Are you a Canadian investor looking to expand your portfolio to include US stocks? Investing in US stocks from Canada can be an excellent way to diversify your portfolio and potentially increase your returns. In this article, we will guide you through the process of buying US stocks from Canada, ensuring you make informed decisions and minimize any potential risks.

Understanding the Basics

Before diving into the process, it’s essential to understand the basics of buying US stocks from Canada. The United States and Canada have different financial systems, so you’ll need to consider factors such as currency exchange rates, brokerage fees, and tax implications.

Choosing a Brokerage

The first step in buying US stocks from Canada is to choose a brokerage firm that offers access to US stock markets. There are several reputable brokerage firms in Canada that offer this service, including:

- Questrade

- Interactive Brokers

- BMO InvestorLine

- TD Direct Investing

Each brokerage has its own set of fees, services, and platform features, so it’s crucial to research and compare your options to find the best fit for your needs.

Opening an Account

Once you have chosen a brokerage, you’ll need to open an account. The process typically involves providing personal information, verifying your identity, and funding your account. Some brokers may require you to provide additional documentation, such as proof of address and tax identification number.

Understanding Currency Exchange Rates

When buying US stocks from Canada, you’ll need to consider the currency exchange rate. The exchange rate can fluctuate, impacting the cost of your investments. It’s essential to keep an eye on the exchange rate to ensure you’re getting the best deal possible.

Tax Implications

When investing in US stocks from Canada, you’ll need to be aware of the tax implications. Generally, Canadian investors are required to pay taxes on any dividends or capital gains earned from US stocks. It’s important to consult with a tax professional to ensure you understand your tax obligations and any potential tax credits or deductions you may be eligible for.

Researching and Analyzing Stocks

Before investing in any stock, it’s crucial to conduct thorough research and analysis. This includes examining the company’s financial statements, industry trends, and competitive position. There are numerous resources available to help you research and analyze stocks, such as:

- Financial websites (e.g., Yahoo Finance, Google Finance)

- Stock analysis tools (e.g., Morningstar, Seeking Alpha)

- Financial news and publications

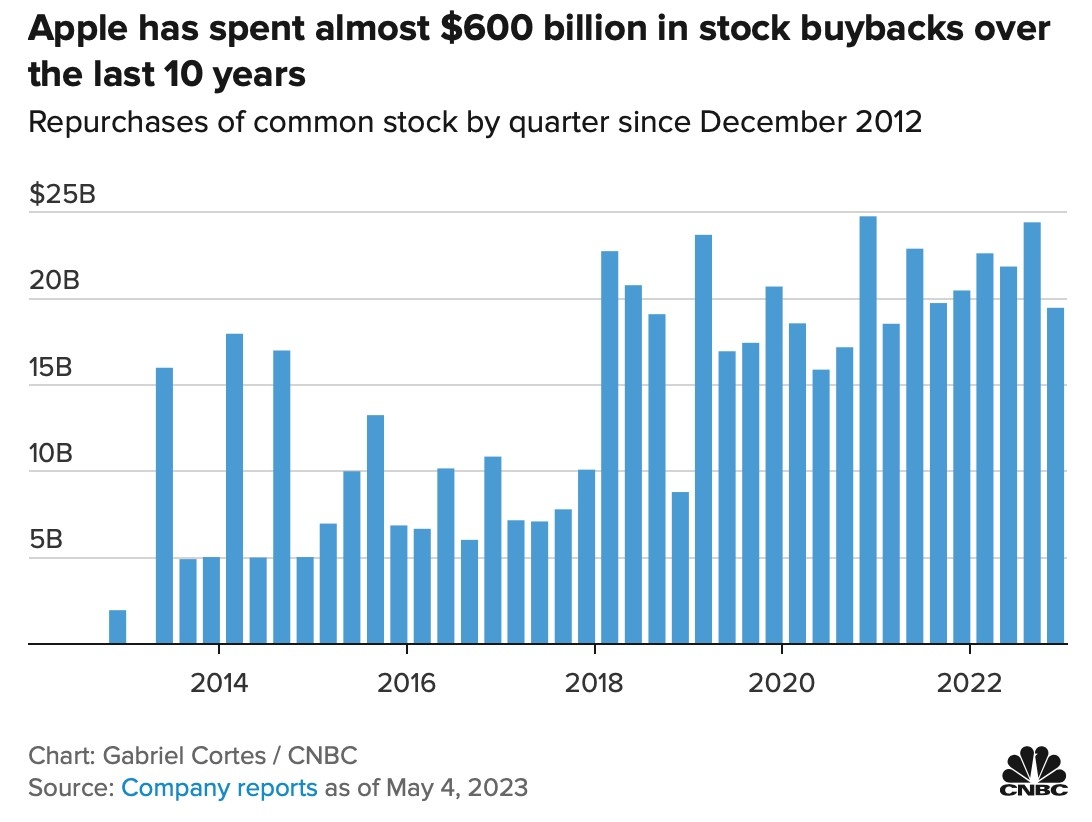

Case Study: Investing in Apple (AAPL)

Let’s say you’ve conducted thorough research on Apple (AAPL) and believe it is a solid investment. To purchase shares of Apple from Canada, follow these steps:

- Log in to your brokerage account.

- Navigate to the US stock market section.

- Enter the ticker symbol (AAPL) and select the number of shares you wish to purchase.

- Review your order details and confirm the purchase.

Remember to track your investment and stay informed about any news or developments that may impact the stock’s performance.

Conclusion

Buying US stocks from Canada can be a valuable addition to your investment portfolio. By following these steps and conducting thorough research, you can make informed decisions and minimize risks. Always consult with a financial advisor or tax professional to ensure you understand the potential benefits and risks of investing in US stocks from Canada.