In today's fast-paced financial world, understanding the stock market is crucial for investors and traders alike. One of the key aspects of this understanding is the ability to predict and analyze stock prices. This article delves into the concept of "clf us stock price" and explores the methodologies and tools used to forecast stock prices in the United States.

What is "clf us stock price"?

The term "clf us stock price" refers to the process of analyzing and predicting the stock prices of companies listed on the United States stock exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ. The goal is to determine whether a stock is overvalued, undervalued, or fairly priced.

Methods Used to Analyze Stock Prices

Fundamental Analysis: This involves examining a company's financial statements, such as its balance sheet, income statement, and cash flow statement. By looking at metrics like earnings per share (EPS), price-to-earnings (P/E) ratio, and debt-to-equity ratio, investors can assess the company's financial health and growth prospects.

Technical Analysis: This method uses historical price and volume data to identify patterns and trends that may indicate future price movements. Traders look for indicators like moving averages, support and resistance levels, and candlestick patterns.

Sentiment Analysis: By analyzing news, social media, and other public information, investors can gauge the market's sentiment towards a particular stock. Positive sentiment can drive up prices, while negative sentiment can lead to a decline.

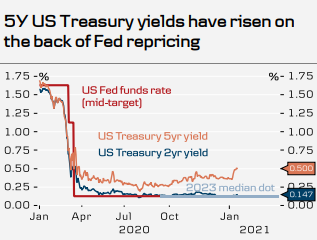

Economic Indicators: Economic data such as unemployment rates, inflation, and interest rates can have a significant impact on stock prices. Traders often use these indicators to predict market movements.

Case Study: Apple Inc. (AAPL)

To illustrate the application of these methods, let's consider Apple Inc. (AAPL), one of the most valuable companies in the world.

Fundamental Analysis:

- EPS: Apple's EPS has been consistently rising over the years, indicating strong profitability.

- P/E Ratio: The company's P/E ratio is currently around 30, which is slightly above the market average but reflects its premium status in the tech industry.

Technical Analysis:

- Moving Averages: Apple's stock has been trading above its 50-day and 200-day moving averages, suggesting a bullish trend.

- Support and Resistance: The stock has found strong support at

150 and resistance at 180.

Sentiment Analysis:

- Social Media: Positive sentiment on social media platforms has been prevalent, with many investors expressing confidence in Apple's long-term prospects.

Economic Indicators:

- Interest Rates: With interest rates remaining low, Apple's debt remains affordable, and the company can continue investing in growth opportunities.

Conclusion

Predicting stock prices is a complex task that requires a comprehensive approach. By combining fundamental, technical, and sentiment analysis, as well as considering economic indicators, investors can make more informed decisions. While there is no foolproof method for predicting stock prices, understanding these concepts can help investors navigate the dynamic world of the US stock market.