The stock market is a dynamic entity, and staying informed about the latest news and developments is crucial for investors. In this article, we delve into the most significant stock market news in the US, providing an in-depth analysis of the latest trends and their implications for investors.

1. The Impact of the Federal Reserve's Policy on the Stock Market

The Federal Reserve has been a major driver of stock market movements in recent times. In early 2021, the Federal Reserve announced its intention to maintain low interest rates for an extended period. This decision was greeted positively by investors, as it implies lower borrowing costs and higher inflation expectations, which are generally good for stocks.

2. Technology Stocks Leading the Charge

Technology stocks have been the standout performers in the US stock market in recent years. Companies like Apple, Microsoft, and Amazon have seen their share prices soar, driven by their strong fundamentals and the increasing demand for their products and services.

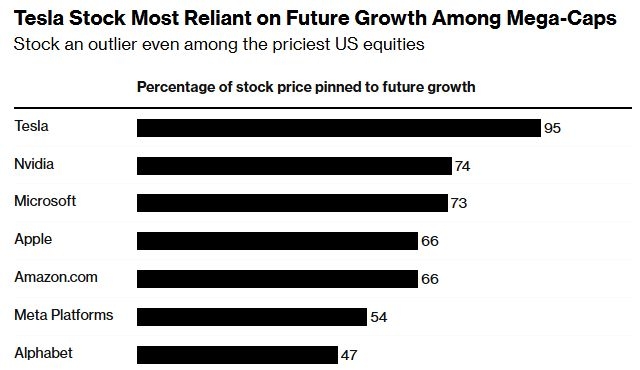

Case Study: Tesla’s Stock Performance

Tesla, an electric vehicle manufacturer, has seen its stock price skyrocket in recent years. The company’s impressive growth in market share and the increasing demand for electric vehicles have contributed to its stock’s rise. As of early 2021, Tesla’s market capitalization exceeded that of traditional automakers like Ford and General Motors.

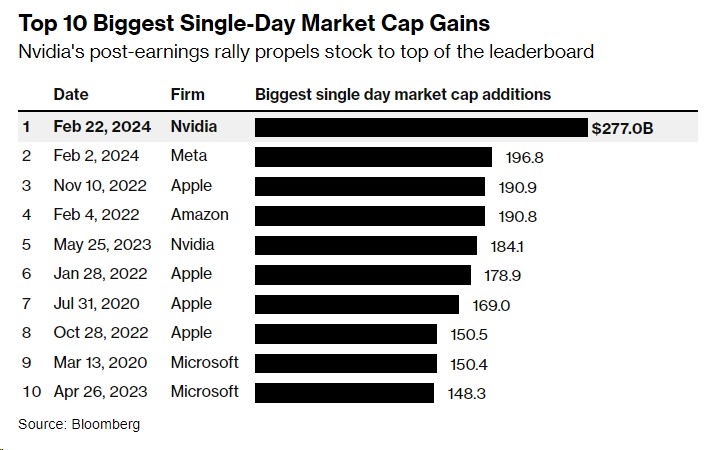

3. The Role of Earnings Reports in Stock Market News

Earnings reports are a critical source of stock market news in the US. Companies release their financial results, including revenue and earnings per share, on a quarterly basis. These reports provide valuable insights into the financial health of companies and can significantly impact their stock prices.

4. The Impact of COVID-19 on the Stock Market

The COVID-19 pandemic has had a profound impact on the US stock market. The initial outbreak in early 2020 led to a sharp sell-off, with the S&P 500 dropping over 30% in just a few weeks. However, the market has since recovered, with many sectors posting strong gains.

5. Dividend Stocks: A Safe Haven for Investors

In times of market uncertainty, dividend stocks have emerged as a safe haven for investors. These stocks provide regular income and are often seen as less volatile than their non-dividend-paying counterparts. Companies like Johnson & Johnson and Procter & Gamble have been popular choices among income-seeking investors.

6. The Rise of ETFs and their Impact on the Stock Market

Exchange-traded funds (ETFs) have become increasingly popular among investors in the US. These funds offer diversification, low fees, and exposure to various sectors and asset classes. The rise of ETFs has had a significant impact on the stock market, with many investors choosing to invest in these funds rather than individual stocks.

In conclusion, the US stock market is a complex and ever-evolving entity. Keeping up with the latest stock market news and developments is crucial for investors looking to make informed decisions. As we have seen, the Federal Reserve, technology stocks, earnings reports, the COVID-19 pandemic, dividend stocks, and the rise of ETFs have all played a significant role in shaping the market landscape. By understanding these factors, investors can better navigate the stock market and achieve their investment goals.