Introduction

As we delve into the complexities of the financial world, the US stock market remains a beacon of economic activity and investment opportunities. As we approach 2025, it is crucial to analyze the current outlook for the US stock market, considering various factors such as economic indicators, market trends, and technological advancements. This article aims to provide a comprehensive analysis of the US stock market's outlook for 2025, highlighting key areas of growth and potential challenges.

Economic Indicators

One of the primary factors influencing the US stock market is the economic indicators. In 2025, the Federal Reserve is expected to continue its monetary policy normalization, which could lead to higher interest rates. This may impact the stock market, as higher rates can increase borrowing costs and potentially lead to a slowdown in economic growth.

However, despite the possibility of higher interest rates, the US economy is expected to remain robust, driven by factors such as a strong labor market, low unemployment rates, and increasing consumer spending. These factors are likely to support the US stock market's growth in the coming years.

Market Trends

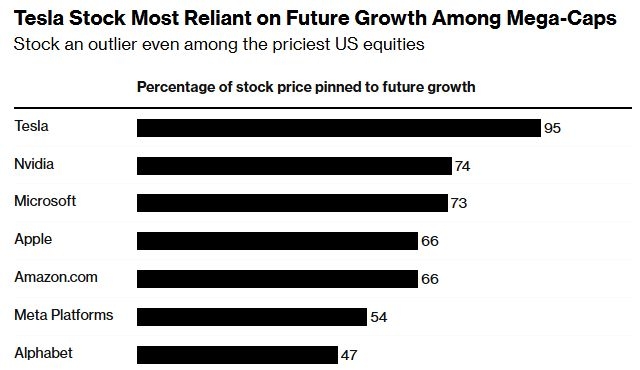

Several key trends are shaping the US stock market outlook for 2025. One of the most significant trends is the increasing emphasis on technology and innovation. As technology continues to revolutionize various industries, companies at the forefront of innovation are likely to see significant growth in their stock prices.

1. Technology and Innovation

Innovation is driving the US stock market forward. The technology sector is expected to remain a major driver of the stock market in 2025. Companies like Apple, Microsoft, and Amazon are not only leading the technology revolution but are also diversifying their offerings, expanding into new markets, and investing heavily in research and development.

2. Renewable Energy and Sustainability

Renewable energy and sustainability are gaining traction.

3. Healthcare and Biotechnology

Healthcare and biotechnology are becoming key players. The healthcare and biotechnology sectors are also expected to see substantial growth in 2025. Companies involved in drug development, medical devices, and telemedicine are likely to benefit from an aging population and increasing healthcare spending.

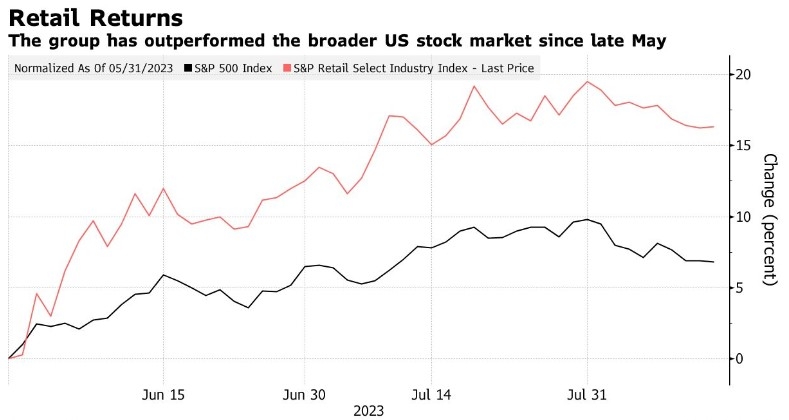

4. E-commerce and Online Retail

E-commerce and online retail are reshaping the retail landscape. As consumers continue to shift towards online shopping, companies like Amazon and Walmart are expected to see significant growth in their stock prices. This trend is likely to continue in 2025, as more consumers embrace the convenience and efficiency of online shopping.

Conclusion

In conclusion, the US stock market outlook for 2025 is promising, driven by factors such as economic growth, technological innovation, and increased investment in key sectors. While challenges such as rising interest rates and geopolitical tensions may pose risks, the overall outlook remains positive. As investors, it is crucial to stay informed about these trends and consider them when making investment decisions.