In a stunning display of market momentum, the index of 30 major US stocks soared over 700 points, marking a significant surge in investor confidence and economic optimism. This unprecedented jump has left many analysts scratching their heads and investors on the edge of their seats. In this article, we delve into the factors that contributed to this remarkable rally and explore its potential implications for the broader market.

Understanding the Index Surge

The index in question, often referred to as the "S&P 500," encompasses the top 500 publicly traded companies in the United States. This index is widely regarded as a bellwether for the overall health of the US economy. The recent jump of over 700 points represents a significant increase in value, with many stocks hitting new all-time highs.

Factors Contributing to the Surge

Several key factors have been identified as contributors to this remarkable surge in the index:

Economic Recovery: The global economy has been slowly recovering from the impact of the COVID-19 pandemic. As vaccination rates increase and restrictions ease, businesses are beginning to regain their momentum, leading to improved earnings and investor optimism.

Corporate Earnings: Many companies have reported strong earnings in recent quarters, fueling investor confidence and driving stock prices higher. Companies across various sectors, including technology, healthcare, and consumer discretionary, have reported robust revenue growth and improved profitability.

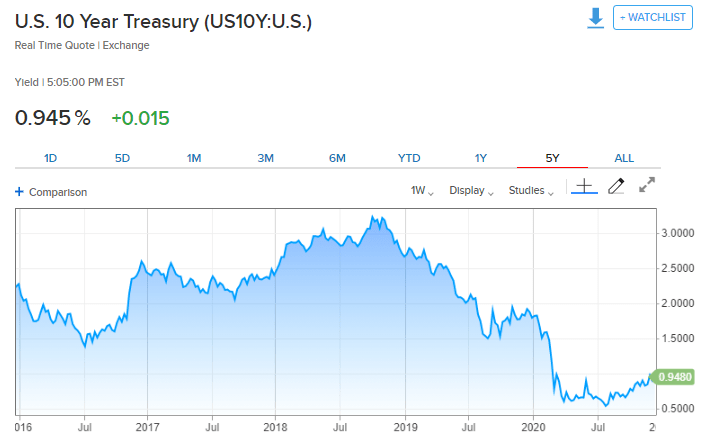

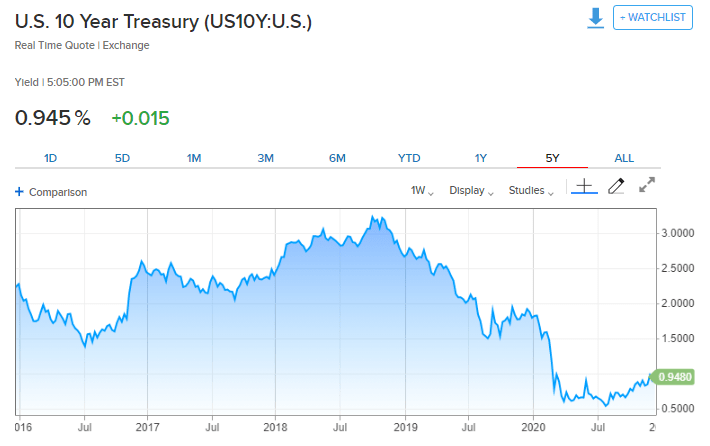

Low Interest Rates: The Federal Reserve has maintained low interest rates to support the economic recovery. This has made borrowing cheaper for businesses and individuals, leading to increased investment and spending.

Market Sentiment: Positive market sentiment has played a crucial role in driving stock prices higher. Investors have been upbeat about the economic outlook and the potential for further growth in the coming months.

Implications for the Broader Market

The recent surge in the index of 30 major US stocks has several potential implications for the broader market:

Rally in Other Markets: The strong performance of the US stock market may encourage investors to seek opportunities in other markets, leading to a broader global rally.

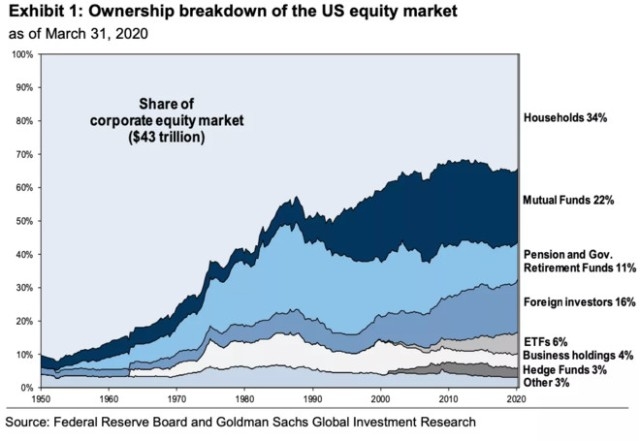

Increased Investment: The positive market sentiment may encourage more investors to enter the stock market, leading to increased investment and liquidity.

Economic Growth: The surge in stock prices may contribute to increased consumer confidence and spending, further supporting economic growth.

Case Studies

To illustrate the impact of the recent surge, let's consider a few case studies:

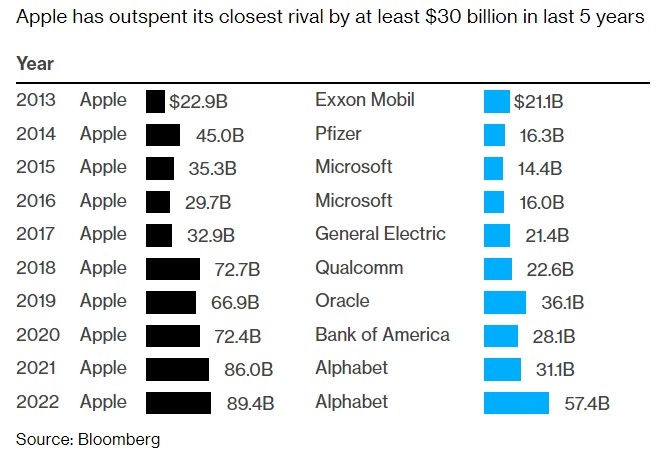

Apple Inc.: Apple, one of the constituent companies in the S&P 500, has seen its stock price soar in recent months. The company's strong performance in the technology sector, coupled with its expansive product portfolio, has contributed to its remarkable growth.

Amazon.com Inc.: Amazon has also experienced significant growth, driven by its dominant position in the e-commerce sector and its expansion into other areas, such as cloud computing and streaming services.

Tesla Inc.: Tesla's stock has surged in recent years, driven by its innovative electric vehicles and growing market share in the automotive industry.

In conclusion, the recent surge in the index of 30 major US stocks is a testament to the resilience and potential of the US economy. As investors continue to embrace opportunities in the stock market, we can expect to see further growth and innovation in the coming years.