In today's fast-paced business world, the traditional corporate structure is evolving. One such revolutionary concept is the joint stock company, a legal entity that is reshaping the way we perceive and operate businesses. This article delves into the essence of a joint stock company, its benefits, and its potential to transform the corporate landscape.

Understanding the Concept

A joint stock company, also known as a corporation, is a legal entity owned by shareholders. These shareholders purchase shares of the company, which represent their ownership stake. The primary characteristic of a joint stock company is that the liability of shareholders is limited to their investment, protecting them from the company's debts and obligations.

Benefits of a Joint Stock Company

The joint stock company model offers several advantages:

- Capital Raising: A joint stock company can raise substantial capital by issuing shares to investors. This enables the company to expand operations, invest in new projects, and remain competitive in the market.

- Limited Liability: As mentioned earlier, shareholders' liability is limited to their investment, which provides a level of security and risk mitigation.

- Professional Management: Joint stock companies often attract skilled professionals to their boards of directors and management teams, ensuring efficient and effective operations.

- Transparency: These companies are required to disclose financial and operational information to shareholders and the public, fostering transparency and accountability.

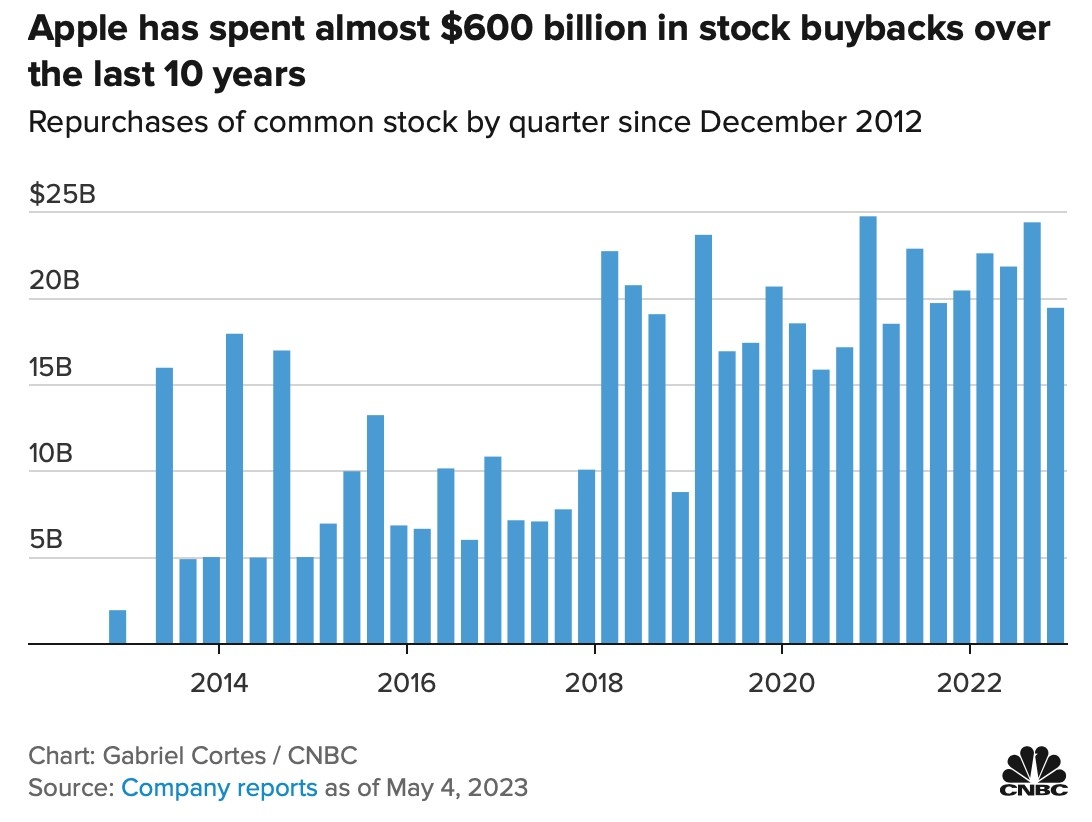

Case Study: Apple Inc.

A prime example of a successful joint stock company is Apple Inc. The company's shares have been publicly traded since 1980, and its stock price has soared over the years, making it one of the most valuable companies in the world. Apple's success can be attributed to its innovative products, strong brand, and transparent operations, all of which are hallmarks of a joint stock company.

Challenges and Considerations

While joint stock companies offer numerous benefits, there are also challenges and considerations to keep in mind:

- Regulatory Compliance: Joint stock companies must adhere to strict regulatory requirements, including financial reporting, corporate governance, and shareholder rights.

- Shareholder Activism: Shareholders can exert significant influence on a company's decisions, which may sometimes lead to conflicts of interest.

- Executive Compensation: High executive compensation can be a point of contention, as some shareholders may feel that it is not proportional to the company's performance.

The Future of Joint Stock Companies

The joint stock company model is likely to continue evolving as technology and global business dynamics change. Here are some potential future trends:

- Increased Focus on Sustainability: Companies are increasingly expected to address environmental, social, and governance (ESG) issues. Joint stock companies may need to adapt their strategies to meet these expectations.

- Blockchain Technology: Blockchain technology could enhance transparency and security in joint stock companies, leading to more efficient operations.

- Globalization: As the world becomes more interconnected, joint stock companies may need to navigate complex regulatory frameworks and cultural differences in various countries.

In conclusion, the joint stock company model offers a unique and powerful way to organize and operate businesses. By leveraging its advantages and addressing its challenges, joint stock companies can continue to drive innovation and growth in the global economy.