Introduction: Investing in the stock market can be a thrilling and lucrative venture, but it’s crucial to stay informed about the financial health of companies you consider investing in. One such financial giant that has captured the attention of investors worldwide is TD Bank, a leading financial institution in the United States. In this article, we will delve into the TD Bank US stock quote and explore the factors that contribute to its remarkable performance.

Understanding TD Bank US Stock Quote: The TD Bank US stock quote refers to the current price at which TD Bank’s shares are trading on the stock exchange. It is essential to keep an eye on this figure as it reflects the market’s perception of the company’s value and potential for growth. By analyzing the stock quote, investors can gain insights into the company’s financial standing and make informed decisions about their investments.

Financial Performance: TD Bank has consistently demonstrated strong financial performance, which has contributed to its favorable stock quote. Over the years, the company has managed to maintain a robust balance sheet and generate impressive revenue figures. Here are some key factors that have influenced TD Bank’s financial performance:

Revenue Growth: TD Bank has experienced significant revenue growth, primarily driven by its diverse business segments, including retail banking, wealth management, and commercial banking. This growth has been a testament to the company’s ability to adapt to changing market conditions and cater to the evolving needs of its customers.

Profitability: The bank has consistently reported strong profitability, with healthy net income margins. This profitability can be attributed to effective cost management and strategic expansion into new markets.

Dividend Payouts: TD Bank has a long-standing tradition of paying dividends to its shareholders. The company’s commitment to returning value to investors has bolstered its stock quote and made it an attractive option for income-seeking investors.

Earnings Per Share (EPS): The bank’s EPS has shown consistent growth, reflecting its ability to generate profits from its operations. A rising EPS is often a positive indicator of a company’s financial health and potential for future growth.

Market Trends: Several market trends have influenced TD Bank’s stock quote, making it an appealing investment opportunity. Here are some notable trends:

Low Interest Rates: The current low-interest rate environment has provided a favorable backdrop for banks like TD Bank, as it allows them to lend at lower rates while maintaining a healthy spread between their interest expenses and income.

Economic Recovery: The ongoing economic recovery has led to increased consumer spending and business activity, which has positively impacted TD Bank’s revenue streams.

Regulatory Environment: The regulatory environment has been relatively stable, allowing TD Bank to focus on its core business activities without significant disruptions.

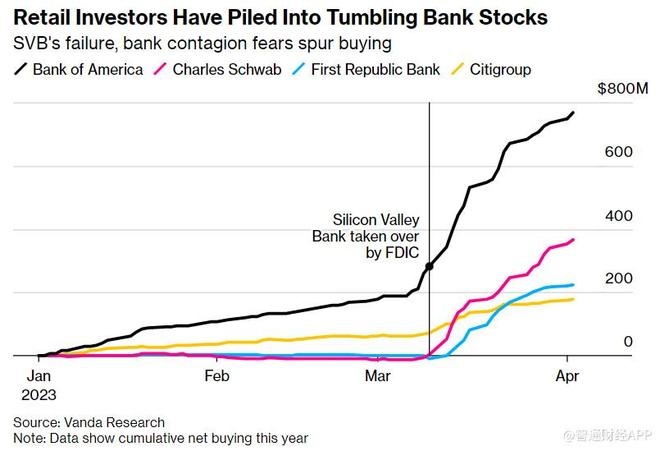

Case Study: TD Bank Acquisition of First Republic Bank One recent case study that highlights TD Bank’s strategic moves is its acquisition of First Republic Bank. This acquisition has expanded TD Bank’s market presence and added significant value to its balance sheet. The successful integration of First Republic Bank has contributed to TD Bank’s growing stock quote and solidified its position as a financial powerhouse in the United States.

Conclusion: In conclusion, the TD Bank US stock quote is a reflection of the company’s strong financial performance, strategic expansion, and market trends. By analyzing the stock quote and understanding the various factors that influence it, investors can make informed decisions about their investments. TD Bank’s impressive track record and potential for future growth make it a compelling investment opportunity in the current market landscape.