Are you interested in investing in US stocks but don't know where to start? You've come to the right place. In this comprehensive guide, we'll explore everything you need to know about investing in US stocks, including the benefits, risks, and the best strategies to get started. Whether you're a beginner or an experienced investor, this article will provide you with valuable insights to help you make informed decisions.

Understanding Ken Us Stock

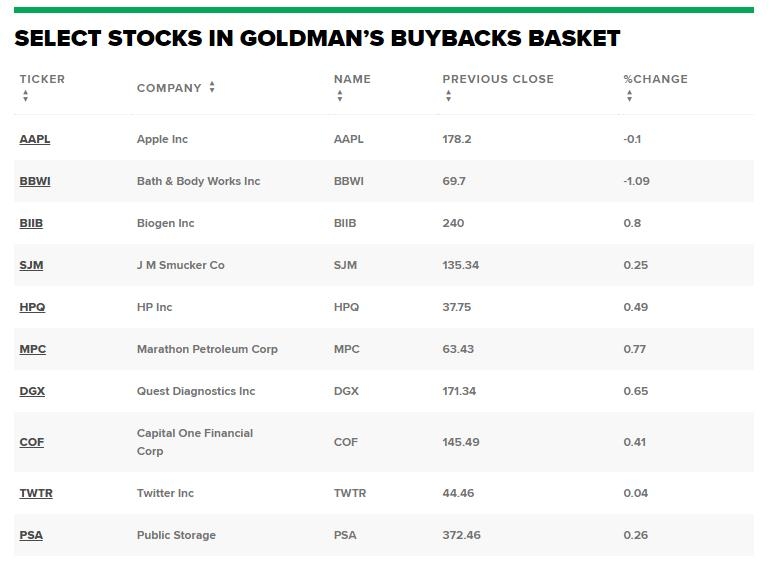

"Ken Us Stock" is a term that refers to investing in stocks listed on the US stock exchanges. The United States is home to some of the world's largest and most successful stock exchanges, including the New York Stock Exchange (NYSE) and the NASDAQ. These exchanges offer a wide range of investment opportunities, from large-cap companies like Apple and Microsoft to small-cap startups with high growth potential.

Benefits of Investing in US Stocks

Investing in US stocks offers several benefits, including:

- Diversification: The US stock market is vast and diverse, offering exposure to a wide range of industries and sectors. This diversification can help reduce your risk and increase your chances of achieving long-term returns.

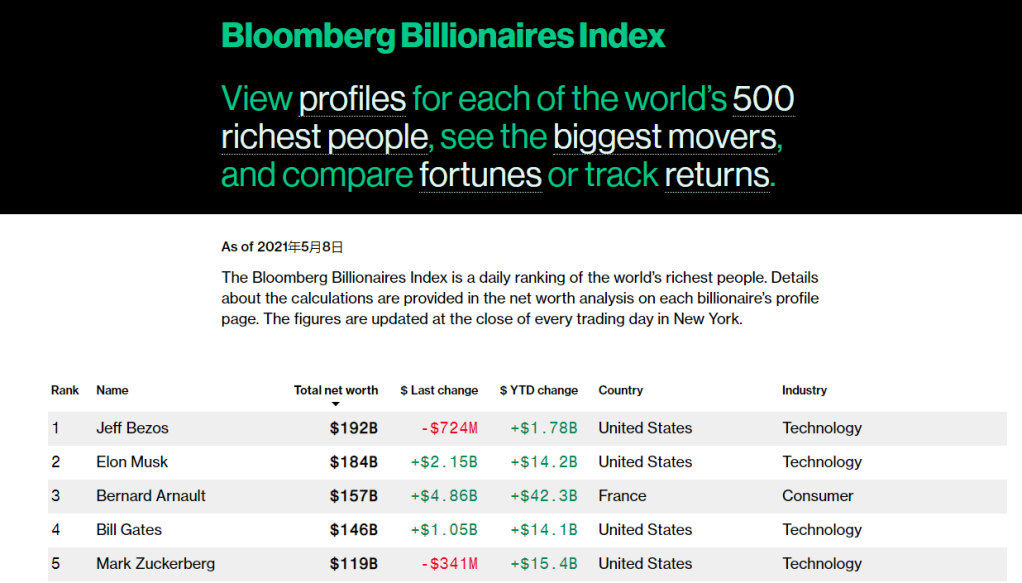

- Access to High-Quality Companies: The US stock market is home to some of the world's most successful and innovative companies. Investing in these companies can provide you with access to their growth and profitability.

- Potential for High Returns: Historically, investing in US stocks has provided investors with high returns over the long term. While there are risks involved, the potential for high returns makes US stocks an attractive investment option.

Risks of Investing in US Stocks

Investing in US stocks also comes with its own set of risks, including:

- Market Volatility: The stock market can be volatile, with prices fluctuating significantly over short periods of time. This volatility can lead to significant losses if you're not prepared.

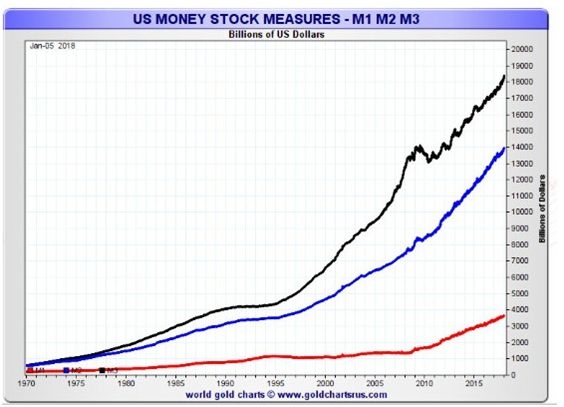

- Economic Factors: Economic factors such as inflation, interest rates, and political instability can impact the performance of US stocks.

- Company-Specific Risks: Investing in individual companies comes with its own set of risks, including poor management, product failures, and competition.

How to Get Started

If you're ready to start investing in US stocks, here are some steps to follow:

- Research: Before investing, it's important to research the companies you're interested in. Look for companies with strong financials, a solid business model, and a competitive advantage.

- Open a Brokerage Account: To buy and sell stocks, you'll need a brokerage account. There are many online brokers to choose from, each with their own fees and features.

- Start Small: If you're new to investing, it's a good idea to start small. This will help you get a feel for the market and reduce your risk.

- Stay Informed: Keep up with the latest news and developments in the stock market and the companies you're invested in. This will help you make informed decisions and adjust your portfolio as needed.

Case Study: Tesla

One of the most notable companies in the US stock market is Tesla. Founded in 2003, Tesla has become a leader in electric vehicles and renewable energy. Since going public in 2010, Tesla's stock has seen significant growth, with the company's market value reaching over $1 trillion at its peak.

Tesla's success can be attributed to several factors, including its innovative technology, strong leadership, and a loyal customer base. However, investing in Tesla also comes with its own set of risks, including high competition and regulatory challenges.

Conclusion

Investing in US stocks can be a rewarding experience, but it's important to do your research and understand the risks involved. By following the steps outlined in this guide, you can get started on your journey to investing in US stocks and potentially achieving long-term financial success.