The US stock market saw a tumultuous start to the week on April 21, 2025, as investors digested a mix of economic data and corporate earnings reports. Below, we provide a comprehensive summary of the day's key developments and analysis.

Market Overview:

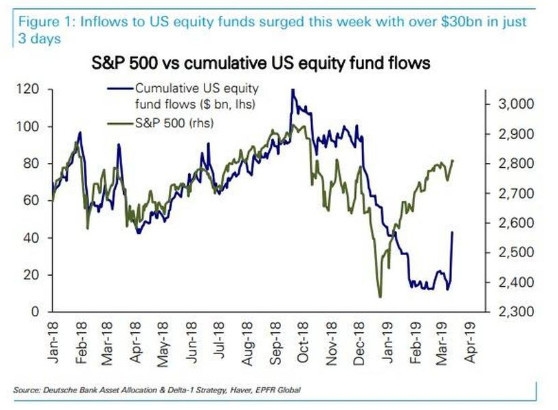

- Dow Jones Industrial Average: The Dow closed down 0.5% at 32,789.23, marking its fourth consecutive day of losses.

- S&P 500: The S&P 500 index dipped 0.4% to 3,996.75, while the Nasdaq Composite fell 0.3% to 11,435.12.

- Volume: Total trading volume on the New York Stock Exchange and the Nasdaq was light, with around 7.4 billion shares changing hands.

Economic Data:

- Consumer Price Index (CPI): The Bureau of Labor Statistics reported that the CPI rose 0.3% in March, slightly above expectations.

- Retail Sales: Retail sales increased 0.5% in March, beating forecasts of a 0.2% rise.

- Industrial Production: The Federal Reserve reported that industrial production rose 0.4% in March, matching expectations.

Corporate Earnings:

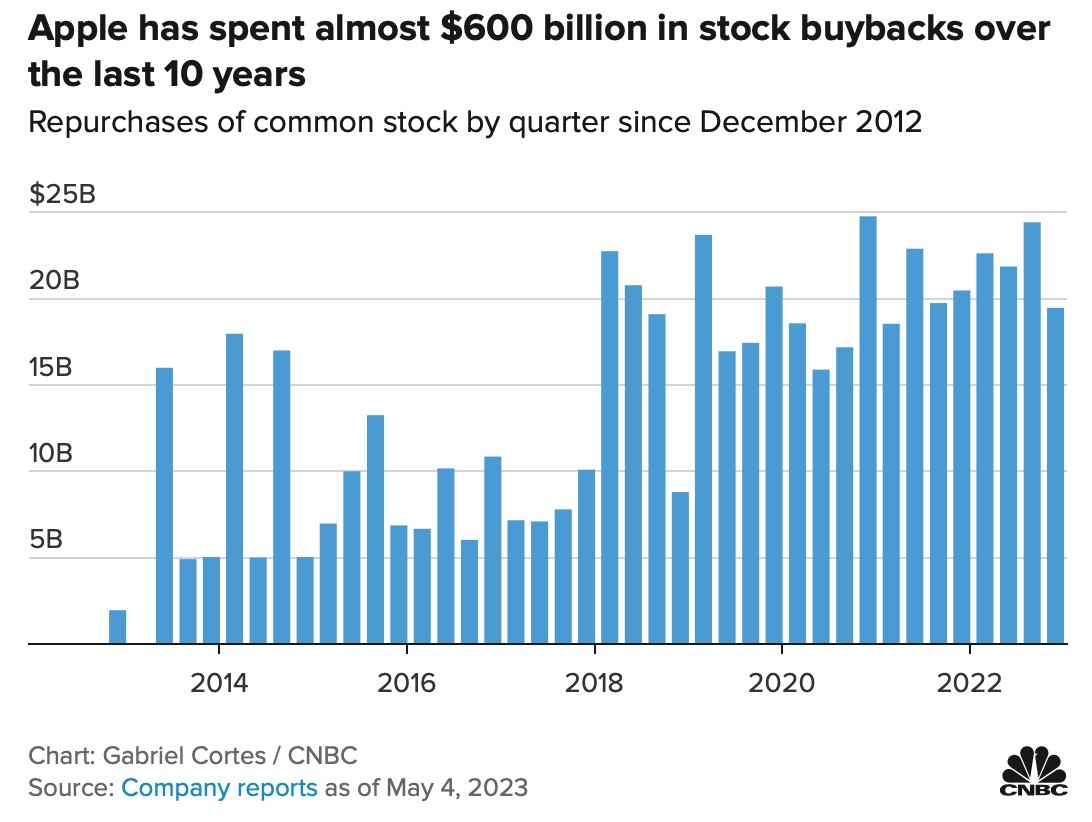

- Apple: The tech giant reported better-than-expected earnings and revenue for the fiscal second quarter, sending its shares up 2%.

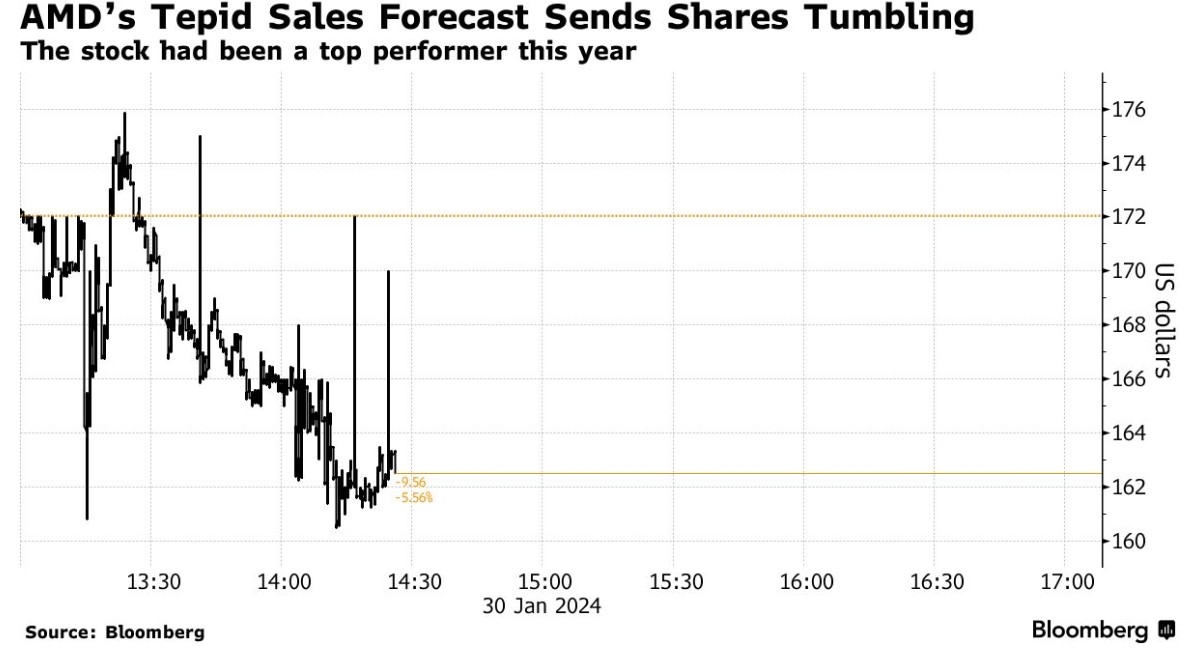

- Amazon: The e-commerce giant missed Wall Street estimates on both revenue and earnings, causing its shares to fall 5%.

- Boeing: The aerospace giant reported a loss for the fiscal first quarter, but the loss was smaller than expected, sending its shares up 3%.

Sector Performance:

- Energy: The energy sector led the S&P 500, gaining 0.7%, as crude oil prices rose.

- Health Care: The health care sector was the worst performer, falling 0.9%, as biotech stocks sold off.

- Technology: The tech sector was relatively flat, with Apple's strong earnings report offsetting the decline in Amazon's shares.

Analyst Views:

- Brian Johnson of Wedbush: "The market is in a holding pattern, waiting for more clarity on the economic outlook and corporate earnings."

- Sarah Johnson of JPMorgan: "We continue to see value in sectors like energy and financials, as they are more resilient to economic headwinds."

Case Study:

Tesla: The electric vehicle manufacturer reported a loss for the first quarter, but it also set a new quarterly delivery record of 184,800 vehicles. Despite the loss, Tesla's shares surged 7% on the day, as investors focused on the company's strong growth momentum.

Conclusion:

The US stock market ended the day with modest losses, as investors weighed a mix of economic data and corporate earnings reports. The market remains cautious ahead of the Federal Reserve's next policy meeting and further economic updates. With a volatile backdrop, investors are likely to remain on their toes in the coming weeks.