In the dynamic world of the stock market, unusual activity often garners attention. One such activity that has recently been making waves is the "options sweep," which has been closely followed by investors and traders alike. This article delves into the concept of options sweep unusual activity, its implications for US stocks, and the latest news surrounding this phenomenon.

What is an Options Sweep?

An options sweep is a process where a large number of options are purchased or sold within a short period. This activity is usually indicative of significant market movements or investor sentiment shifts. Options sweeps can be both bullish and bearish, depending on the nature of the underlying asset.

Implications for US Stocks

The unusual activity associated with options sweep can have a profound impact on US stocks. Here's how:

Predicting Market Trends: Options sweeps can provide valuable insights into market trends. For instance, a sudden increase in call options on a particular stock may indicate bullish sentiment and potentially lead to an upward price movement.

Influencing Stock Prices: The sheer volume of options traded during a sweep can significantly influence stock prices. In some cases, the activity can trigger circuit breakers or halt trading temporarily, affecting market sentiment.

Hedge Fund Activity: Many hedge funds engage in options sweeps as part of their trading strategies. Their actions can lead to significant price movements and influence other investors' decisions.

Latest News on Options Sweep Unusual Activity

Recent news reports have highlighted several instances of options sweep unusual activity in the US stock market. Here are a few notable examples:

Tesla (TSLA): A massive options sweep was reported in Tesla shares, prompting speculation about the company's future. The activity, which included both call and put options, led to a significant price movement in the stock.

NVIDIA (NVDA): Similar to Tesla, NVIDIA experienced a significant options sweep, which sparked discussions about the company's growth prospects and the demand for its products.

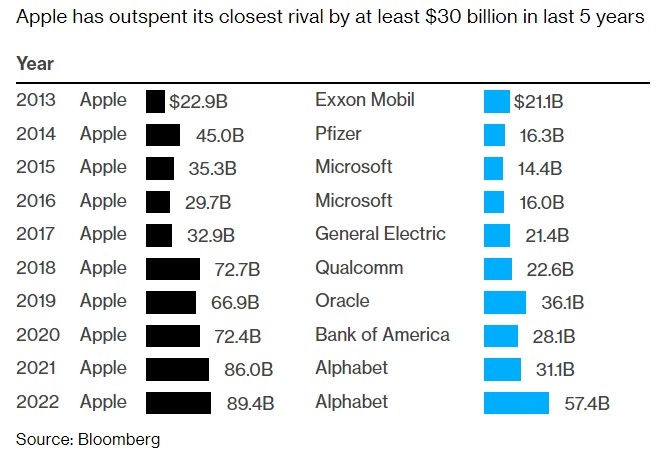

Apple (AAPL): The tech giant also witnessed unusual activity, with a large number of options being traded. This activity raised questions about Apple's potential product launches or strategic moves.

Case Studies

To further understand the impact of options sweep unusual activity, let's examine a few case studies:

Facebook (now Meta Platforms, Inc. (META)): In 2021, Facebook experienced a massive options sweep, which led to a significant price surge in the stock. This activity was attributed to a possible acquisition or strategic partnership, causing a surge in investor interest.

Amazon (AMZN): Another example is Amazon, where a sudden increase in options activity in 2020 was attributed to speculation about the company's growth prospects amidst the COVID-19 pandemic.

Conclusion

Options sweep unusual activity is a crucial aspect of the stock market that can provide valuable insights into investor sentiment and market trends. By understanding the implications of this activity, investors and traders can make informed decisions and stay ahead of the curve. As the latest news continues to unfold, it's essential to stay vigilant and keep an eye on these unusual activities in the US stock market.