In the ever-evolving world of finance, the stock market serves as a critical barometer of economic health and investor sentiment. Known as "the market," it offers invaluable insights into the direction of the economy, potential risks, and opportunities. By examining the intercept, or the point at which the stock market intersects with various factors, we can gain a deeper understanding of the market's potential implications. This article delves into the intercept and what it can tell us about the stock market.

Understanding the Intercept

The intercept refers to the starting point or baseline of a stock's price, which is determined by the equation of the line representing the relationship between the stock's price and a specific variable, such as time, market capitalization, or economic indicators. By analyzing the intercept, investors and analysts can identify trends, patterns, and potential risks within the stock market.

Economic Indicators and the Intercept

Economic indicators, such as unemployment rates, GDP growth, and inflation, play a crucial role in determining the intercept of a stock. For instance, when the unemployment rate is low, indicating a strong labor market, the intercept of a stock may rise as investors expect higher earnings for companies. Conversely, a high unemployment rate could lead to a lower intercept, reflecting investor concerns about the economy.

Market Capitalization and the Intercept

Market capitalization, or the total value of a company's outstanding shares, also influences the intercept. Generally, companies with higher market capitalizations have higher intercepts, as investors perceive them as more stable and less risky. Conversely, companies with lower market capitalizations may have lower intercepts, indicating higher risk and potential for growth or decline.

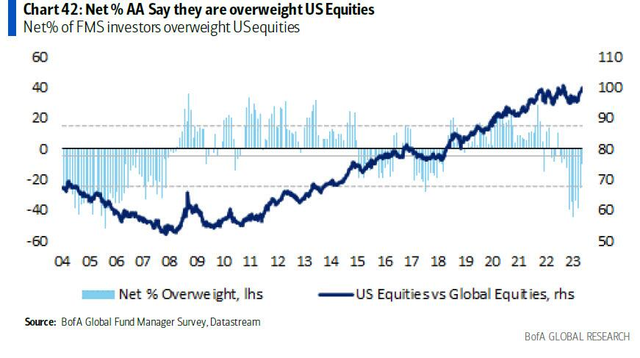

Investor Sentiment and the Intercept

Investor sentiment, or the overall mood of investors in the market, is another critical factor affecting the intercept. When investors are optimistic, the intercept may rise, as they are willing to pay higher prices for stocks. On the other hand, when investors are pessimistic, the intercept may fall, reflecting a lack of confidence in the market.

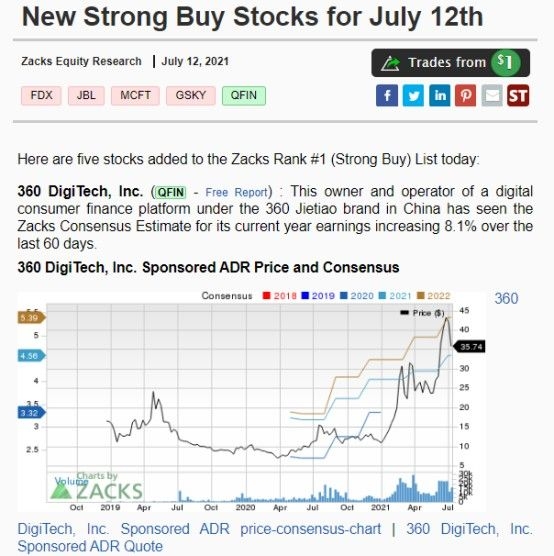

Case Study: Tech Stocks and the Intercept

To illustrate the impact of the intercept, let's consider the technology sector. In recent years, tech stocks have seen significant growth, with their intercepts rising accordingly. This can be attributed to factors such as increasing demand for technology products and services, strong earnings reports, and a positive outlook for the future of the industry. However, as investor sentiment shifts, the intercept of tech stocks may fluctuate, reflecting changes in investor confidence.

Conclusion

The intercept of the stock market serves as a valuable tool for investors and analysts to gauge the direction of the economy, potential risks, and opportunities. By examining the relationship between various factors and the intercept, we can gain a deeper understanding of the stock market and make more informed investment decisions. As always, it's crucial to consider a range of factors and maintain a balanced perspective when analyzing the intercept and its implications for the stock market.