Are you a U.S. investor looking to expand your portfolio? Have you considered adding Canadian stocks to your investment mix? If so, you're not alone. The Canadian stock market offers a range of opportunities for investors, from large, well-established companies to smaller, emerging businesses. But can U.S. investors buy Canadian stocks? The answer is yes, and in this article, we'll explore how you can do it, the benefits of investing in Canadian stocks, and some key considerations to keep in mind.

Understanding the Canadian Stock Market

The Canadian stock market is one of the largest in the world, with a diverse range of industries and companies. The Toronto Stock Exchange (TSX) is the main stock exchange in Canada, and it's home to many of the country's largest companies, including energy giants like Suncor Energy and Royal Dutch Shell, as well as financial institutions like the Royal Bank of Canada and Toronto-Dominion Bank.

How U.S. Investors Can Buy Canadian Stocks

Brokerage Accounts: The most common way for U.S. investors to buy Canadian stocks is through a brokerage account. Many U.S. brokers offer access to Canadian stocks, allowing you to trade them just like you would U.S. stocks.

Direct Investment: Some Canadian companies offer direct investment options for U.S. investors. This can be done through a direct purchase of shares or through a DR (depositary receipt) program.

ETFs and Mutual Funds: Exchange-traded funds (ETFs) and mutual funds that invest in Canadian stocks are also available to U.S. investors. These funds can be purchased through your brokerage account or directly from the fund company.

Benefits of Investing in Canadian Stocks

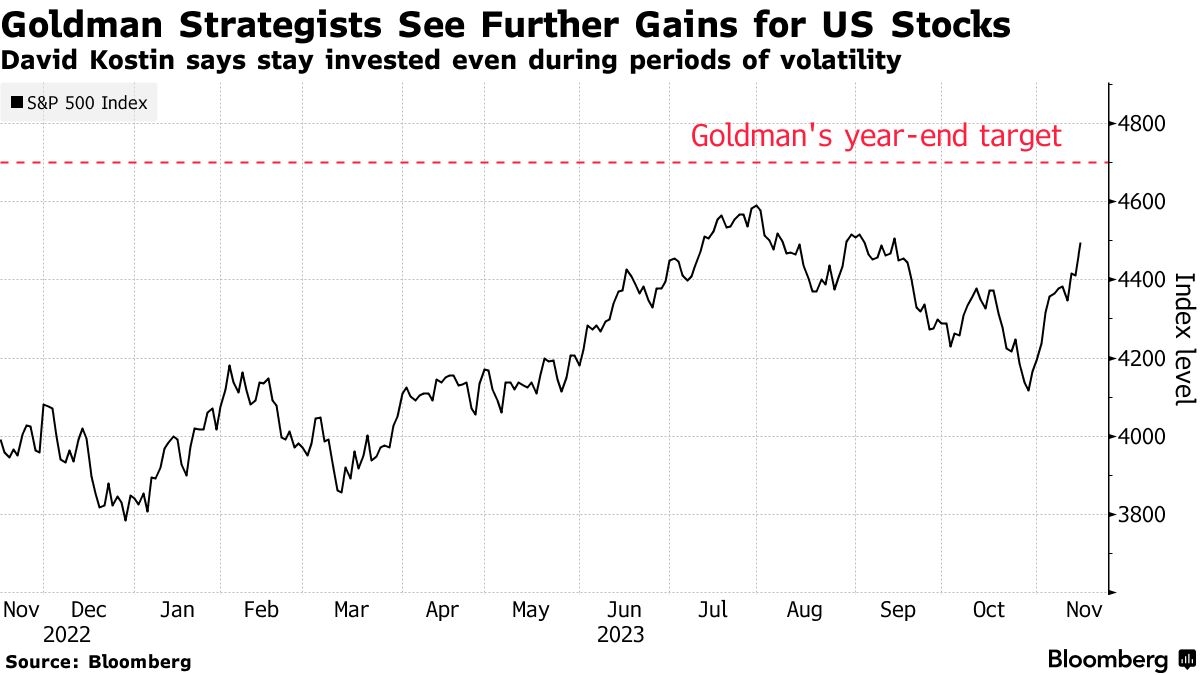

Diversification: Investing in Canadian stocks can help diversify your portfolio, reducing your exposure to U.S. market volatility.

Strong Economic Performance: The Canadian economy has shown resilience over the years, with strong growth in certain sectors like energy, technology, and healthcare.

Access to High-Quality Companies: The Canadian stock market is home to many high-quality companies with strong financials and growth potential.

Key Considerations for U.S. Investors

Currency Fluctuations: Investing in Canadian stocks means dealing with currency fluctuations, as the Canadian dollar is different from the U.S. dollar.

Tax Implications: U.S. investors need to be aware of the tax implications of investing in Canadian stocks. While U.S. tax laws generally apply, there may be additional considerations depending on the specific investment and your individual tax situation.

Research and Due Diligence: As with any investment, it's important to conduct thorough research and due diligence before investing in Canadian stocks.

Case Study: Suncor Energy

Suncor Energy is one of Canada's largest energy companies, with a focus on oil sands development and production. For U.S. investors looking to invest in Canadian stocks, Suncor offers a solid opportunity. The company has a strong track record of financial performance and is well-positioned to benefit from the long-term growth of the energy sector.

In conclusion, U.S. investors can certainly buy Canadian stocks, and doing so can offer a range of benefits. Whether you're looking to diversify your portfolio or gain exposure to high-quality companies, the Canadian stock market is worth considering. Just be sure to do your research and understand the potential risks and rewards before making any investment decisions.