In the globalized world we live in, investors from Europe have more opportunities than ever to diversify their portfolios by investing in U.S. stocks. With the advancements in technology and the ease of online trading, purchasing U.S. stocks from Europe has become more accessible than ever before. This article aims to provide a comprehensive guide for European investors looking to buy U.S. stocks, covering the process, advantages, and considerations involved.

Understanding the Process

The first step for European investors is to open a brokerage account that allows trading in U.S. stocks. This can be done with both domestic and international brokers. Many European brokers offer services that enable clients to trade U.S. stocks directly, while others require investors to use a third-party service to execute trades.

Once the brokerage account is set up, investors can start purchasing U.S. stocks. The process is similar to buying stocks within Europe, with the primary difference being the currency conversion. When buying U.S. stocks, investors will need to convert their European currency to U.S. dollars, which may incur additional fees and exchange rate fluctuations.

Advantages of Buying U.S. Stocks from Europe

Investing in U.S. stocks offers several advantages for European investors:

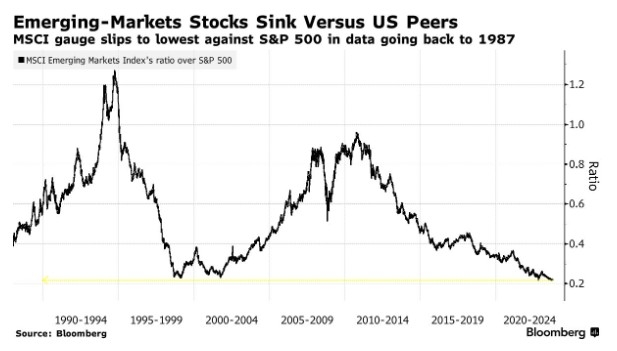

- Diversification: The U.S. stock market is one of the largest and most diverse in the world, providing exposure to a wide range of industries and sectors.

- Economic Growth: The U.S. economy is one of the most robust in the world, offering potential for long-term growth and investment returns.

- Access to Leading Companies: The U.S. stock market is home to many of the world's largest and most successful companies, such as Apple, Microsoft, and Google.

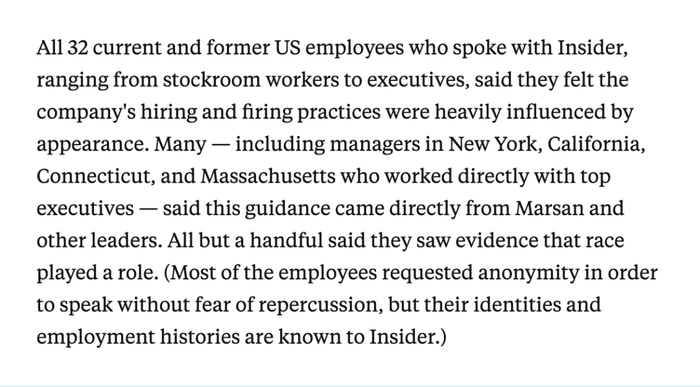

- Regulatory Environment: The U.S. has a well-regulated stock market, providing investors with a level of security and transparency.

Considerations for European Investors

While there are many advantages to buying U.S. stocks from Europe, there are also several considerations to keep in mind:

- Currency Conversion: As mentioned earlier, investors will need to convert their European currency to U.S. dollars, which may incur additional fees and exchange rate fluctuations.

- Tax Implications: European investors may be subject to taxes on their U.S. stock investments, depending on their country of residence. It's important to consult with a tax professional to understand the tax implications.

- Transaction Costs: The process of buying U.S. stocks from Europe may incur additional transaction costs, such as brokerage fees and currency conversion fees.

- Market Volatility: The U.S. stock market can be volatile, and it's important for investors to understand the risks involved before investing.

Case Study: Investing in U.S. Stocks from Europe

Let's consider a hypothetical example of a European investor named Maria, who wants to invest in U.S. stocks. Maria opens a brokerage account with a domestic broker that offers services for trading U.S. stocks. After conducting research, she decides to invest in Apple Inc. (AAPL).

Maria buys 100 shares of AAPL at a price of

Conclusion

Buying U.S. stocks from Europe has become a viable option for European investors looking to diversify their portfolios. While there are some considerations to keep in mind, the advantages of investing in the U.S. stock market can be significant. By understanding the process, advantages, and considerations involved, European investors can make informed decisions about their investments.