Introduction

The stock market has always been a rollercoaster ride, and the current state of the US stock market is no exception. With record-high valuations and uncertainty surrounding various economic factors, investors are left wondering if the current US stock market is overvalued. In this article, we will delve into the key indicators that suggest whether the market is overvalued or not.

Market Valuation Indicators

One of the primary indicators used to determine if a stock market is overvalued is the price-to-earnings (P/E) ratio. This ratio compares the current stock price to the company's earnings per share (EPS). Historically, a P/E ratio above 20 has been considered a sign of an overvalued market. As of the latest data, the S&P 500's P/E ratio is hovering around 21, which is slightly above the long-term average.

Another indicator to consider is the cyclically adjusted price-to-earnings (CAPE) ratio, also known as the Shiller P/E ratio. This ratio takes into account the average inflation-adjusted earnings of a company over the past 10 years. The CAPE ratio currently stands at around 31, which is well above its long-term average of 16. This suggests that the stock market is overvalued when compared to historical standards.

Economic Factors

Several economic factors have contributed to the current overvaluation of the US stock market. One of the key factors is the low-interest-rate environment. With the Federal Reserve keeping interest rates at historic lows, investors have been flocking to the stock market in search of higher returns. This has driven stock prices up, despite a lack of earnings growth.

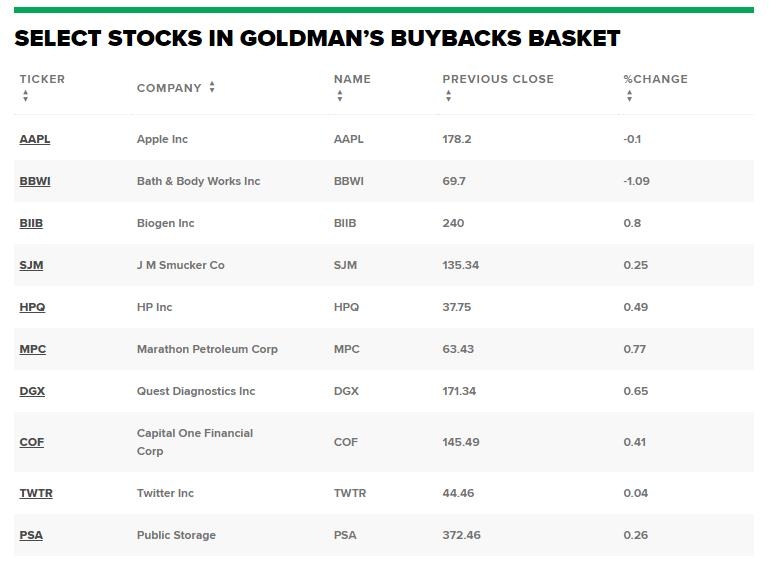

Another factor is the strong performance of the technology sector. Companies like Apple, Microsoft, and Amazon have seen their stock prices soar, pushing the overall market valuation higher. However, this has also created a market that is heavily reliant on a few large companies, which can be risky if those companies face challenges.

Market Volatility

The current stock market is also characterized by high volatility. While this can be seen as a sign of investor optimism, it can also indicate that the market is overvalued. When prices are fluctuating widely, it suggests that investors are unsure of the market's direction and may be driven by speculative behavior rather than fundamental analysis.

Case Studies

To illustrate the potential risks of an overvalued market, let's consider a few historical examples. In the late 1990s, the tech bubble burst, leading to significant losses for investors. Similarly, the housing market collapse in 2008 caused a global financial crisis and resulted in a bear market for stocks. These events demonstrate that overvalued markets can lead to sudden and severe downturns.

Conclusion

In conclusion, the current US stock market appears to be overvalued based on several indicators, including the P/E ratio and CAPE ratio. While the market may continue to rise in the short term, it is important for investors to remain cautious and aware of the potential risks. By staying informed and diversified, investors can navigate the choppy waters of the stock market and protect their investments.