In the ever-evolving world of finance, the US stock market remains a cornerstone of global economic activity. As of [current date], the market is experiencing a mix of opportunities and challenges. This article provides a comprehensive overview of the current state of the US stock market, including key trends, notable developments, and potential future directions.

Current Market Trends

- Technology Stocks Dominate: The technology sector has been a major driver of the US stock market's growth in recent years. Companies like Apple, Microsoft, and Amazon have seen significant gains, contributing to the overall market's upward trend.

- Economic Recovery: The US economy has been gradually recovering from the impact of the COVID-19 pandemic. This recovery has been supported by various stimulus measures and the increasing vaccination rate, which has helped to boost consumer confidence and spending.

- Inflation Concerns: Despite the economic recovery, inflation remains a concern for investors. The Federal Reserve has been closely monitoring inflation and has indicated that it may take steps to control rising prices.

Notable Developments

- Tesla's Record-Breaking Stock Price: In April 2021, Tesla's stock price reached an all-time high, making it the most valuable carmaker in the world. This milestone highlights the growing importance of electric vehicles and sustainable technologies in the global market.

- Facebook's Name Change: In October 2021, Facebook announced that it would change its name to Meta, reflecting its expanding focus on virtual reality and other immersive technologies.

- Inflation-Linked Bonds: In response to rising inflation, the US Treasury has started issuing inflation-protected bonds, which offer investors a way to protect their portfolios against inflationary pressures.

Potential Future Directions

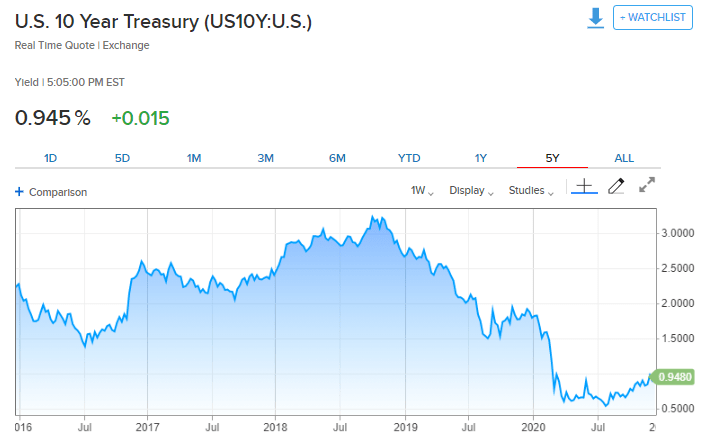

- Interest Rate Hikes: The Federal Reserve has indicated that it may start raising interest rates later this year. This could potentially slow down the stock market's growth, but it may also help to control inflation.

- Economic Diversification: The US stock market has traditionally been heavily reliant on technology and financial sectors. However, there is a growing trend towards diversification, with increased investment in sectors like healthcare, consumer goods, and renewable energy.

- Global Economic Recovery: As the global economy continues to recover from the pandemic, the US stock market is likely to benefit from increased trade and investment opportunities.

Case Study: Apple's Stock Performance

Apple's stock has been a major driver of the US stock market's growth in recent years. Since 2012, Apple's stock price has increased by over 500%, making it one of the best-performing stocks in the market. This growth can be attributed to several factors, including:

- Innovative Products: Apple has consistently introduced innovative products, such as the iPhone, iPad, and Apple Watch, which have helped to drive demand and revenue growth.

- Strong Earnings: Apple has consistently reported strong earnings, which have helped to boost investor confidence and drive stock price gains.

- Global Expansion: Apple has expanded its presence in key markets around the world, which has helped to drive revenue growth and increase its market share.

In conclusion, the US stock market is currently experiencing a mix of opportunities and challenges. While technology stocks continue to dominate, there are also signs of economic recovery and diversification. As investors navigate this complex landscape, it is important to stay informed and stay focused on long-term investment strategies.