Introduction

The United States stock market has always been a beacon for investors seeking growth and diversification. With the rise of globalization, European companies have increasingly become a part of the U.S. stock market landscape. This article explores the potential investment opportunities in European companies listed on U.S. exchanges, highlighting their benefits and risks.

Understanding European Companies in US Stocks

European companies listed on U.S. exchanges are those that have chosen to trade their shares on American stock markets. This allows investors to gain exposure to European markets without having to navigate the complexities of foreign exchanges. Some of the most popular European companies listed in the U.S. include Volkswagen, Airbus, and AstraZeneca.

Benefits of Investing in European Companies

Diversification: Investing in European companies can help diversify your portfolio, reducing the risk associated with investing solely in U.S. stocks. European markets often have different economic cycles and sectors, which can provide balance to your investment strategy.

Growth Potential: European companies often have access to large and growing markets within the European Union. This can lead to significant growth opportunities for investors.

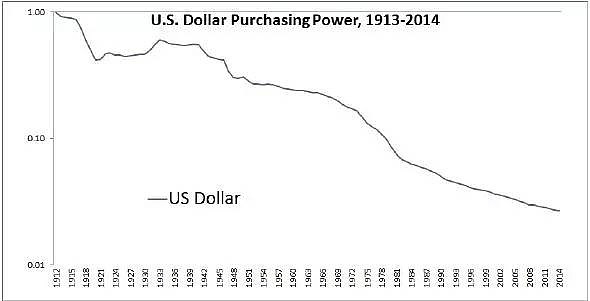

Currency Exposure: Investing in European companies can provide exposure to the Euro, which can be beneficial if the currency strengthens against the U.S. dollar.

Risks of Investing in European Companies

Currency Risk: Fluctuations in the exchange rate between the Euro and the U.S. dollar can impact the returns on investments in European companies.

Political and Economic Risk: European companies may be exposed to political and economic instability in their home countries, which can affect their performance.

Regulatory Risk: Different regulatory environments in Europe and the U.S. can pose challenges for European companies operating in both markets.

Case Studies

Volkswagen: Volkswagen, a German automaker, has been listed on the New York Stock Exchange since 1982. Despite facing challenges related to the diesel emissions scandal, Volkswagen has shown resilience and continues to be a popular investment among U.S. investors.

Airbus: Airbus, a European aerospace company, has been listed on the New York Stock Exchange since 2000. The company has grown significantly over the years and has become a key player in the global aviation industry.

Conclusion

Investing in European companies listed on U.S. exchanges can be a lucrative opportunity for investors seeking diversification and growth. However, it is important to carefully consider the risks and benefits associated with these investments. By understanding the unique characteristics of European companies in the U.S. stock market, investors can make informed decisions and potentially achieve significant returns.