Are you a non-resident considering investing in U.S. stocks? If so, you're not alone. The United States has long been a top destination for foreign investors looking to diversify their portfolios and gain access to some of the world's most successful companies. However, investing in U.S. stocks can be complex for non-residents. This comprehensive guide will walk you through the process, providing you with the knowledge and tools you need to make informed decisions.

Understanding U.S. Stock Market Basics

Before diving into the intricacies of buying U.S. stocks for non-residents, it's crucial to have a basic understanding of the U.S. stock market. The U.S. stock market is one of the largest and most liquid in the world, featuring three major exchanges: the New York Stock Exchange (NYSE), the Nasdaq Stock Market, and the Chicago Stock Exchange.

These exchanges list shares of publicly traded companies, allowing investors to buy and sell stocks. To invest in these stocks, non-residents must open a brokerage account with a U.S.-based brokerage firm that offers services to international clients.

Opening a Brokerage Account for Non-Resident Investors

The first step in buying U.S. stocks for non-residents is opening a brokerage account. This process typically involves the following:

- Choosing a Brokerage Firm: Research and compare brokerage firms that cater to non-resident investors. Look for firms with competitive fees, a strong reputation, and a user-friendly platform.

- Completing the Application: Fill out the brokerage application, providing personal and financial information, including your tax identification number or Social Security number (if applicable).

- Proof of Residence: Submit proof of your non-resident status, such as a passport, visa, or residency certificate.

- Funding the Account: Deposit funds into your brokerage account to purchase U.S. stocks.

Understanding U.S. Tax Implications

One of the most significant considerations for non-resident investors is the tax implications of owning U.S. stocks. Here's what you need to know:

- Withholding Tax: Non-resident investors are subject to a 30% withholding tax on dividends and interest earned from U.S. stocks. However, this rate can be reduced under certain tax treaties.

- Capital Gains Tax: Non-residents may also be subject to capital gains tax on the sale of U.S. stocks. The tax rate depends on the holding period and the investor's country of residence.

It's essential to consult with a tax professional or financial advisor to understand the specific tax obligations and ensure compliance with U.S. tax laws.

Popular U.S. Stocks for Non-Resident Investors

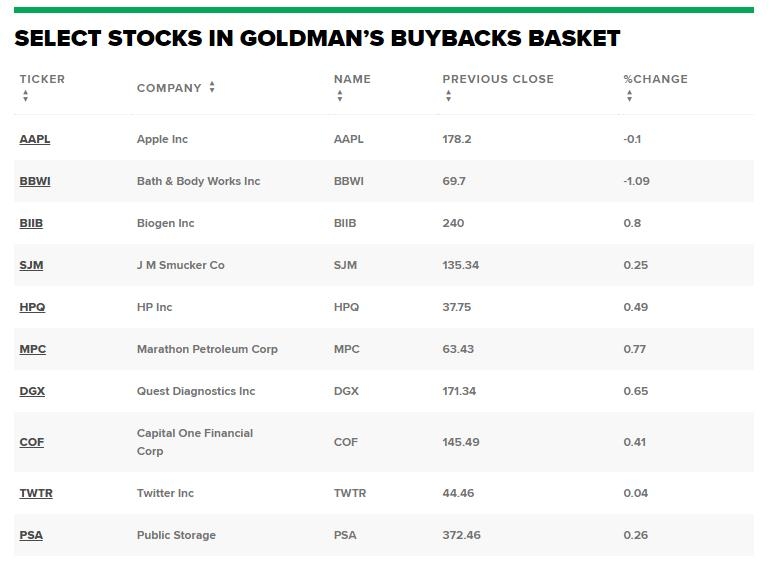

When it comes to investing in U.S. stocks, there are several popular options to consider:

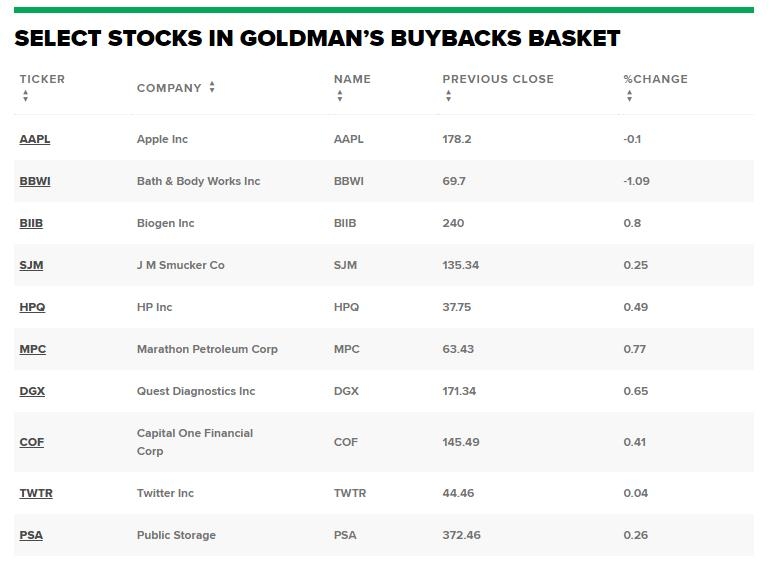

- Technology Stocks: Companies like Apple, Microsoft, and Amazon dominate the technology sector, offering growth potential and stability.

- Healthcare Stocks: The healthcare industry is a critical component of the U.S. economy, with companies like Johnson & Johnson and Pfizer providing exposure to a diverse range of healthcare products and services.

- Financial Stocks: U.S. financial institutions, such as JPMorgan Chase and Bank of America, offer exposure to the U.S. banking and financial services sector.

Case Study: Investing in U.S. Stocks for Non-Resident Investors

Let's consider a hypothetical example of a non-resident investor, John, from Canada, who decides to invest in U.S. stocks:

- Opening a Brokerage Account: John selects a brokerage firm that caters to non-resident investors and opens a brokerage account.

- Researching and Investing: John conducts research and decides to invest in Apple and Microsoft, two leading technology companies.

- Withholding Tax: John is aware that a 30% withholding tax will apply to the dividends he receives from these stocks, but he plans to seek a reduced rate under the U.S.-Canada tax treaty.

- Monitoring and Selling: Over time, John's investments appreciate, and he decides to sell his shares, generating a capital gain.

In this example, John must comply with U.S. tax laws and consult with a tax professional to understand his tax obligations.

Buying U.S. stocks for non-residents can be a lucrative investment opportunity. By understanding the process, tax implications, and popular investment options, you can make informed decisions and potentially benefit from the growth and stability of the U.S. stock market. Remember to consult with a financial advisor or tax professional to ensure compliance with all relevant regulations and to maximize your investment returns.