In the dynamic world of stock trading, momentum stocks often catch the eye of investors seeking rapid growth. Over the past five days, several US stocks have surged, showcasing their impressive potential. Let's delve into the best performers and what they might indicate for the future.

Top Momentum Stocks in the Past 5 Days

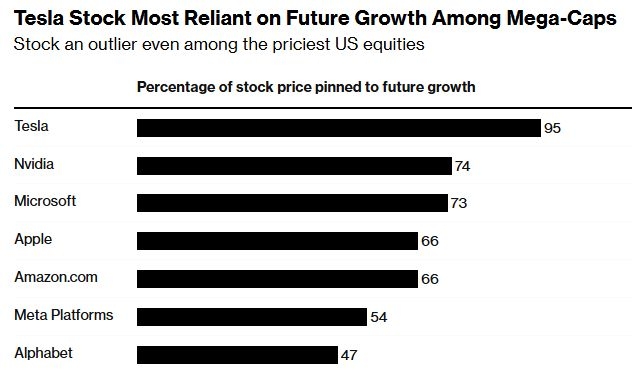

Tesla, Inc. (TSLA)

- Why It's Up: Tesla has been a consistent performer, driven by its leadership in electric vehicles and renewable energy solutions. The recent surge could be attributed to its expanding production capacity and the increasing demand for electric vehicles globally.

- Case Study: Tesla's announcement of its new Gigafactory in Berlin has been a significant driver for its stock price. This expansion into Europe is expected to further boost its market share and revenue.

NVIDIA Corporation (NVDA)

- Why It's Up: NVIDIA's dominance in the GPU market has been a major factor in its impressive performance. The rise in demand for gaming and AI solutions has propelled its stock higher.

- Case Study: NVIDIA's partnership with IBM for AI research and development has been a major boost for its stock. This collaboration is expected to enhance its AI capabilities and market position.

Shopify Inc. (SHOP)

- Why It's Up: Shopify has been a standout performer in the e-commerce sector, driven by its platform's ability to facilitate online sales for businesses of all sizes.

- Case Study: Shopify's recent acquisition of 6 River Systems, a logistics automation company, has been well-received by investors. This acquisition is expected to strengthen Shopify's logistics capabilities and enhance its e-commerce offerings.

Square, Inc. (SQ)

- Why It's Up: Square has been a leader in mobile payment solutions, with its Cash App gaining significant traction among consumers.

- Case Study: Square's partnership with Visa for a new payment service has been a major driver for its stock. This partnership is expected to expand Square's reach and enhance its payment solutions.

Facebook, Inc. (META)

- Why It's Up: Despite recent controversies, Facebook (now Meta) continues to be a major player in the social media and advertising space.

- Case Study: Meta's announcement of its new virtual reality platform, Meta Quest 3, has been a significant driver for its stock. This platform is expected to enhance the company's virtual reality offerings and drive revenue growth.

What These Performances Indicate

The surge in these momentum stocks over the past five days suggests a strong interest in sectors like electric vehicles, technology, and e-commerce. These sectors are expected to see significant growth in the coming years, driven by factors like technological advancements, changing consumer preferences, and government policies.

Investing in Momentum Stocks

Investing in momentum stocks can be risky, as they can be highly volatile. However, for those who are willing to take on the risk, these stocks offer the potential for significant returns. It's essential to conduct thorough research and consider factors like the company's fundamentals, market trends, and potential risks before investing.

Conclusion

The past five days have seen impressive performances from several US momentum stocks. These stocks highlight the potential of sectors like electric vehicles, technology, and e-commerce. As always, investors should conduct thorough research and consider their risk tolerance before investing.