Introduction: In the ever-evolving world of finance, keeping up with stock prices is crucial for investors and traders alike. One particular stock that has caught the attention of many is Task Us. This article delves into the latest trends and predictions surrounding Task Us stock price, providing valuable insights for those looking to stay ahead in the market.

Understanding Task Us:

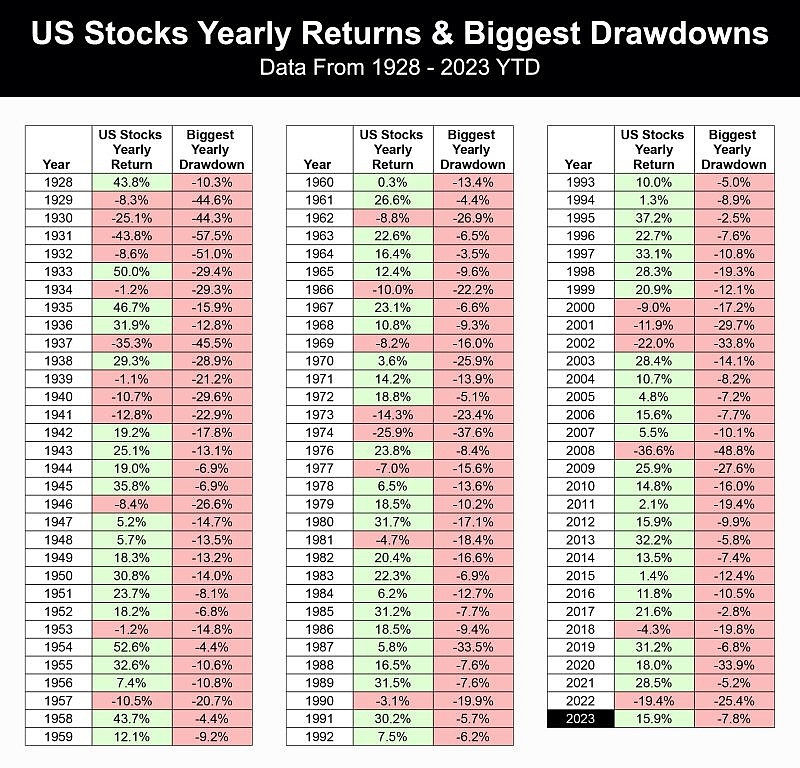

Historical Stock Price Analysis: To gauge the potential future of Task Us stock price, it's crucial to analyze its historical performance. Over the past few years, Task Us has shown remarkable growth, with its stock price experiencing significant ups and downs. By examining these trends, we can identify patterns and make more informed predictions.

Market Trends:

- Sector Performance: The technology sector has been witnessing substantial growth in recent years. Task Us, being a key player in this sector, has benefited from this upward trend.

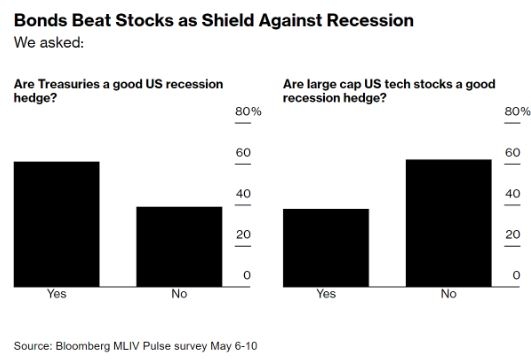

- Economic Factors: Economic indicators such as GDP growth, inflation rates, and interest rates can significantly impact stock prices. Analyzing these factors can provide valuable insights into Task Us' stock price movement.

Company Performance:

- Revenue Growth: Task Us has demonstrated consistent revenue growth, which is a positive sign for its stock price.

- Profitability: Examining the company's profitability, including earnings per share (EPS) and return on equity (ROE), can provide insights into its financial health.

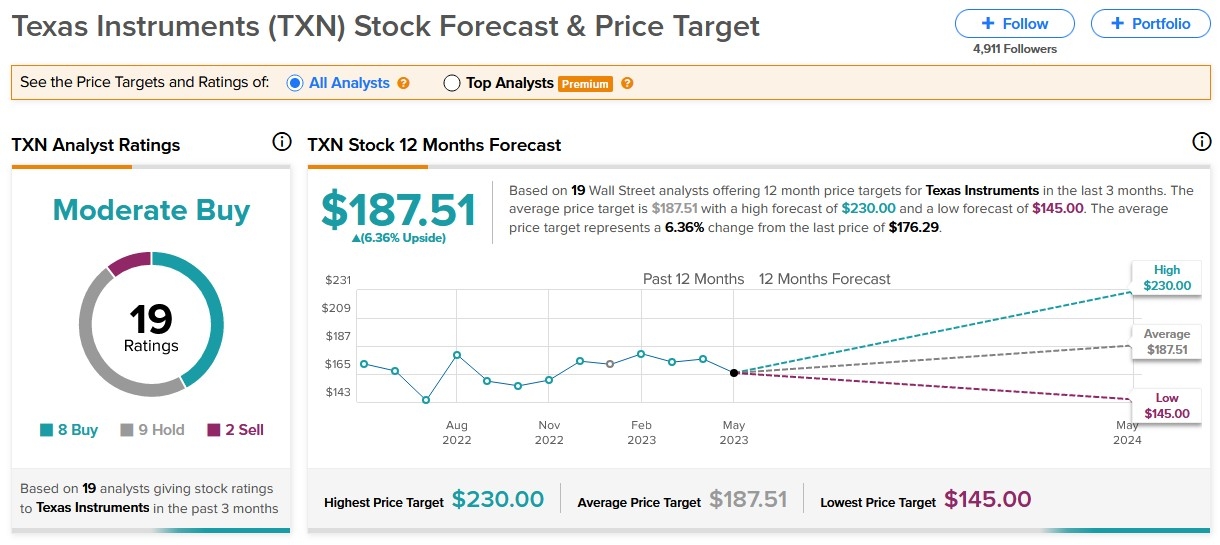

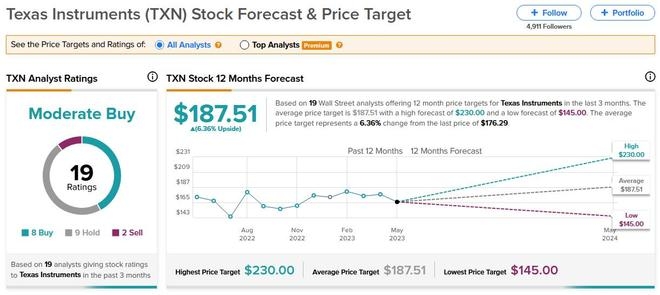

Analyst Predictions: Analysts play a crucial role in predicting stock prices. By analyzing their reports and recommendations, we can gain a better understanding of Task Us' future stock price trajectory.

Predictions for Task Us Stock Price: Based on the analysis of historical trends, market conditions, and analyst predictions, here are some potential scenarios for Task Us stock price:

- Long-term Growth: Given Task Us' strong market position and consistent revenue growth, it is likely to experience long-term growth in its stock price.

- Short-term Volatility: Short-term fluctuations in the stock price are common, especially in the technology sector. Investors should be prepared for volatility in the short term.

- Potential for Dividends: Task Us has the potential to increase dividends, which can provide additional value to shareholders.

Case Study: Task Us Acquisition One notable case study involving Task Us is its acquisition by a major technology conglomerate. This acquisition not only resulted in a significant increase in Task Us' stock price but also opened up new growth opportunities for the company. This case study highlights the potential for significant stock price growth through strategic partnerships and acquisitions.

Conclusion: Understanding the Task Us stock price is crucial for investors and traders looking to capitalize on market trends. By analyzing historical trends, market conditions, and analyst predictions, one can make more informed decisions. While there are inherent risks in the stock market, staying informed and adapting to market conditions can lead to successful investment outcomes.