In the dynamic world of finance, the US large company stock index is a vital tool for investors and market analysts. This index serves as a benchmark for the performance of the largest and most influential companies in the United States. In this article, we will delve into the details of the US large company stock index, its significance, and how it can be used to make informed investment decisions.

What is the US Large Company Stock Index?

The US large company stock index is a measure of the overall performance of the largest publicly traded companies in the United States. It is often referred to as the S&P 500 Index, which stands for Standard & Poor's 500. The S&P 500 is a market capitalization-weighted index that includes the top 500 companies listed on the New York Stock Exchange (NYSE) and the NASDAQ.

Why is the S&P 500 Index Important?

The S&P 500 Index is one of the most widely followed stock market indices in the world. It offers a snapshot of the broader U.S. stock market and is often used as a proxy for the overall health of the U.S. economy. Here are some key reasons why the S&P 500 Index is important:

- Market Performance Benchmark: The S&P 500 Index is a key benchmark for evaluating the performance of the U.S. stock market. Investors and analysts use it to track the overall market trends and make investment decisions.

- Economic Indicator: The S&P 500 Index is considered a leading economic indicator. It reflects the economic conditions of the United States and can provide insights into the future direction of the economy.

- Diversification: The S&P 500 Index includes a diverse range of companies across various sectors and industries. This diversification helps to reduce the risk associated with investing in a single stock or sector.

How is the S&P 500 Index Calculated?

The S&P 500 Index is calculated based on the market capitalization of the companies included in the index. Market capitalization is the total value of a company's outstanding shares of stock. The companies in the S&P 500 are weighted based on their market capitalization, with larger companies having a greater impact on the index.

Key Components of the S&P 500 Index

The S&P 500 Index includes companies from various sectors and industries. Some of the key components of the index include:

- Technology: Companies like Apple, Microsoft, and Google are among the largest technology companies in the world and are included in the S&P 500 Index.

- Healthcare: The healthcare sector is represented by companies like Johnson & Johnson and Pfizer.

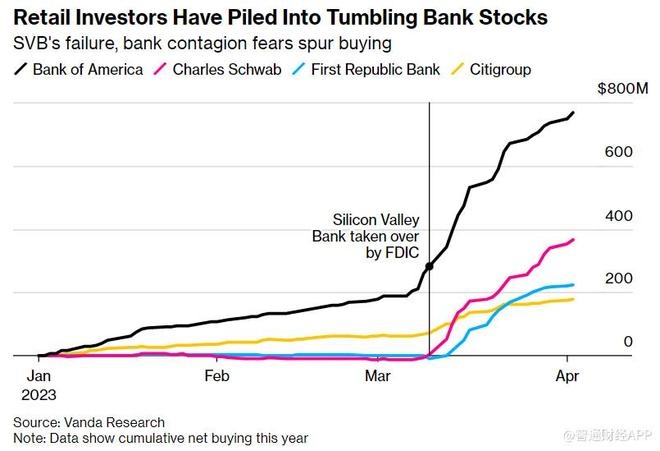

- Finance: Financial companies such as JPMorgan Chase and Bank of America are included in the index.

- Consumer Goods: Companies like Procter & Gamble and Coca-Cola are part of the consumer goods sector within the S&P 500.

Case Study: The Impact of the S&P 500 Index on the Stock Market

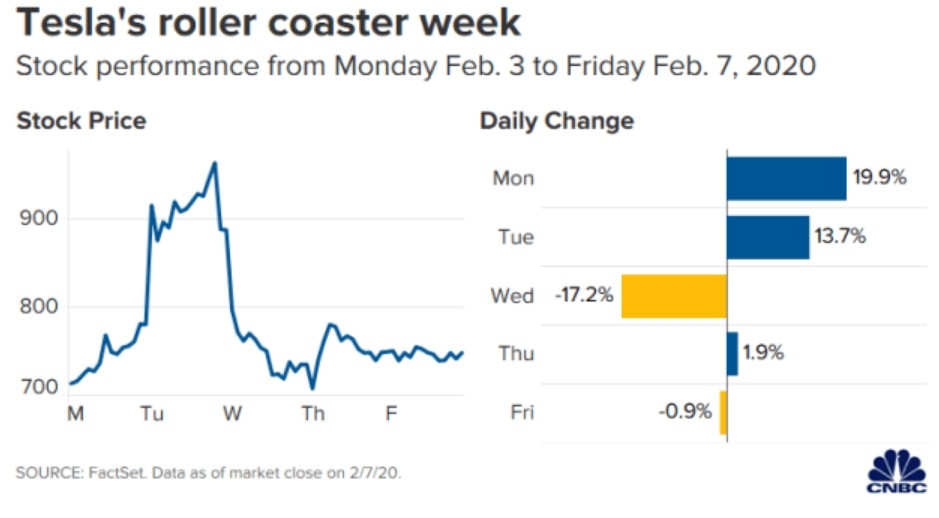

In 2020, the S&P 500 Index experienced significant volatility due to the COVID-19 pandemic. The index dropped sharply in March, but it recovered strongly by the end of the year. This example highlights the importance of the S&P 500 Index as a leading economic indicator and a benchmark for market performance.

In conclusion, the US large company stock index, particularly the S&P 500 Index, is a crucial tool for investors and market analysts. It provides valuable insights into the performance of the U.S. stock market and the broader economy. By understanding the S&P 500 Index, investors can make more informed decisions and better navigate the dynamic world of finance.