Are you looking to invest in the United States' largest and fastest-growing companies without the hassle of picking individual stocks? If so, US Large Cap Growth Stocks ETFs could be the answer you're seeking. These exchange-traded funds (ETFs) provide investors with a simple, cost-effective way to gain exposure to some of the most powerful companies in the country. In this article, we will explore the benefits of investing in US Large Cap Growth Stocks ETFs, how they work, and some of the best-performing funds available.

Understanding US Large Cap Growth Stocks ETFs

First, let's clarify what US Large Cap Growth Stocks ETFs are. These funds are designed to track the performance of a basket of large-cap growth stocks, which are companies with significant market capitalization and a history of rapid growth. Large-cap stocks are typically those with a market capitalization of over $10 billion, while growth stocks are characterized by their high earnings growth rate and potential for capital appreciation.

The Benefits of Investing in US Large Cap Growth Stocks ETFs

Investing in US Large Cap Growth Stocks ETFs offers several advantages:

Diversification: By investing in a fund that holds a portfolio of large-cap growth stocks, you can achieve diversification, reducing your risk in case any single stock underperforms.

Low Cost: ETFs typically have lower fees than actively managed mutual funds, making them a cost-effective way to invest in a broad market index.

Ease of Access: You can buy and sell US Large Cap Growth Stocks ETFs like regular stocks, making them easy to trade and manage.

Tax Efficiency: ETFs are structured to be tax-efficient, meaning they tend to have lower tax implications than mutual funds.

Access to High-Performing Companies: US Large Cap Growth Stocks ETFs provide exposure to some of the most successful and innovative companies in the country, such as Apple, Amazon, and Google.

Top US Large Cap Growth Stocks ETFs

Here are some of the best-performing US Large Cap Growth Stocks ETFs to consider:

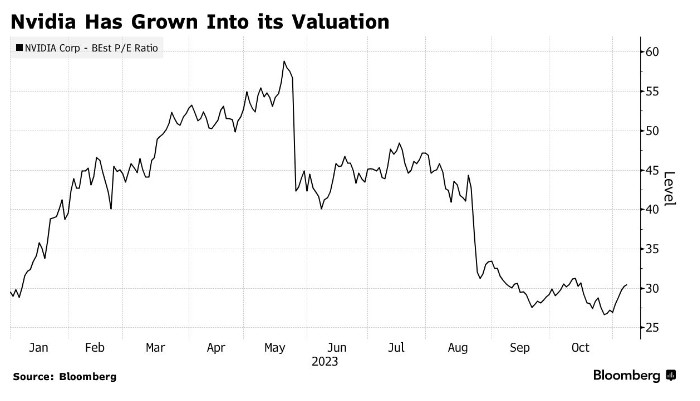

Vanguard Growth ETF (VUG): This ETF tracks the performance of the CRSP US Large-Cap Growth Index and includes companies like Visa, Microsoft, and NVIDIA.

iShares S&P 500 Growth ETF (IVW): This fund follows the S&P 500 Growth Index and offers exposure to a wide range of large-cap growth companies, including Apple, Amazon, and Tesla.

SPDR S&P 500 Growth ETF (RPG): This ETF tracks the S&P 500 Growth Index and provides investors with access to a diverse portfolio of high-growth companies.

Case Study: Apple Inc.

One of the most successful companies in the history of the stock market, Apple Inc., is a prime example of a large-cap growth stock. Since its inception in 1976, Apple has revolutionized the tech industry and has grown into a global giant with a market capitalization of over $2 trillion. Investors who held shares in Apple's stock would have seen significant gains over the years. By investing in a US Large Cap Growth Stocks ETF like VUG or IVW, investors could have gained exposure to Apple and other high-growth companies without the need to pick individual stocks.

In conclusion, US Large Cap Growth Stocks ETFs are an excellent way for investors to gain exposure to some of the fastest-growing companies in the United States. These funds offer diversification, low cost, and tax efficiency, making them an attractive option for investors seeking long-term growth.