Are you interested in expanding your investment portfolio to include Canadian stocks, specifically those listed on the Toronto Stock Exchange (TSX)? Trading TSX stocks from the United States can be a lucrative opportunity, but it requires a clear understanding of the process. In this article, we will guide you through the steps to trade TSX stocks in the US, ensuring you make informed decisions and maximize your investment potential.

Understanding the Toronto Stock Exchange

The Toronto Stock Exchange is one of the largest stock exchanges in North America, with a diverse range of companies listed across various sectors. By trading TSX stocks, investors can gain exposure to Canadian industries, including energy, mining, and technology, which may offer different opportunities compared to those available in the US.

Steps to Trade TSX Stocks in the US

Open a Canadian Brokerage Account:

To trade TSX stocks, you need a Canadian brokerage account. This account will allow you to buy and sell Canadian securities. Many Canadian brokerage firms offer accounts to US investors, so you have a wide range of options to choose from.

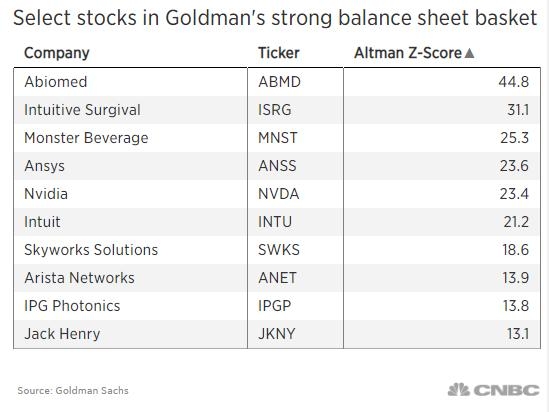

Research and Select Stocks: Once you have your Canadian brokerage account, it's time to research and select the TSX stocks you want to invest in. Consider factors such as the company's financial health, industry trends, and market performance. Utilize financial websites, news outlets, and stock analysis tools to gather information.

Understand the Trading Process: Trading TSX stocks is similar to trading US stocks. You can place market orders, limit orders, and stop orders. However, it's essential to be aware of the Canadian trading hours, which are typically 9:30 AM to 4:00 PM ET (Eastern Time).

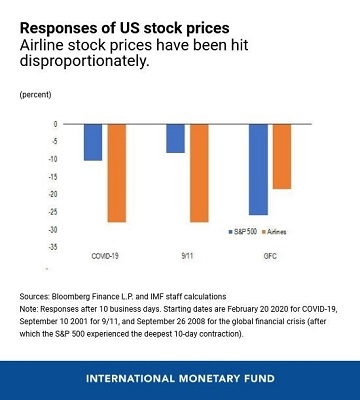

Monitor Your Investments: After purchasing TSX stocks, it's crucial to monitor their performance regularly. Keep an eye on market news, company earnings reports, and any other relevant information that may impact the stock's price.

Stay Informed About Canadian Tax Implications: When trading TSX stocks, it's important to understand the tax implications. While US investors are generally subject to Canadian tax laws, the specifics can vary depending on the individual's circumstances. Consult with a tax professional to ensure compliance.

Case Study: Investment in TSX Energy Stocks

Let's consider a hypothetical scenario where a US investor decides to invest in TSX energy stocks. By opening a Canadian brokerage account and conducting thorough research, the investor identifies a promising energy company with strong growth potential.

After purchasing shares, the investor monitors the stock's performance and stays informed about industry news. As a result, the investor benefits from the rising energy prices and sells the shares at a higher price, realizing a profit.

Conclusion

Trading TSX stocks from the US can be a rewarding investment strategy. By following these steps and staying informed, you can successfully navigate the Canadian market and potentially enhance your investment portfolio. Remember to conduct thorough research, monitor your investments, and consult with a tax professional to ensure compliance with Canadian tax laws.