In the wake of the tumultuous year 2022, investors and financial analysts have been grappling with the repercussions of the US stock crash. This article delves into the reasons behind the downturn, its impact on various sectors, and the strategies that investors can adopt to navigate through these turbulent times.

The Catalysts Behind the Stock Market Downturn

The US stock crash of 2022 can be attributed to several factors. Inflation played a significant role, with the Consumer Price Index (CPI) reaching a 40-year high. This, coupled with the Federal Reserve's aggressive monetary policy, resulted in higher interest rates, which in turn, impacted investor confidence.

Supply Chain Disruptions and Geopolitical Tensions also contributed to the downturn. The ongoing conflict in Eastern Europe and the global supply chain crisis, exacerbated by the COVID-19 pandemic, led to increased uncertainty and volatility in the market.

Sector-Specific Impacts

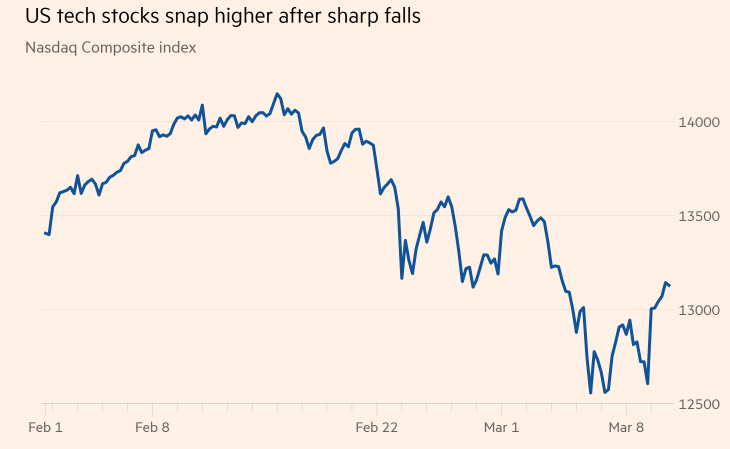

The US stock crash had a varied impact on different sectors. Technology stocks, which had been leading the market before the downturn, saw significant declines. This can be attributed to regulatory scrutiny and concerns regarding overvaluation.

On the other hand, healthcare and consumer discretionary sectors emerged as winners during the downturn. The increased focus on healthcare due to the pandemic and the shift towards online shopping contributed to the growth of these sectors.

Case Study: Tesla’s Stock Performance

One of the most prominent examples of the US stock crash was the performance of Tesla’s stock. After reaching an all-time high in 2021, the stock plummeted by nearly 65% in 2022. This decline can be attributed to several factors, including concerns regarding production delays and increased competition.

Strategies for Navigating the Downturn

Despite the challenges posed by the US stock crash, investors can adopt several strategies to mitigate their risks. Diversification remains a crucial strategy, as it helps in spreading the risk across different sectors and asset classes.

Risk Management is also essential. Investors should set clear stop-loss levels to limit their potential losses. Additionally, focusing on quality stocks with strong fundamentals can provide a cushion against market volatility.

Conclusion

The US stock crash of 2022 has been a challenging period for investors. However, by understanding the underlying factors and adopting appropriate strategies, investors can navigate through these turbulent times and emerge stronger. As the market continues to evolve, staying informed and adaptable will be key to success.