The Organization of the Petroleum Exporting Countries (OPEC) plays a pivotal role in the global oil market. Its decisions can significantly impact various sectors, including the technology industry. In this article, we will delve into how OPEC's actions affect U.S. tech stocks and the broader market.

OPEC's Influence on Global Oil Prices

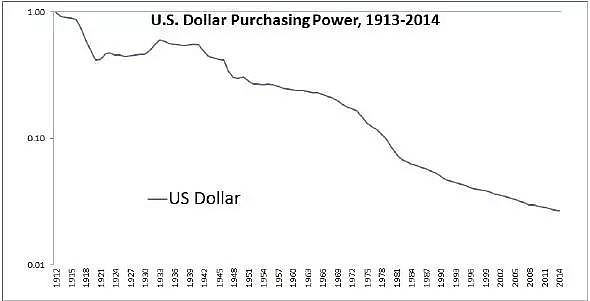

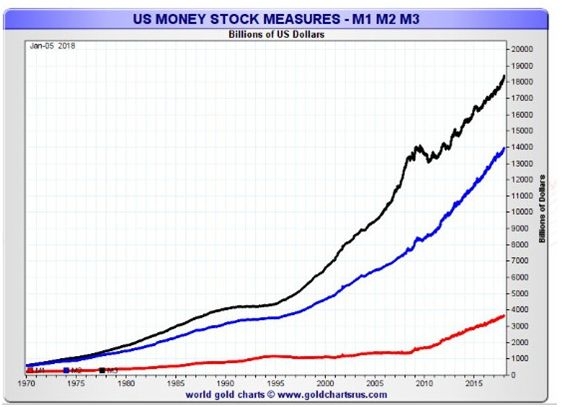

OPEC is responsible for producing and exporting a substantial portion of the world's oil. Its members, including Saudi Arabia, Iran, and Venezuela, collectively determine the supply of crude oil. By adjusting production levels, OPEC can influence global oil prices, which, in turn, affect various industries, including technology.

How Oil Prices Impact Tech Stocks

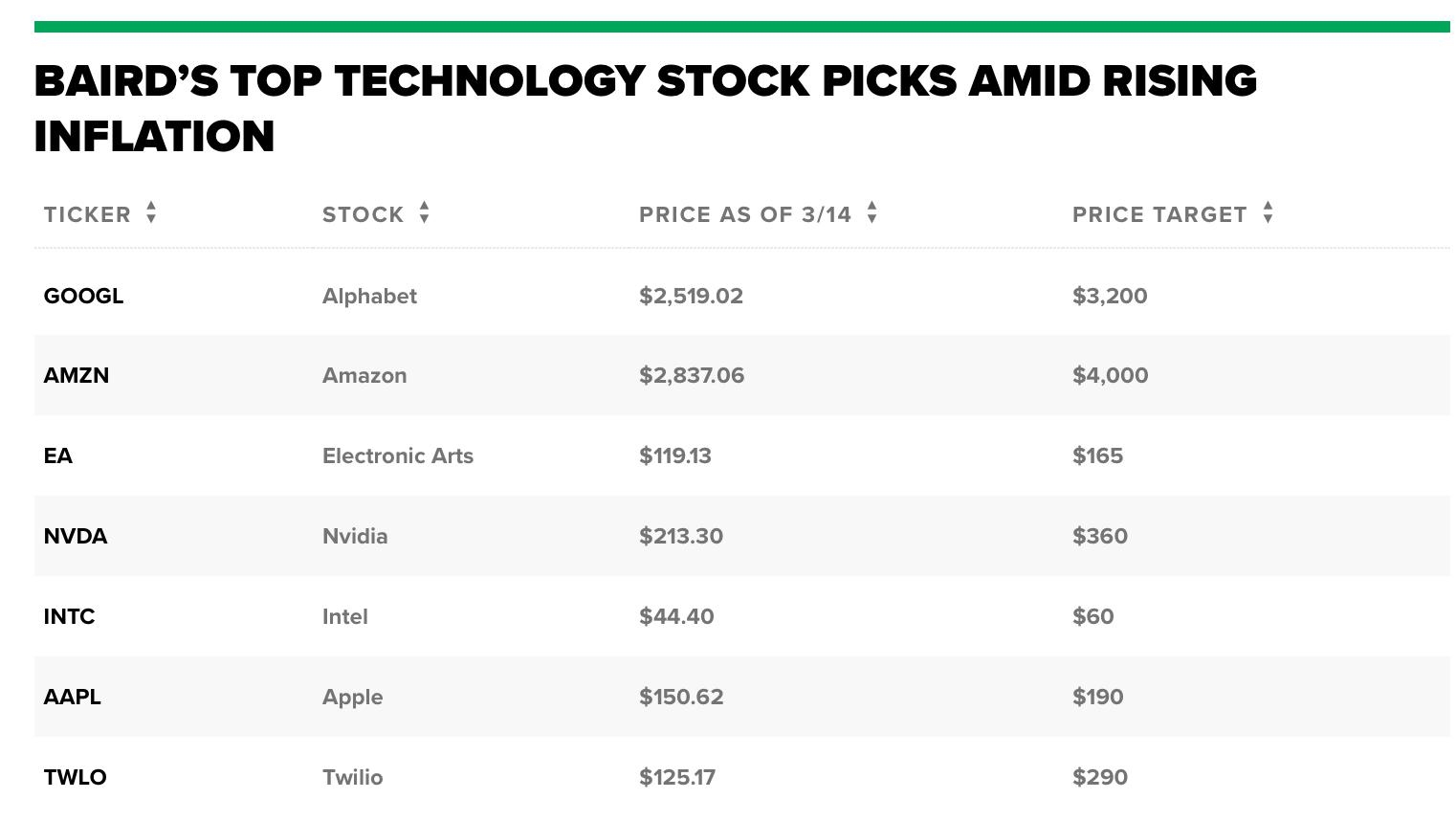

Semiconductor Industry: The semiconductor industry heavily relies on oil for manufacturing processes. Higher oil prices can increase production costs, leading to higher prices for chips and, subsequently, for tech products. As a result, companies like Intel and NVIDIA may experience increased expenses and lower profitability.

Transportation: The transportation of goods and services is another significant factor influenced by oil prices. Higher oil prices can lead to increased transportation costs, which can be passed on to consumers in the form of higher prices for tech products. This can negatively impact the revenue of companies like Amazon and FedEx.

Data Centers: Data centers, which are the backbone of the tech industry, consume vast amounts of electricity. Higher oil prices can lead to increased electricity costs, which can impact the profitability of cloud computing companies like Amazon Web Services (AWS).

Case Study: OPEC's Decision in 2014

In 2014, OPEC decided to maintain its production levels despite a global oil glut, leading to a significant drop in oil prices. This decision had a profound impact on the tech industry.

- Consumer Spending: Lower oil prices led to increased consumer spending, as people had more disposable income. This, in turn, resulted in higher demand for tech products.

- Tech Companies: Companies like Apple and Samsung saw a surge in sales, as consumers bought more smartphones and other tech gadgets.

- Semiconductor Industry: Despite the drop in oil prices, the semiconductor industry experienced a decline in revenue due to increased production costs and lower demand for chips.

Conclusion

OPEC's decisions have a significant impact on the global oil market, which, in turn, affects the technology industry. Understanding the relationship between OPEC, oil prices, and tech stocks is crucial for investors and industry professionals. By staying informed about OPEC's actions and their implications, stakeholders can make more informed decisions and navigate the ever-changing landscape of the tech industry.