The stock market is a complex ecosystem, constantly influenced by a multitude of factors. From economic indicators to geopolitical events, everything seems to have a direct or indirect impact on the performance of stocks. One such factor that often takes a toll on the US stock market is global events. In this article, we will delve into the impact of global events on the US stock market and how investors can navigate through such challenging times.

Understanding the Connection

Global events can significantly affect the US stock market in several ways. Firstly, they can lead to fluctuations in investor sentiment. For instance, a geopolitical event such as a trade war or political instability in a major economy can cause investors to become wary of the market, leading to a sell-off. Secondly, global events can impact the economic outlook, affecting corporate earnings and, subsequently, stock prices.

Recent Examples

To illustrate this point, let's consider a few recent examples. The COVID-19 pandemic is perhaps the most significant global event of the past few years. It caused widespread panic and uncertainty, leading to a sharp decline in stock prices. However, as the pandemic subsided, and economies began to recover, the stock market also staged a remarkable comeback.

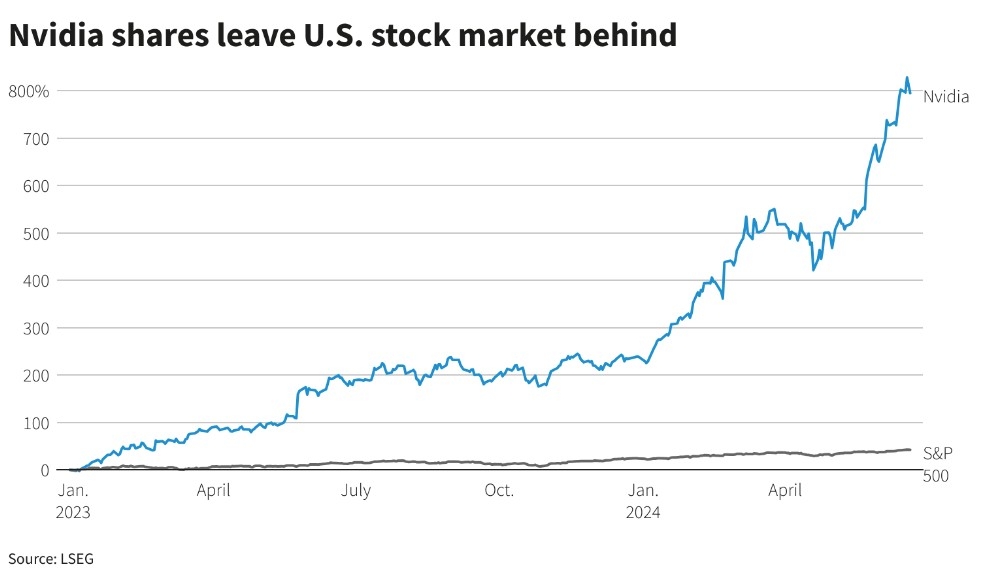

Another example is the recent tensions between the US and China. These tensions have led to trade disputes and uncertainty, causing investors to sell off stocks in sectors heavily reliant on Chinese exports, such as technology and consumer goods.

Impact on Different Sectors

Global events can also have a differential impact on different sectors of the economy. For instance, the technology sector, which is heavily exposed to global trade, tends to be more sensitive to such events. Conversely, sectors like healthcare and consumer staples are often considered more resilient and less affected by global events.

Navigating Through Turbulence

So, how can investors navigate through such turbulent times? Firstly, it's essential to stay informed and keep a close eye on global events. This will help investors make informed decisions and avoid making impulsive moves. Secondly, diversification can be a powerful tool in mitigating risks. By investing in a mix of assets across different sectors and geographies, investors can reduce their exposure to any single event.

Conclusion

In conclusion, global events can take a toll on the US stock market, leading to volatility and uncertainty. However, by staying informed and employing prudent investment strategies, investors can navigate through these challenging times and protect their portfolios. As always, it's crucial to remember that investing in the stock market involves risks, and it's essential to consult with a financial advisor before making any investment decisions.