Are you interested in the world of investing and the potential of Apple stock? If so, you've come to the right place. In this article, we will delve into the relationship between Apple stock and the US dollar, exploring how currency fluctuations can impact your investment decisions. Get ready to uncover the intricacies of this dynamic partnership.

Understanding Apple Stock

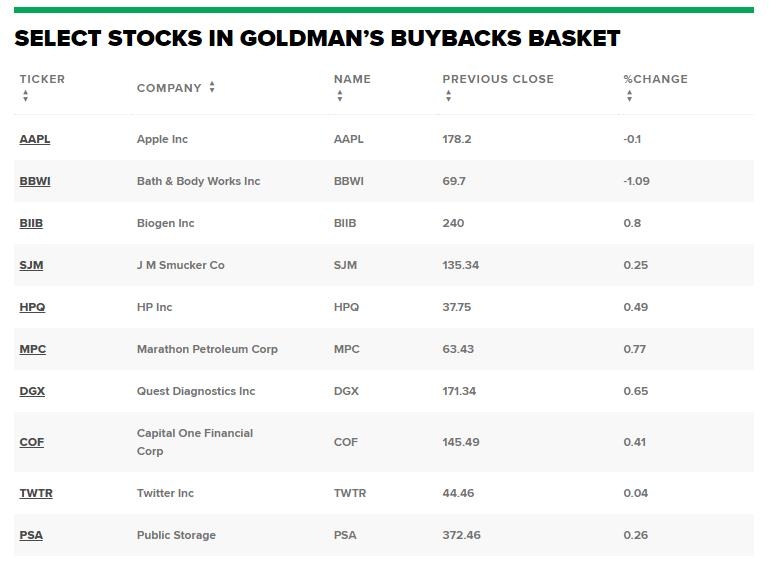

First, let's establish a clear understanding of Apple stock. Apple Inc., founded in 1976, has become one of the most valuable and influential companies in the world. With its diverse product range, including the iPhone, iPad, Mac, and Apple Watch, Apple has revolutionized the tech industry. As a result, investors have been flocking to buy Apple stock, hoping to capitalize on its growth potential.

The US Dollar Connection

Now, let's examine the connection between Apple stock and the US dollar. Since Apple is a US-based company, its stock is priced in US dollars. This means that when you buy Apple stock, you're essentially purchasing a piece of a company denominated in the US dollar. Consequently, currency fluctuations can have a significant impact on the value of your investment.

Impact of Currency Fluctuations

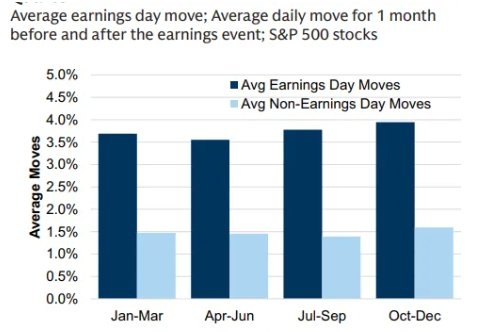

When the US dollar strengthens against other currencies, it can make Apple stock less attractive to international investors. This is because they would need to exchange their own currency for US dollars to purchase the stock, effectively paying more for the same amount of shares. Conversely, when the US dollar weakens, international investors find it cheaper to buy Apple stock, potentially boosting demand and increasing its value.

Case Studies

To illustrate this relationship, let's look at a couple of case studies. In 2018, when the US dollar was strong, Apple's stock price experienced downward pressure due to a decline in international demand. However, in 2020, when the US dollar weakened, Apple's stock price surged as international investors flocked to the company's shares.

Another example is the tech sector's response to the COVID-19 pandemic. In 2020, as the global economy struggled, the US dollar weakened, and investors sought refuge in tech stocks like Apple. This led to a significant increase in Apple's stock price, demonstrating the impact of currency fluctuations on the company's valuation.

Conclusion

In conclusion, the relationship between Apple stock and the US dollar is a critical factor for investors to consider. Understanding how currency fluctuations can impact the value of your investment can help you make informed decisions. Keep an eye on the US dollar's movements and stay tuned to the latest economic news to stay ahead of the curve in the world of Apple stock investments.