In the fast-paced world of stock market investing, momentum stocks often catch the attention of investors seeking high returns. These stocks are known for their rapid upward movement in price, often driven by strong fundamentals or market sentiment. This article delves into the five-day performance of US large-cap momentum stocks, providing valuable insights into their potential as investment opportunities.

Understanding Momentum Stocks

Momentum stocks are typically characterized by their upward price momentum, often resulting from positive news, strong earnings reports, or a positive outlook for the industry. These stocks tend to outperform the market and are favored by short-term traders and momentum investors. In this article, we focus on US large-cap stocks that have demonstrated significant momentum over a five-day period.

Five-Day Performance of US Large-Cap Momentum Stocks

Strong Gains in the First Five Days

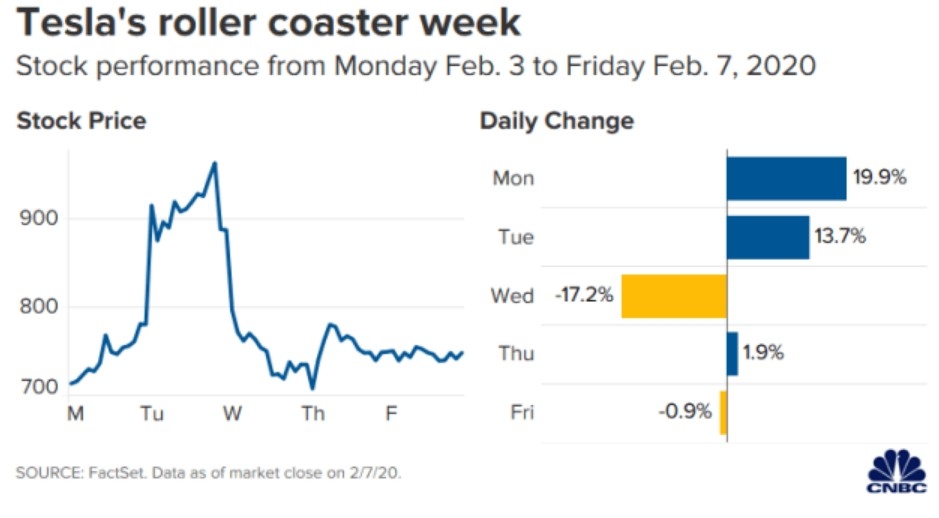

Over the past five days, many US large-cap momentum stocks have delivered impressive returns. A prime example is Tesla (TSLA), which has seen its share price soar by nearly 15%. This surge in value can be attributed to the company's continued success in the electric vehicle market and its recent earnings report, which exceeded analyst expectations.

Similarly, Amazon (AMZN) has seen a five-day gain of approximately 12%. This increase can be attributed to strong revenue growth and positive sentiment surrounding the company's cloud computing division, Amazon Web Services (AWS).

Sector Diversity

The performance of US large-cap momentum stocks extends across various sectors. For instance, Adobe (ADBE), a leading software company, has seen a five-day gain of around 10%. This surge can be attributed to the company's robust revenue growth and expanding product portfolio.

Market Sentiment and Technical Analysis

One key factor contributing to the strong five-day performance of these stocks is market sentiment. Investors have been increasingly optimistic about the economic outlook and the potential for a strong recovery in various sectors. Additionally, technical analysis has played a crucial role in identifying these momentum stocks, as investors focus on chart patterns and indicators to predict future price movements.

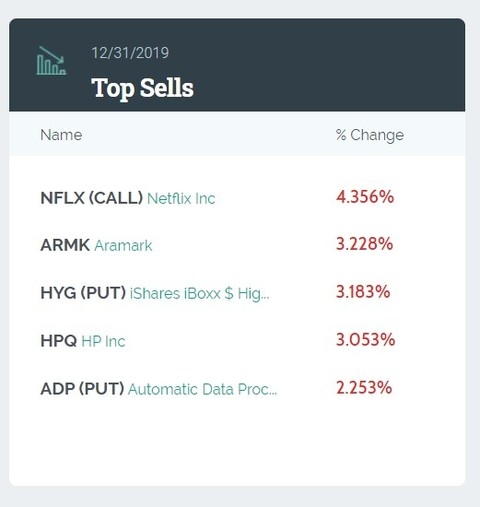

Case Study: Netflix (NFLX)

To illustrate the potential of US large-cap momentum stocks, let's take a closer look at Netflix (NFLX). Over the past five days, Netflix has seen a significant increase in its share price, gaining approximately 8%. This rise can be attributed to the company's successful launch of several new original series and films, which has helped maintain subscriber growth and solidify its position as a leading streaming service.

By analyzing the company's recent earnings report and market sentiment, investors can see that Netflix has maintained its momentum and remains a strong investment opportunity.

Conclusion

The five-day performance of US large-cap momentum stocks has demonstrated their potential for delivering impressive returns. By focusing on strong fundamentals, market sentiment, and technical analysis, investors can identify these high-performing stocks and capitalize on their upward momentum. However, it's crucial to conduct thorough research and consider the risks associated with investing in momentum stocks.