Introduction: Are you looking to invest in stocks, but aren't sure if you can buy them in a UK ISA? In this article, we'll delve into the ins and outs of UK Individual Savings Accounts (ISAs) and answer your burning question. We'll explore what stocks can be purchased, the benefits of investing in a UK ISA, and how to get started. So, let's jump right in!

Understanding UK ISAs An Individual Savings Account, commonly known as an ISA, is a tax-efficient way to save and invest in the UK. With an ISA, you can invest your money in various assets, including stocks, bonds, and even some funds and exchange-traded funds (ETFs). The best part? The UK government allows you to invest up to £20,000 annually, and your earnings from these investments will be tax-free.

Stocks You Can Buy in a UK ISA You can purchase a wide range of stocks in a UK ISA. These include stocks from UK companies, as well as those listed on major international exchanges. Here are a few examples:

- UK Companies: Invest in stocks from well-known UK companies like Tesco, BP, and Vodafone.

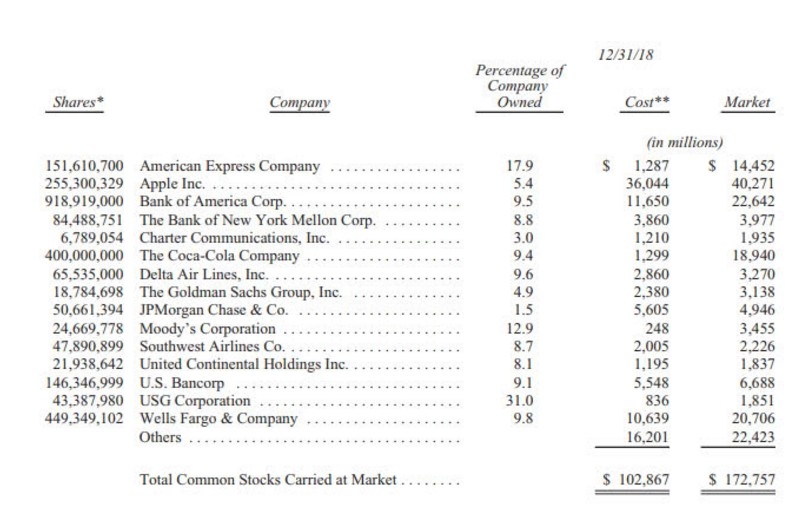

- International Stocks: Expand your investment portfolio by purchasing stocks from international companies, such as Apple, Amazon, and Google.

- Emerging Markets: Invest in stocks from emerging markets, giving you exposure to fast-growing economies.

Benefits of Investing in a UK ISA There are several advantages to investing in a UK ISA, including:

- Tax Efficiency: Your investments will grow tax-free, allowing you to keep more of your earnings.

- Flexibility: You can withdraw your funds at any time, although doing so may affect your tax-free status.

- Diversification: Investing in a UK ISA allows you to diversify your portfolio, reducing your risk.

- Access to Professional Advice: Many UK ISA providers offer professional advice to help you make informed investment decisions.

How to Buy Stocks in a UK ISA To buy stocks in a UK ISA, you need to follow these steps:

- Choose an ISA Provider: Research and select an ISA provider that suits your needs. Some popular providers include Hargreaves Lansdown, Interactive Brokers, and Fidelity.

- Open an Account: Open a UK ISA account with your chosen provider. You may need to provide personal and financial information, as well as your national insurance number.

- Fund Your Account: Transfer funds from your bank account to your new ISA. This can usually be done online or over the phone.

- Research and Select Stocks: Research and identify the stocks you want to invest in. You can use various online tools and resources to help you make informed decisions.

- Place Your Order: Once you've selected your stocks, place an order through your ISA provider. They will handle the transaction on your behalf.

Case Study: Investing in a UK ISA Let's say you want to invest in a UK ISA and purchase shares of Amazon. Here's a step-by-step guide:

- Choose an ISA Provider: Select a provider like Hargreaves Lansdown.

- Open an Account: Open a UK ISA account with Hargreaves Lansdown.

- Fund Your Account: Transfer £10,000 to your new ISA.

- Research Amazon: Research Amazon's stock price and performance.

- Place Your Order: Place an order to purchase 10 shares of Amazon at the current market price.

By following these steps, you can start investing in stocks through a UK ISA and potentially enjoy tax-free growth on your investments. Remember to always do your research and seek professional advice before making any investment decisions.