In the ever-evolving world of technology, investing in the right stocks can be a game-changer. With numerous tech companies making waves, it's crucial to identify the top US tech stocks to buy. This guide will help you navigate through the sea of options and invest in companies with strong potential for growth.

Why Invest in US Tech Stocks?

The US tech industry is renowned for its innovation and leadership. Companies like Apple, Microsoft, and Google have revolutionized various sectors, making them dominant players in the global market. Investing in US tech stocks can offer numerous benefits, including:

- High Growth Potential: Tech companies often experience rapid growth, offering substantial returns on investment.

- Innovation: The US tech industry is at the forefront of innovation, providing investors with access to cutting-edge technologies.

- Diversification: Investing in tech stocks can diversify your portfolio, reducing risks associated with other sectors.

Top US Tech Stocks to Buy in 2023

Apple Inc. (AAPL)

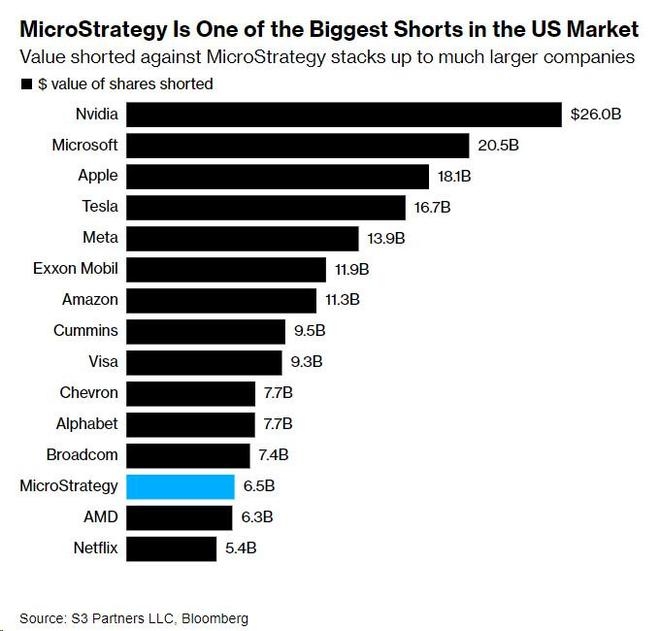

- Why Buy: As the world's largest tech company by market cap, Apple continues to dominate the smartphone, computer, and wearables markets. With a strong ecosystem of products and services, Apple is well-positioned for long-term growth.

Microsoft Corporation (MSFT)

- Why Buy: Microsoft is a leading player in cloud computing, productivity, and gaming. The company's Azure cloud platform and Office 365 suite have gained significant market share, making it a solid investment choice.

Amazon.com, Inc. (AMZN)

- Why Buy: Amazon is the world's largest e-commerce company and continues to expand its services, including cloud computing (Amazon Web Services), digital streaming (Amazon Prime Video), and grocery delivery (Amazon Fresh).

Facebook, Inc. (FB)

- Why Buy: Although the company has faced regulatory challenges, Facebook (now Meta) remains a dominant player in social media and digital advertising. Its recent focus on the metaverse and virtual reality could open new avenues for growth.

Tesla, Inc. (TSLA)

- Why Buy: Tesla is leading the electric vehicle (EV) revolution and has become a symbol of innovation in the automotive industry. The company's growing production capacity and expansion into new markets make it an attractive investment.

Intel Corporation (INTC)

- Why Buy: As a leader in semiconductor manufacturing, Intel continues to develop advanced chips for various applications, including data centers, artificial intelligence, and autonomous vehicles.

Adobe Inc. (ADBE)

- Why Buy: Adobe is a dominant player in digital media and marketing solutions. Its Creative Cloud suite and Document Cloud services have gained widespread adoption among professionals worldwide.

NVIDIA Corporation (NVDA)

- Why Buy: NVIDIA is a leader in graphics processing units (GPUs) and artificial intelligence (AI). The company's GPUs are widely used in gaming, data centers, and autonomous vehicles.

Case Study: Amazon.com, Inc.

Amazon's meteoric rise from an online bookstore to the world's largest e-commerce company is a testament to its innovative business model. The company's focus on customer satisfaction, continuous expansion into new markets, and strategic investments in cloud computing have contributed to its success.

In 1994, Amazon started as an online bookstore. By 1999, it had expanded its product range to include electronics, toys, and other general merchandise. Today, Amazon offers a vast array of products and services, including cloud computing (Amazon Web Services), digital streaming (Amazon Prime Video), and grocery delivery (Amazon Fresh).

Conclusion

Investing in the top US tech stocks can be a lucrative venture. By understanding the potential of these companies and their market positions, you can make informed investment decisions. However, it's crucial to conduct thorough research and consider your risk tolerance before investing.