules and regulations to ensure compliance.

Real-World Examples

Speculating on Stock Price Movement: Imagine you believe that a particular stock, like Apple Inc. (AAPL), will increase in value over the next few months. By purchasing a futures contract on AAPL, you can profit from this price increase without owning the actual stock.

Hedging Against Potential Losses: Suppose you own 100 shares of a particular stock and are worried about potential market downturns. By purchasing a futures contract that goes short on that stock, you can protect yourself from potential losses if the stock price falls.

Leveraging Your Investments: Let's say you have

10,000 to invest. By using leverage, you can control a position worth 100,000 in futures on a particular stock. This allows you to potentially earn a higher return on your investment.

Conclusion

Futures on US stocks offer a unique and powerful way to trade the stock market. By understanding the basics, key factors, and real-world examples, you can make informed decisions and potentially profit from this exciting market. Always remember to manage your risk effectively and stay informed about market trends and regulatory changes.