In the ever-evolving landscape of the tech industry, Huawei stands as a prominent player. With a strong presence globally, the Chinese tech giant has captured the attention of investors worldwide. This article delves into the Huawei stock performance in the US, examining its market trends, potential risks, and future prospects.

Understanding Huawei Stock US

Huawei Stock US refers to the shares of Huawei Technologies Co., Ltd., a leading global provider of information and communications technology (ICT) infrastructure and smart devices. The stock is listed on the New York Stock Exchange (NYSE) under the ticker symbol "HWS."

Market Performance

In recent years, Huawei has experienced a rollercoaster ride in the US stock market. Despite facing various challenges, including trade restrictions and geopolitical tensions, the company has managed to maintain its position as a key player in the tech industry.

Rise and Fall: Huawei's stock initially soared following its IPO in 2018, reaching a peak of

Recovery: Since then, the stock has shown signs of recovery, with the price stabilizing around

Factors Influencing Huawei Stock US

Several factors influence the performance of Huawei Stock US:

- Geopolitical Tensions: The relationship between the US and China has been a significant driver of market sentiment. Any escalation in tensions can negatively impact Huawei's stock.

- Trade Restrictions: The US government's restrictions on Huawei have impacted its business operations and supply chain. These restrictions have also raised concerns about the company's long-term prospects.

- Economic Factors: The global economy and market conditions can also influence Huawei's stock performance. Factors such as inflation, interest rates, and consumer spending patterns play a crucial role.

Case Studies

To illustrate the impact of these factors on Huawei Stock US, let's look at a couple of case studies:

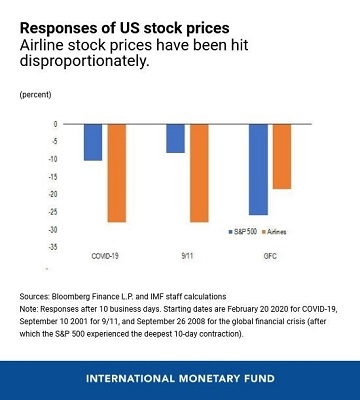

- 2019 Trade War: In May 2019, the US imposed additional restrictions on Huawei, including a blacklist that limited American companies from selling technology to the Chinese tech giant. This led to a sharp decline in Huawei's stock, as investors feared the impact of these restrictions on the company's business.

- COVID-19 Pandemic: The global pandemic has also had a significant impact on Huawei's stock. The company has faced challenges in manufacturing and supply chain disruptions, which have affected its revenue and profitability.

Future Prospects

Looking ahead, the future of Huawei Stock US remains uncertain. While the company has made significant strides in diversifying its business and expanding into new markets, geopolitical tensions and trade restrictions continue to pose a risk.

However, Huawei's strong position in the global tech industry and its commitment to innovation may provide a silver lining. As the company continues to invest in research and development, it could emerge stronger and more resilient in the face of adversity.

In conclusion, Huawei Stock US is a complex investment with a range of factors influencing its performance. While the road ahead remains challenging, investors with a long-term perspective may find opportunities in this dynamic and evolving market.