In the fast-paced world of stock markets, the US500 share price is a term that often catches the attention of investors and traders. But what exactly does it mean? This article aims to provide a comprehensive guide to understanding the US500 share price, its significance, and how it can impact your investment decisions.

What is the US500 Share Price?

The US500 refers to the S&P 500 Index, which is a stock market index that tracks the performance of 500 large companies listed on stock exchanges in the United States. The index represents approximately 80% of the total market capitalization of all U.S. stocks. The US500 share price, therefore, represents the aggregate value of these 500 companies.

Why is the US500 Share Price Important?

The US500 share price is a critical indicator of the overall health and performance of the U.S. stock market. It provides investors with a snapshot of the market's trends and potential opportunities. Here are a few reasons why the US500 share price is important:

- Market Trend Indicator: The US500 share price can help investors identify market trends. For example, if the US500 share price is rising, it may indicate a strong market sentiment, while a falling US500 share price may suggest a bearish market.

- Investment Opportunities: The US500 index includes some of the largest and most successful companies in the United States, such as Apple, Microsoft, and Amazon. By tracking the US500 share price, investors can identify potential investment opportunities in these companies.

- Economic Indicator: The US500 share price can also serve as an economic indicator. A rising US500 share price may suggest a strong economy, while a falling US500 share price may indicate economic challenges.

Factors Affecting the US500 Share Price

Several factors can influence the US500 share price. Some of the key factors include:

- Economic Data: Economic data, such as GDP growth, unemployment rates, and inflation, can impact the US500 share price. Positive economic data may lead to a rising US500 share price, while negative data may cause a decline.

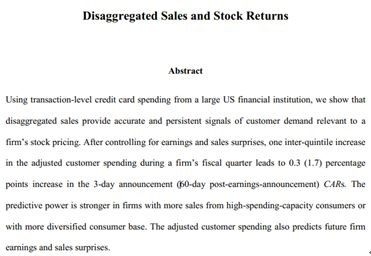

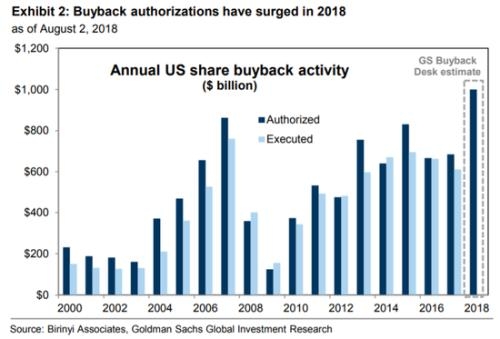

- Corporate Earnings: The financial performance of companies included in the US500 index can significantly impact the index's share price. Strong earnings reports can lead to a rising US500 share price, while weak earnings reports can cause a decline.

- Market Sentiment: The overall sentiment in the market can also affect the US500 share price. For example, if investors are optimistic about the market, the US500 share price may rise, while a pessimistic outlook may lead to a decline.

Case Study: The Impact of the US500 Share Price on the Stock Market

In February 2020, the US500 share price experienced a significant decline due to the outbreak of the COVID-19 pandemic. The index fell by approximately 30% in just a few weeks. This decline was primarily driven by the negative economic impact of the pandemic, including rising unemployment rates, falling consumer spending, and disruptions in global supply chains.

However, as the pandemic situation improved and economies started to recover, the US500 share price began to rise again. By the end of 2020, the index had recovered most of its losses, reflecting the resilience of the U.S. stock market.

Conclusion

Understanding the US500 share price is crucial for investors and traders who want to make informed investment decisions. By analyzing the factors that affect the US500 share price and staying informed about market trends, investors can identify potential opportunities and mitigate risks.