Are you contemplating whether it's the right time to sell your US stocks? Making this decision can be daunting, especially given the volatile nature of the stock market. In this article, we'll delve into the factors you should consider before making a decision, providing you with a comprehensive guide to help you make an informed choice.

Understanding the Market

First and foremost, it's crucial to understand the current market conditions. The stock market is influenced by a myriad of factors, including economic indicators, political events, and global trends. To make an informed decision, you need to stay updated with the latest market news and developments.

Assess Your Financial Goals

Before selling your stocks, take a moment to reflect on your financial goals. Are you planning to retire soon, or do you need the funds for a specific purpose? Understanding your financial objectives will help you determine whether it's the right time to sell.

Consider the Tax Implications

Selling stocks can have significant tax implications. It's essential to consider the capital gains tax rate, which varies depending on your income level and the holding period of the stocks. Consulting with a tax professional can provide valuable insights into the potential tax liabilities associated with selling your stocks.

Analyze Your Portfolio

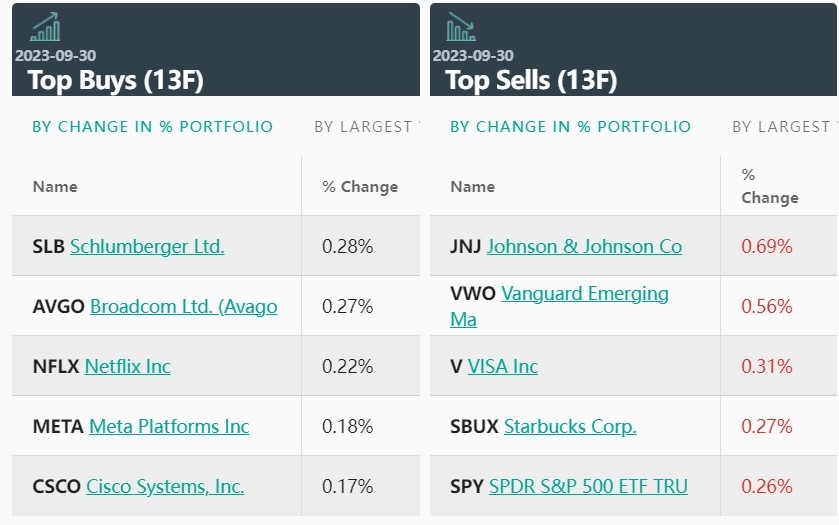

Review your portfolio to assess the performance of your US stocks. Have they been consistently generating profits, or have they been underperforming? It's important to evaluate the overall performance of your investments to determine whether they align with your investment strategy.

Market Trends and Predictions

Stay informed about market trends and predictions. While it's impossible to predict the future with certainty, analyzing market trends can provide valuable insights into potential opportunities and risks. Consider the following factors:

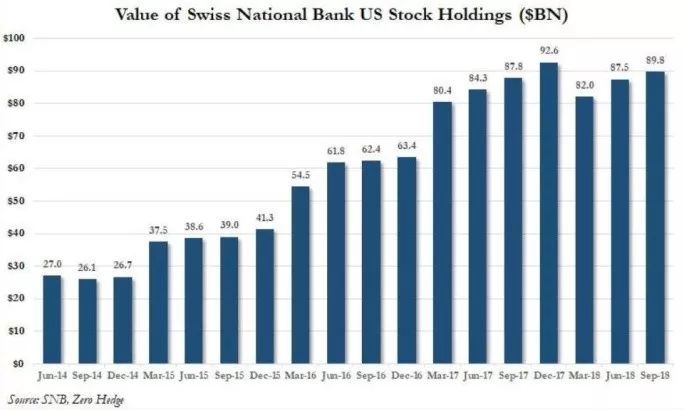

- Economic Indicators: Monitor economic indicators such as GDP growth, unemployment rates, and inflation to gauge the overall health of the economy.

- Sector Performance: Evaluate the performance of different sectors within the US stock market. Some sectors may be experiencing growth, while others may be facing challenges.

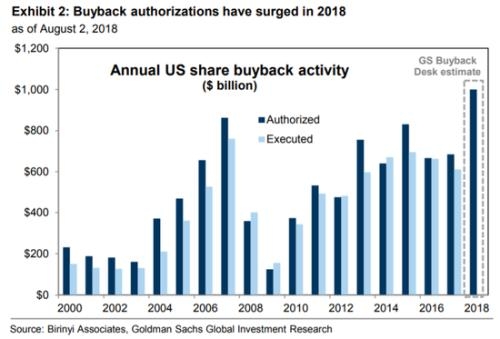

- Market Valuations: Assess the market valuations to determine whether stocks are overvalued or undervalued.

Case Study: Tech Stocks

Let's consider a case study involving tech stocks. In recent years, tech stocks have experienced significant growth, with companies like Apple, Microsoft, and Amazon leading the pack. However, there have been concerns about overvaluation and potential regulatory challenges. If you own tech stocks and are unsure about their future performance, it may be wise to reconsider your position.

Diversification

Diversification is key to managing risk in your investment portfolio. If you have a well-diversified portfolio, selling your US stocks may not be necessary. However, if your portfolio is heavily concentrated in a particular sector or asset class, it may be beneficial to rebalance your investments.

Seek Professional Advice

Ultimately, the decision to sell your US stocks should be based on a thorough analysis of your financial situation, investment goals, and market conditions. Consulting with a financial advisor can provide you with personalized advice and help you make an informed decision.

In conclusion, deciding whether to sell your US stocks is a complex decision that requires careful consideration. By understanding the market, assessing your financial goals, and seeking professional advice, you can make an informed choice that aligns with your investment strategy.