In recent years, the cannabis industry has experienced a remarkable transformation, with a growing number of U.S.-based pot companies emerging as leaders in the market. As more states legalize marijuana, investors are looking for opportunities to tap into this burgeoning sector. This article will provide an in-depth look at US-based pot company stocks, highlighting key players, growth potential, and investment considerations.

Understanding the Market

The U.S. cannabis market is divided into two main segments: medical marijuana and recreational marijuana. Medical marijuana is legal in 33 states, while recreational marijuana is legal in 18 states, plus the District of Columbia. This fragmented regulatory landscape presents both challenges and opportunities for pot companies.

Key Players in the US Cannabis Industry

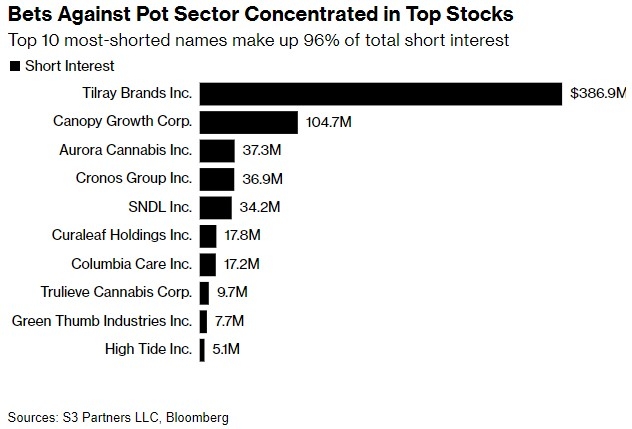

Canopy Growth Corporation (TSX: WEED): Based in Smiths Falls, Ontario, Canada, Canopy Growth is one of the world's largest cannabis companies. The company operates in multiple countries, including the United States, through its subsidiary, Acreage Holdings. Canopy Growth has a strong reputation for its high-quality products and innovative approaches to cannabis cultivation.

Curaleaf Holdings, Inc. (CSE: CURA, OTCQX: CURAF): Curaleaf is the largest U.S. cannabis company by market capitalization. Headquartered in Scottsdale, Arizona, the company operates in 23 states and offers a wide range of cannabis products, including flowers, concentrates, and edibles.

GW Pharmaceuticals PLC (NASDAQ: GWPH): Although not a traditional cannabis company, GW Pharmaceuticals has developed a marijuana-based drug called Epidiolex, which is approved by the FDA for the treatment of epilepsy. The company has a significant presence in the U.S. market and is exploring additional therapeutic applications for its cannabis-based products.

Aurora Cannabis Inc. (TSX: ACB, NYSE: ACB): Aurora Cannabis is another major player in the global cannabis market. The company, based in Edmonton, Alberta, Canada, operates in 25 countries and offers a diverse portfolio of cannabis products, including flowers, oils, and edibles.

Growth Potential

The U.S. cannabis market is expected to grow at a rapid pace in the coming years, driven by increasing demand for medical and recreational marijuana. According to a report by Grand View Research, the U.S. cannabis market is projected to reach $146.4 billion by 2025.

Several factors contribute to this growth potential:

- Legalization: The increasing number of states legalizing marijuana creates a larger market for pot companies.

- Innovation: The cannabis industry is rapidly evolving, with new products and technologies being developed to meet consumer demand.

- Investment: As the market continues to grow, more investors are looking to invest in US-based pot company stocks.

Investment Considerations

Investing in US-based pot company stocks can be risky, as the industry is still in its infancy and subject to regulatory changes. Here are some key considerations for investors:

- Regulatory Risk: The legal status of marijuana varies by state, and federal laws still classify cannabis as a Schedule I drug. This creates uncertainty for pot companies and investors.

- Market Competition: The cannabis industry is highly competitive, with many companies vying for market share.

- Operational Risk: Pot companies face challenges related to cultivation, distribution, and branding.

Case Studies

Curaleaf Holdings, Inc. is a prime example of a successful U.S.-based pot company. The company has grown rapidly through acquisitions and organic growth, becoming the largest cannabis company in the United States. Curaleaf's focus on quality, innovation, and customer service has helped the company achieve its success.

GW Pharmaceuticals PLC is another company that has made significant strides in the cannabis industry. The company's Epidiolex drug has received FDA approval for the treatment of epilepsy, making it a leader in the medical marijuana space.

In conclusion, US-based pot company stocks offer significant growth potential for investors. However, it's important to carefully consider the risks and rewards associated with this industry before making investment decisions.