In the world of finance, the US market stock index stands as a beacon of economic health and investment opportunities. This guide delves into what a US market stock index is, how it works, and why it's a crucial tool for investors and analysts alike.

What is a US Market Stock Index?

A US market stock index is a statistical measure of the value of a selection of stocks representing a specific market or sector within the United States. These indexes are designed to track the performance of the overall market or specific segments of it. The most well-known US market stock indexes include the S&P 500, the Dow Jones Industrial Average (DJIA), and the NASDAQ Composite.

The S&P 500

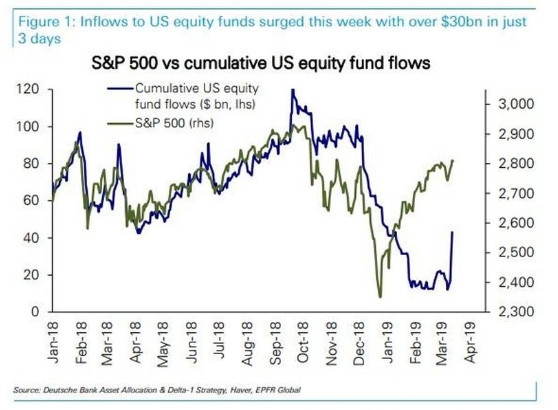

The S&P 500 is one of the most widely followed stock market indexes in the world. It consists of 500 of the largest publicly traded companies in the United States, representing a broad range of industries. This index is often seen as a benchmark for the U.S. stock market and is used to gauge the overall health of the economy.

The Dow Jones Industrial Average (DJIA)

The DJIA is another major stock index that tracks the performance of 30 large companies in the United States, representing various sectors of the economy. It's known for its historical significance and is often used as a gauge of the stock market's overall performance.

The NASDAQ Composite

The NASDAQ Composite is an index that tracks the performance of all the stocks listed on the NASDAQ stock exchange, which is known for its high-tech and growth-oriented companies. It's particularly popular among tech investors and is often seen as a bellwether for the tech sector.

How Stock Indexes Work

Stock indexes are calculated using a variety of methodologies, but the most common is the price-weighted method. In this method, each stock in the index is assigned a weight based on its price. The index value is then calculated by adding up the prices of all the stocks in the index and dividing by a divisor.

Why Are Stock Indexes Important?

Stock indexes serve several important purposes:

Performance Benchmarking: Investors and analysts use stock indexes to compare the performance of their portfolios or specific stocks to the broader market.

Economic Indicators: Stock indexes can be used as economic indicators, providing insights into the overall health of the economy.

Investment Opportunities: Stock indexes can highlight sectors or individual stocks that may offer attractive investment opportunities.

Case Study: The 2008 Financial Crisis

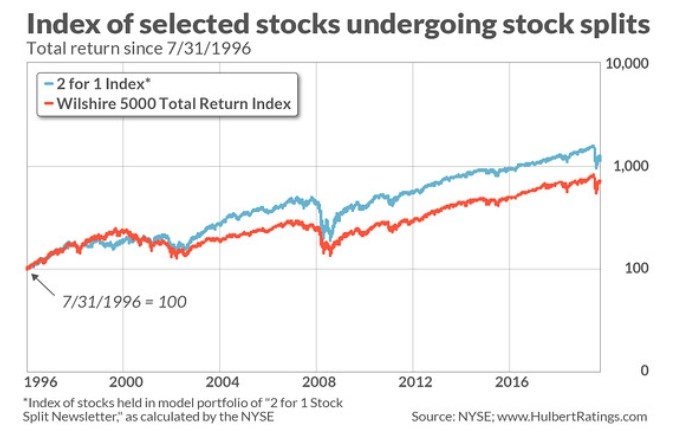

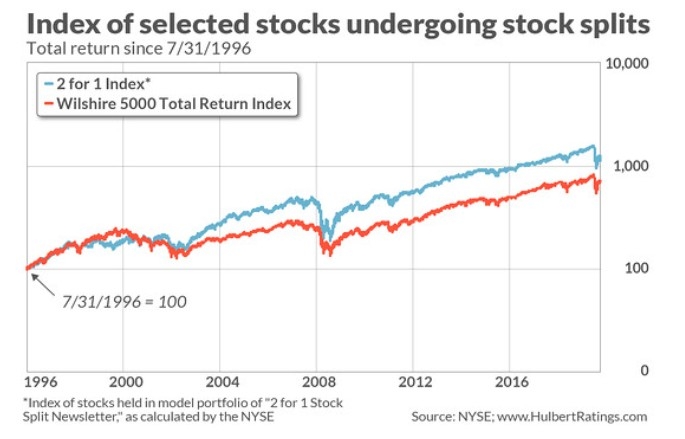

One of the most notable events in the history of the US market stock indexes was the 2008 financial crisis. During this period, many stock indexes, including the S&P 500 and the DJIA, experienced significant declines. However, after the crisis, these indexes recovered and reached new highs, demonstrating their resilience and ability to recover from major downturns.

Conclusion

Understanding the US market stock index is crucial for anyone interested in investing or analyzing the stock market. By tracking the performance of a broad range of stocks, these indexes provide valuable insights into the health of the economy and potential investment opportunities. Whether you're a seasoned investor or just starting out, familiarizing yourself with these indexes can help you make more informed decisions.