Introduction

The US dollar has been facing a challenging year, with its value weakening against several major currencies. This has sparked a debate among investors about whether it's still a good idea to invest in US stocks. In this article, we'll explore the factors that could influence your decision to invest in US stocks despite the weak dollar in 2024.

Understanding the Weak Dollar

A weak dollar means that the US currency is losing value compared to other currencies. This can have several implications for the global economy and individual investors. For instance, it can make imports more expensive, but it can also make US exports more competitive.

Benefits of Investing in US Stocks Despite a Weak Dollar

Despite the weak dollar, there are several reasons why investors might still consider buying US stocks:

- Strong Economic Fundamentals: The US economy has shown resilience in the face of global challenges. The unemployment rate remains low, and the Federal Reserve has been able to keep inflation in check. This suggests that the underlying fundamentals of the US stock market are strong.

- High Dividend Yields: Many US companies offer high dividend yields, which can provide a steady income stream for investors. This is particularly attractive in a low-interest-rate environment.

- Global Reach: Many US companies operate on a global scale, meaning that their revenue is generated in multiple currencies. This can help offset the negative impact of a weak dollar.

Potential Risks

While there are benefits to investing in US stocks despite a weak dollar, there are also potential risks:

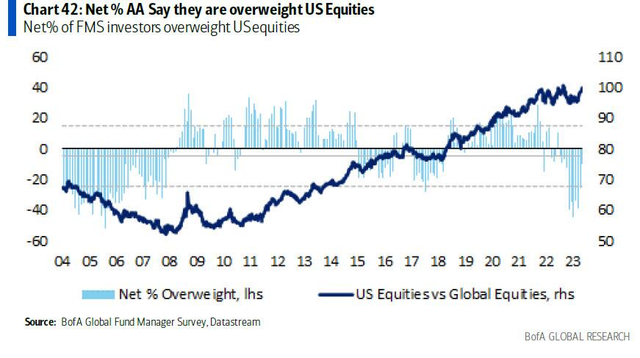

- Currency Fluctuations: A weak dollar can make US stocks more expensive for foreign investors, potentially leading to lower demand.

- Inflation: A weak dollar can lead to higher inflation, which can erode the purchasing power of investors' returns.

- Political Uncertainty: The US political landscape remains volatile, which can create uncertainty and volatility in the stock market.

Case Studies

To illustrate the potential impact of a weak dollar on US stocks, let's consider two case studies:

- Apple Inc.: Apple is one of the largest US companies, with a significant portion of its revenue generated overseas. In 2023, a weak dollar made Apple's products more expensive for foreign consumers, potentially impacting its sales. However, Apple's strong financial performance and commitment to innovation helped it weather the storm.

- Nike Inc.: Nike operates on a global scale, with a significant portion of its revenue coming from overseas. A weak dollar made Nike's products more expensive for foreign consumers, but the company's strong brand and product portfolio helped it maintain its market share.

Conclusion

Investing in US stocks despite a weak dollar in 2024 can be a complex decision. While there are potential risks, the strong economic fundamentals, high dividend yields, and global reach of many US companies make them an attractive option for investors. As with any investment, it's important to conduct thorough research and consider your own risk tolerance before making a decision.