As we navigate through the complexities of the financial world, understanding the current trends and risks in the US stock market is crucial for investors and market enthusiasts alike. With October 2025 fast approaching, this article delves into the key trends and potential risks that investors should be aware of.

Trend 1: Technological Advancements Driving Growth

One of the prominent trends in the US stock market for October 2025 is the surge in technology stocks. The continuous advancements in AI, blockchain, and quantum computing are expected to drive significant growth in this sector. Companies like Tesla and Microsoft have already demonstrated the potential of these technologies to revolutionize industries.

Trend 2: Diversification in Energy Sector

The energy sector has seen a remarkable transformation in recent years. The rise of renewable energy sources, such as solar and wind, has not only reduced carbon emissions but also created opportunities for investors. Companies like Tesla and SolarEdge are leading this shift, and their stocks are expected to benefit from this trend.

Trend 3: Shift Towards ESG Investing

Environmental, Social, and Governance (ESG) investing has gained significant traction in recent years. As more investors prioritize sustainability and ethical practices, companies with strong ESG profiles are likely to see increased demand for their stocks. This trend is expected to continue in October 2025, with companies like Nike and Apple leading the way.

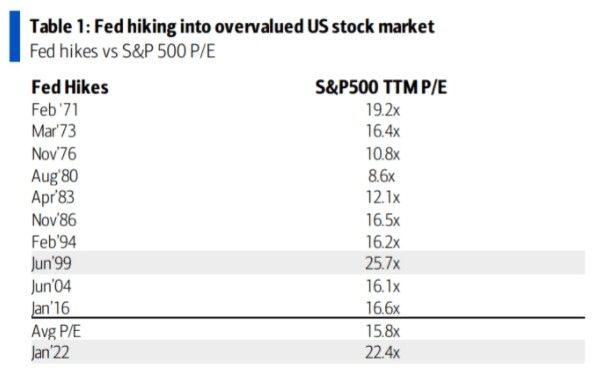

Risk 1: Inflation and Interest Rates

One of the major risks in the US stock market for October 2025 is the potential for rising inflation and interest rates. The Federal Reserve's monetary policy decisions can have a significant impact on the stock market. Higher interest rates can lead to increased borrowing costs for companies, which may in turn affect their profitability.

Risk 2: Geopolitical Uncertainties

Geopolitical uncertainties, such as trade tensions and political instability, can also pose risks to the US stock market. For instance, tensions between the US and China have the potential to disrupt global supply chains and affect the earnings of companies with significant exposure to these markets.

Risk 3: Market Volatility

The stock market is inherently volatile, and October 2025 is no exception. Factors such as economic data releases, corporate earnings reports, and geopolitical events can lead to significant market fluctuations. Investors should be prepared for potential volatility and maintain a diversified portfolio to mitigate risks.

Case Study: Amazon's Stock Performance

To illustrate the potential risks and trends in the US stock market, let's consider the case of Amazon. Over the past few years, Amazon has been a leader in the e-commerce and cloud computing sectors. However, the company's stock has faced volatility due to various factors, including rising competition and concerns about its valuation.

In October 2025, if Amazon's earnings reports show strong revenue growth and improved profitability, the stock could see a positive response. However, if there are signs of increased competition or economic headwinds, the stock may face downward pressure.

In conclusion, understanding the trends and risks in the US stock market is essential for investors looking to make informed decisions. While technological advancements, diversification in the energy sector, and a shift towards ESG investing present promising opportunities, investors should also be aware of the risks associated with inflation, geopolitical uncertainties, and market volatility. By staying informed and maintaining a diversified portfolio, investors can navigate the complexities of the stock market in October 2025.