In the United States, the stock market is often a reflection of the nation's political climate. The upcoming elections are no exception. As investors, it's crucial to understand how political events, such as the US elections, can impact the stock market. This article explores the potential effects of the upcoming elections on stocks and provides insights into how investors can navigate these changes.

The Political Landscape

The upcoming elections in the United States are shaping up to be highly competitive. With a divided Congress and a contentious presidential race, the political landscape is more uncertain than ever. This uncertainty can lead to volatility in the stock market, as investors react to potential policy changes and political developments.

Historical Precedents

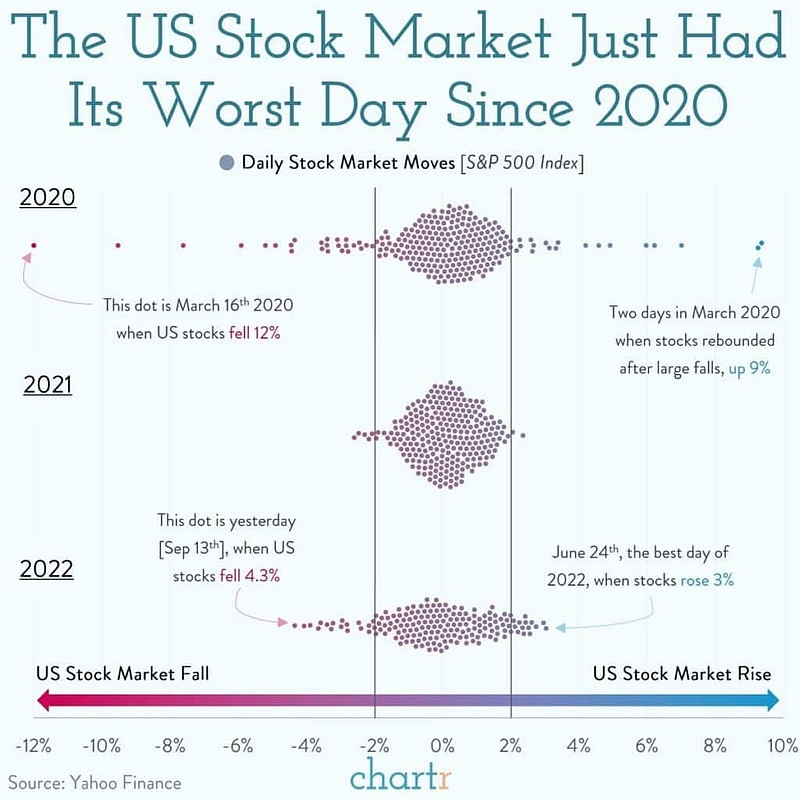

Historically, political events have had a significant impact on the stock market. For example, during the 2016 presidential election, the market experienced a period of volatility as investors awaited the outcome. Similarly, the 2020 election brought about a surge in market uncertainty, which was reflected in the stock market's performance.

Potential Impacts of the Upcoming Elections

1. Tax Policies

One of the key areas where political events can impact the stock market is through tax policies. Different political parties have varying views on taxation, which can lead to changes in corporate tax rates. For instance, if the Democrats win the presidency and maintain control of Congress, they may push for higher corporate tax rates. This could potentially lead to a decline in stock prices, as companies may face increased costs.

2. Healthcare Policies

Healthcare policies are another area where political events can have a significant impact on the stock market. Different political parties have different approaches to healthcare, which can affect industries such as pharmaceuticals and healthcare services. For example, if the Democrats win the presidency and maintain control of Congress, they may push for more regulations on the pharmaceutical industry. This could lead to lower stock prices for pharmaceutical companies.

3. Environmental Policies

Environmental policies are also a crucial area where political events can impact the stock market. Different political parties have different views on climate change and environmental regulations. For instance, if the Democrats win the presidency and maintain control of Congress, they may push for stricter environmental regulations. This could lead to increased costs for companies in industries such as energy and manufacturing, potentially leading to lower stock prices.

Navigating the Market

As investors, it's crucial to stay informed about political events and their potential impact on the stock market. Here are some tips for navigating the market during the upcoming elections:

- Stay Informed: Keep up-to-date with the latest political news and developments. This will help you understand the potential impact of different political events on the stock market.

- Diversify Your Portfolio: Diversifying your portfolio can help mitigate the risk of political events impacting your investments. Consider investing in different sectors and asset classes to spread out your risk.

- Seek Professional Advice: If you're unsure about how to navigate the market during the upcoming elections, consider seeking advice from a financial advisor. They can provide personalized guidance based on your individual investment goals and risk tolerance.

Conclusion

The upcoming US elections are a crucial event that could have a significant impact on the stock market. By understanding the potential impacts of political events and staying informed, investors can navigate the market and make informed decisions. As always, it's crucial to stay diversified and seek professional advice when needed.