The US stock market has always been a reflection of the nation's economic health and global influence. One of the most significant legislative bills in recent years, the "Big Beautiful Bill," has sparked considerable debate and speculation about its potential impact on the stock market. This article delves into the implications of this legislation, analyzing its effects on various sectors and the broader market landscape.

Understanding the Big Beautiful Bill

The Big Beautiful Bill, also known as the "Economic Empowerment Act," is a comprehensive legislative package aimed at boosting economic growth, improving infrastructure, and enhancing consumer protection. The bill encompasses several key areas, including tax reforms, investment incentives, and regulatory changes.

Impact on the Stock Market

The stock market is a sensitive barometer of economic conditions and investor sentiment. The Big Beautiful Bill is expected to have a multifaceted impact on the US stock market, with several key factors at play:

1. Tax Reforms

The bill proposes significant tax cuts for corporations and high-income individuals. This could lead to increased profitability and dividend payments, boosting investor confidence and potentially driving stock prices higher. However, it's important to consider the long-term implications of reduced tax revenue, which could lead to increased government debt and potentially higher interest rates.

2. Investment Incentives

The bill includes provisions aimed at encouraging investment in key sectors, such as renewable energy, infrastructure, and technology. This could lead to increased capital spending and job creation, driving growth in these sectors and potentially benefiting the broader market.

3. Regulatory Changes

The bill proposes several regulatory changes aimed at streamlining business operations and reducing compliance costs. This could lead to increased efficiency and profitability for companies, potentially boosting stock prices.

Sector-Specific Impacts

The Big Beautiful Bill is expected to have varying impacts on different sectors of the US stock market:

1. Tech Sector

The tech sector is likely to benefit significantly from the bill's investment incentives and regulatory changes. Companies in this sector are known for their high capital expenditures and potential for growth, making them attractive targets for investors.

2. Energy Sector

The bill's focus on renewable energy could benefit companies in the energy sector, particularly those involved in solar, wind, and other alternative energy sources.

3. Infrastructure Sector

Investment in infrastructure is a key component of the bill, and companies involved in construction, transportation, and utilities could see increased demand and potentially higher stock prices.

Case Studies

To illustrate the potential impact of the Big Beautiful Bill, let's consider a few case studies:

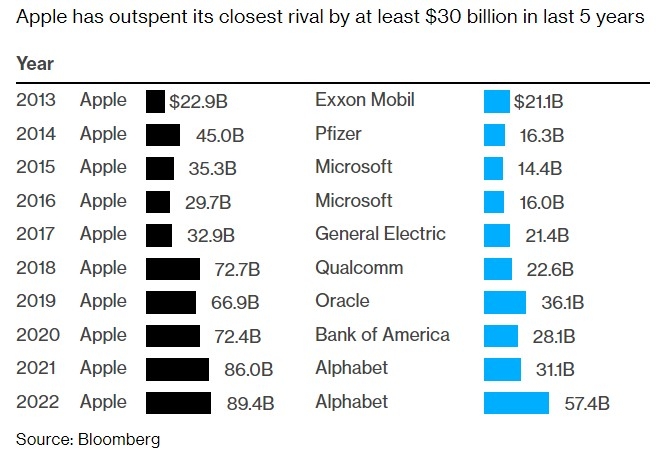

1. Apple Inc.

Apple Inc. is a prime example of a company that could benefit from the bill's tax cuts and investment incentives. The company has a significant presence in the tech sector and is known for its high capital expenditures. A reduction in tax rates and increased investment in key areas could lead to higher profitability and potentially higher stock prices.

2. Tesla Inc.

Tesla Inc., a leader in the renewable energy sector, could benefit significantly from the bill's focus on alternative energy sources. Increased investment in this area could lead to higher demand for Tesla's products and potentially higher stock prices.

Conclusion

The Big Beautiful Bill has the potential to have a significant impact on the US stock market, with various factors at play. While the bill offers several opportunities for growth and investment, it also presents potential risks, such as increased government debt and higher interest rates. Investors and market participants will need to closely monitor the implementation of the bill and its effects on the market to make informed decisions.