The United States stock market, often referred to as the "World's Largest Stock Market," is a pivotal force in global finance. With a vast array of companies, industries, and market sectors, it's essential to stay informed about the latest trends and insights. This article delves into the current state of the US markets, highlighting key trends and offering valuable insights for investors and market enthusiasts.

Understanding the US Stock Market

The US stock market is a diverse landscape, encompassing everything from small-cap startups to blue-chip giants. The major indices, such as the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite, serve as benchmarks for market performance. These indices represent a cross-section of the market, making them crucial tools for gauging the overall health of the US economy.

Recent Trends in the US Markets

Tech Stocks: The technology sector, particularly the FAANG stocks (Facebook, Amazon, Apple, Netflix, and Google), has been a significant driver of market growth. However, recent regulatory concerns and increased competition have caused some volatility in this sector.

Growth vs. Value Stocks: The debate between growth and value stocks has been a hot topic in recent years. Growth stocks, characterized by their rapid earnings growth potential, have outperformed value stocks for much of the past decade. However, value stocks have shown signs of life in recent months, leading to a more balanced market landscape.

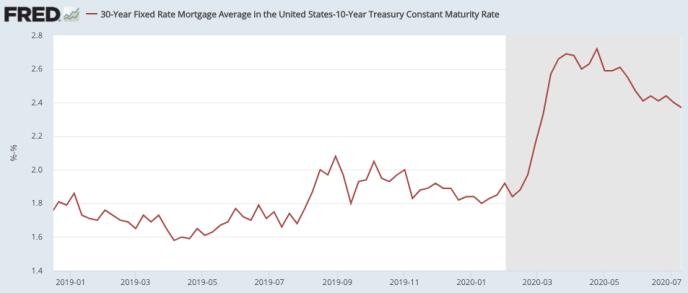

Inflation and Interest Rates: The Federal Reserve's monetary policy has a significant impact on the US markets. As inflation remains a concern, the Fed has been raising interest rates, which can affect borrowing costs and corporate earnings.

Economic Recovery: The US economy has been gradually recovering from the COVID-19 pandemic, with a focus on vaccination rates and consumer spending. This recovery has contributed to the overall strength of the US stock market.

Case Study: Tesla's Impact on the NASDAQ Composite

Tesla's meteoric rise has had a substantial impact on the NASDAQ Composite. As one of the most highly valued companies in the world, Tesla's inclusion in the NASDAQ 100 index has helped to push the index higher. This case study demonstrates how individual companies can influence broader market trends.

Conclusion

The US markets are dynamic and ever-changing, offering a wealth of opportunities and challenges for investors. By staying informed about the latest trends and insights, investors can make informed decisions and navigate the complexities of the market. Whether you're a seasoned investor or just starting out, understanding the current state of the US markets is crucial for long-term success.