The Indian stock market is a significant player in the global financial landscape, with its performance often being influenced by a variety of external factors. Among these, the U.S. elections hold a special place, as they can significantly impact the global economy and, subsequently, the Indian stock market. This article delves into how U.S. elections affect the Indian stock market, highlighting the key factors at play.

Economic Policies and Market Sentiment

One of the primary ways U.S. elections can affect the Indian stock market is through changes in economic policies. Election outcomes often lead to shifts in the administration's approach to issues such as trade, taxes, and fiscal stimulus. These changes can directly impact the global economy, including India.

For instance, a Democratic victory in the U.S. elections could lead to increased government spending and higher taxes on corporations. This could boost the Indian stock market if it encourages foreign investment in the country. Conversely, a Republican victory might lead to tax cuts and reduced government spending, which could negatively impact the Indian stock market if it leads to a slowdown in the global economy.

Interest Rates and the Rupee

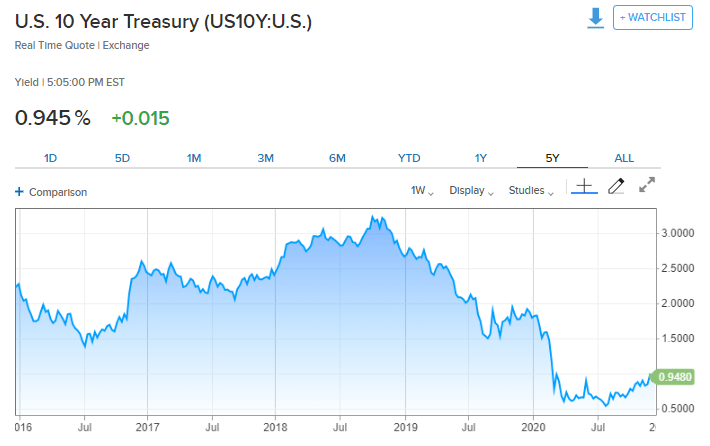

The U.S. Federal Reserve's policies on interest rates are another crucial factor that can influence the Indian stock market. A rise in U.S. interest rates can lead to strengthening of the U.S. dollar, which, in turn, can weaken the Indian rupee. A weaker rupee can make imports more expensive, potentially impacting the Indian stock market negatively.

On the other hand, if the U.S. Federal Reserve keeps interest rates low, it can help keep the Indian rupee stable and support the Indian stock market. This is because lower interest rates in the U.S. can lead to lower returns on U.S. investments, making them less attractive and encouraging investors to look for better returns in other markets, including India.

Trade Policies and Geopolitical Stability

The U.S. is India's largest trading partner, and the trade policies of the U.S. administration can significantly impact the Indian stock market. A protectionist stance by the U.S. could lead to higher tariffs on Indian goods, impacting the country's exports and, consequently, the Indian stock market.

Moreover, the geopolitical stability of the U.S. is crucial for the Indian stock market. A stable and predictable U.S. foreign policy can lead to greater confidence in the global economy, supporting the Indian stock market. Conversely, a more unpredictable foreign policy can lead to uncertainty and volatility in the market.

Case Studies

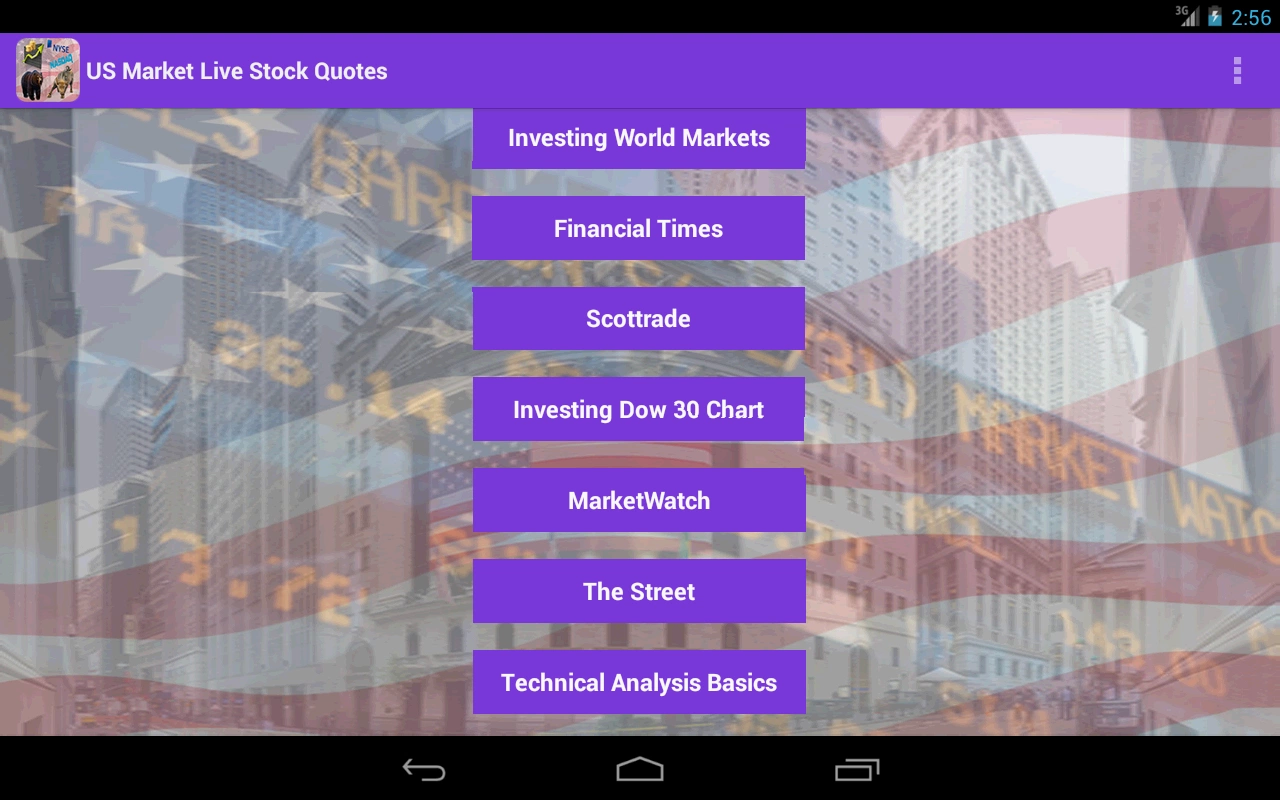

Several historical examples illustrate the impact of U.S. elections on the Indian stock market. For instance, in the 2016 U.S. elections, the Indian stock market initially fell after the surprise victory of Donald Trump. However, it later recovered as investors concluded that his policies were unlikely to have a significant negative impact on the Indian economy.

Similarly, in the 2020 U.S. elections, the Indian stock market initially rose after Joe Biden's victory, as investors were optimistic about his policies. However, the market later corrected as concerns about his proposed policies and rising inflation began to surface.

Conclusion

The U.S. elections can have a significant impact on the Indian stock market, primarily through changes in economic policies, interest rates, and trade policies. Understanding these factors can help investors make more informed decisions and navigate the potential market volatility that follows the U.S. elections.