In the ever-evolving world of finance, the phrase "stocks go down" is often a source of concern for investors. However, understanding the reasons behind stock market downturns and how to navigate through them is crucial for long-term financial success. This article delves into the causes of stock market volatility, strategies for mitigating risks, and tips for staying composed during turbulent times.

What Causes Stock Market Volatility?

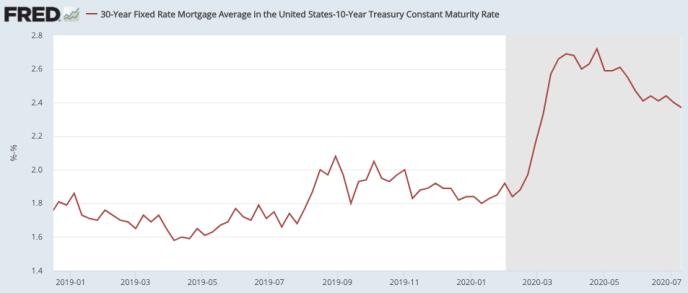

Stock prices can fluctuate significantly due to a variety of factors, including economic indicators, geopolitical events, and corporate earnings reports. Economic indicators such as interest rates, unemployment rates, and inflation rates can influence investor sentiment and lead to changes in stock prices. Geopolitical events like political instability, trade disputes, and natural disasters can also cause uncertainty in the market.

One key factor contributing to stock market volatility is the correlation between stock prices and corporate earnings. When companies report lower-than-expected earnings, their stocks often suffer. Conversely, strong earnings reports can boost stock prices.

Strategies for Mitigating Investment Risks

To navigate through the volatility of the stock market, investors can adopt several strategies:

Diversify Your Portfolio: Diversification helps to spread out risk by investing in a variety of asset classes, such as stocks, bonds, and real estate. This approach can reduce the impact of market downturns on your portfolio.

Set Realistic Expectations: It's important to have realistic expectations about your investments. The stock market can be unpredictable, and losses are a possibility. By setting realistic expectations, you can stay focused on your long-term investment goals.

Use Stop-Loss Orders: A stop-loss order is an instruction to sell a security when it reaches a certain price. This strategy can help limit potential losses by automatically selling the security when the price falls to a predetermined level.

Stay Informed: Keeping up-to-date with financial news and economic indicators can help you make informed decisions about your investments. However, it's important to avoid getting swayed by emotional reactions to the news.

Seek Professional Advice: Consulting with a financial advisor can provide valuable insights into managing your investments and navigating the complexities of the stock market.

Case Study: The 2008 Financial Crisis

A prime example of how stocks can go down is the 2008 financial crisis. The crisis was caused by a combination of factors, including the housing bubble, risky lending practices, and inadequate regulatory oversight. As a result, the stock market plummeted, with the S&P 500 Index falling more than 50% from its peak.

Despite the extreme volatility, investors who remained focused on their long-term investment strategy and avoided panic selling were able to recover their losses over time. This case study highlights the importance of sticking to your investment plan and avoiding emotional reactions during market downturns.

In conclusion, while the phrase "stocks go down" may seem ominous, understanding the reasons behind stock market volatility and adopting the right strategies can help you navigate through turbulent times. By diversifying your portfolio, setting realistic expectations, and seeking professional advice, you can position yourself for long-term financial success.