The ongoing trade war between the United States and China has sent shockwaves through global markets, with investors closely monitoring the effects on stocks. The conflict, which has seen tariffs and trade barriers imposed on a wide range of goods, has particularly affected companies with significant exposure to the US and Chinese markets. In this article, we delve into the impact of the trade war on stocks, exploring the affected sectors and the implications for investors.

Agricultural Stocks Take a Hit

One of the sectors most affected by the US-China trade war is agriculture. The US has imposed tariffs on Chinese imports of soybeans, pork, and other agricultural products, leading to a significant decrease in demand for American agricultural goods in China. This has had a detrimental effect on US agricultural stocks, with companies such as Monsanto and John Deere experiencing downward pressure on their shares.

Technology Stocks Feel the Heat

The technology sector has also been significantly impacted by the trade war. The US government has imposed restrictions on the export of certain technologies to China, affecting companies such as Apple and Microsoft. These restrictions have led to concerns about supply chains and potential delays in product development, causing investors to reassess their investments in technology stocks.

Automotive Stocks Face Uncertainty

The automotive industry has been another major sector affected by the trade war. The US has imposed tariffs on Chinese-made cars, which has led to a decrease in demand for these vehicles in the US market. This has had a knock-on effect on companies such as Tesla and BMW, with investors concerned about the potential for further trade barriers and increased production costs.

Financial Stocks and the Trade War

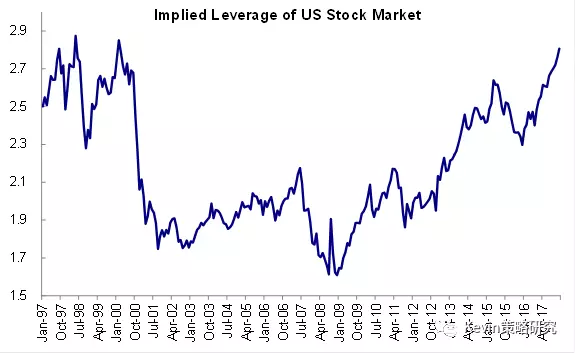

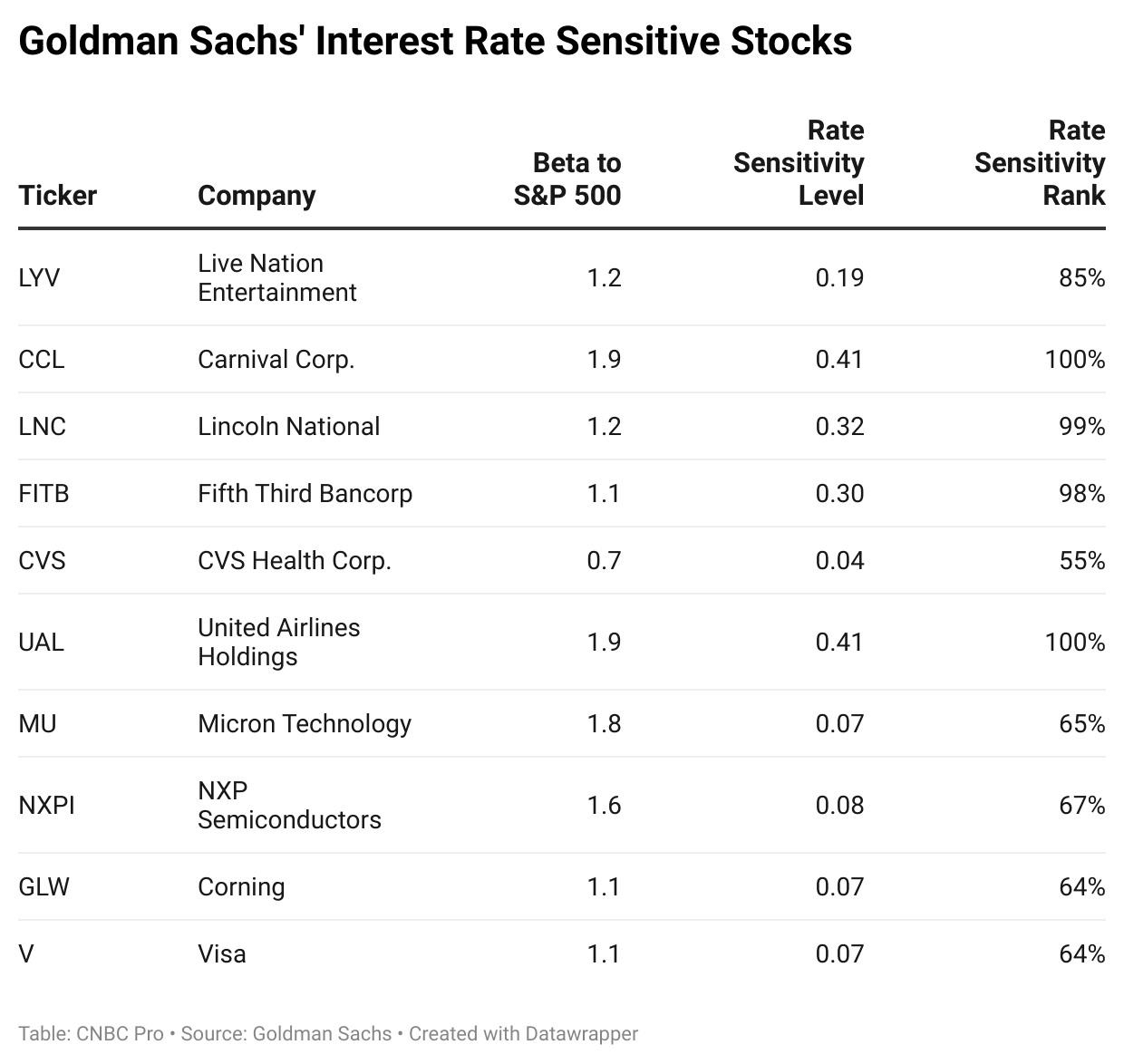

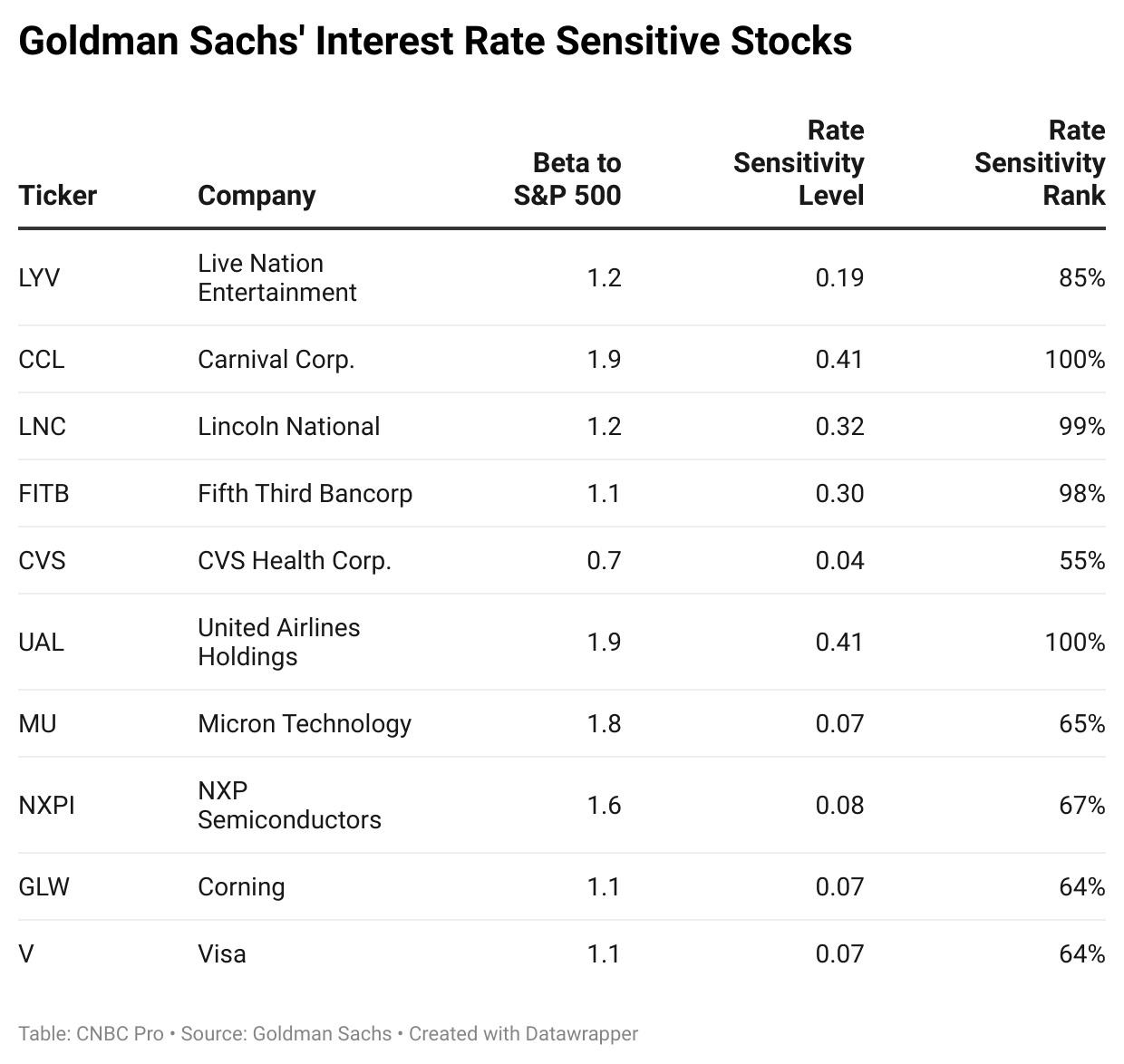

The trade war has also had implications for financial stocks. As tensions escalate, investors are becoming increasingly cautious, leading to higher volatility in the stock market. This has had a negative impact on financial institutions, with companies such as Goldman Sachs and JPMorgan Chase experiencing downward pressure on their shares.

Case Studies: Apple and Tesla

To illustrate the impact of the trade war on individual companies, let's consider two prominent examples: Apple and Tesla.

Apple: As a significant exporter to China, Apple has been affected by the trade war. The company's supply chain, which includes many Chinese manufacturers, has been disrupted by tariffs and trade barriers. This has led to concerns about the company's ability to maintain its market share in China, and investors have been reassessing their investments accordingly.

Tesla: Tesla, which has a growing market in China, has also been affected by the trade war. The company has faced challenges in securing parts and components from its suppliers in China, leading to increased production costs and delays. This has raised concerns about the company's ability to maintain its growth trajectory in the world's largest automotive market.

In conclusion, the US-China trade war has had a significant impact on stocks, affecting a wide range of sectors and individual companies. Investors need to be aware of the potential risks and implications of the trade war when making investment decisions.