In the world of financial markets, staying updated with stock index futures is crucial for investors. Bloomberg, a leading provider of financial information, offers real-time data on US stock index futures. This article will delve into what you need to know about these futures, their significance, and how to stay ahead of the curve.

Understanding US Stock Index Futures

Firstly, let's define what US stock index futures are. They are financial contracts that allow investors to speculate on the future direction of a stock index. These indexes, such as the S&P 500, represent the performance of a basket of stocks and are widely considered as a gauge of the overall market's health.

Bloomberg's Role in Tracking US Stock Index Futures

Bloomberg plays a pivotal role in tracking and reporting on US stock index futures. Their platform offers real-time updates, historical data, and advanced analytics that help investors make informed decisions. By monitoring these futures, investors can gain insights into market sentiment, potential trends, and upcoming market movements.

Why Are US Stock Index Futures Important?

US stock index futures are significant for several reasons:

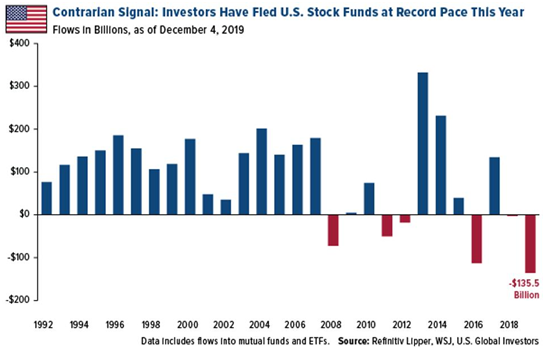

- Market Sentiment: The movement of these futures can reflect market sentiment, indicating whether investors are bullish or bearish on the market.

- Risk Management: Investors can use stock index futures as a hedging tool to protect their portfolio against market downturns.

- Profit Opportunities: Speculating on these futures can offer opportunities for profit, especially if an investor has a strong understanding of market trends.

How to Monitor US Stock Index Futures on Bloomberg

Bloomberg provides a comprehensive suite of tools to monitor US stock index futures. Here are some key features:

- Real-Time Data: Access real-time quotes, prices, and volume data for various stock indexes.

- Historical Data: Analyze historical price movements and identify patterns or trends.

- Customizable Dashboards: Create personalized dashboards to monitor specific indexes or sectors.

- Alerts and Notifications: Set up alerts for price movements, earnings reports, or other market events.

Case Studies: Real-Life Applications of US Stock Index Futures

Let's look at a few real-life examples of how US stock index futures have been used:

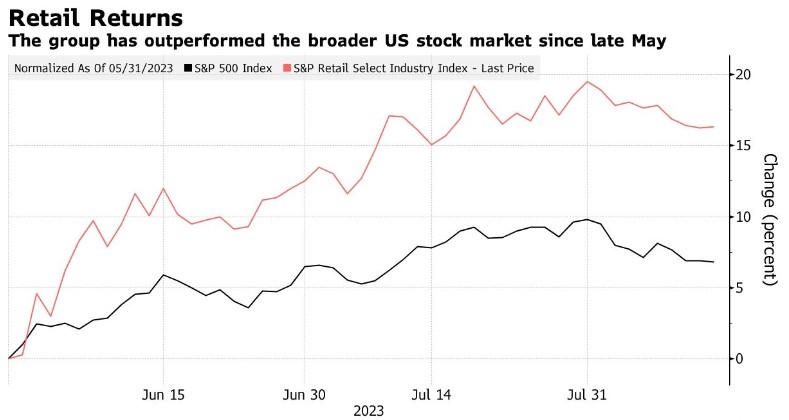

- Speculating on Market Trends: An investor may notice that the S&P 500 futures are showing a strong upward trend. Based on this information, the investor might decide to buy stocks or ETFs that track the S&P 500.

- Hedging Against Market Volatility: A portfolio manager may use stock index futures to hedge their portfolio against potential market downturns, protecting their clients' investments.

- Strategic Positioning: An experienced investor might use US stock index futures to strategically position their portfolio for upcoming market events, such as earnings reports or economic announcements.

Conclusion

Staying informed about US stock index futures is essential for investors looking to navigate the complex financial markets. With the help of platforms like Bloomberg, investors can access real-time data, historical insights, and advanced analytics to make informed decisions. By understanding the significance of these futures and monitoring them closely, investors can increase their chances of success in the financial markets.