In the ever-evolving landscape of global finance, understanding the macro risks that could impact the US stock market is crucial for investors. As the economy continues to shift and adapt, these risks can significantly influence the outlook for US stocks. In this article, we'll delve into some of the key macro risks currently shaping the US stocks outlook and discuss how investors can navigate these challenges.

Inflation and Interest Rates

One of the most significant macro risks currently facing the US stock market is inflation. The Federal Reserve has been raising interest rates to combat rising inflation, which has created uncertainty in the market. Higher interest rates can lead to increased borrowing costs for companies, potentially slowing down economic growth and affecting stock prices.

For example, tech giants like Apple and Microsoft, which rely heavily on consumer spending, may face challenges if inflation continues to rise. These companies could see a decrease in demand for their products as consumers become more cautious with their spending.

Geopolitical Tensions

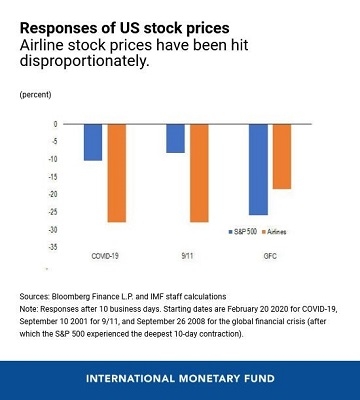

Geopolitical tensions also pose a significant risk to the US stock market. Issues such as trade disputes, political instability, and conflicts can create uncertainty and volatility in the market. In recent years, tensions between the US and China have been a major concern for investors.

For instance, the ongoing trade war between the two countries has led to increased tariffs and supply chain disruptions, affecting companies like Apple and Tesla. These tensions could continue to impact the US stock market in the coming years.

Economic Slowdown

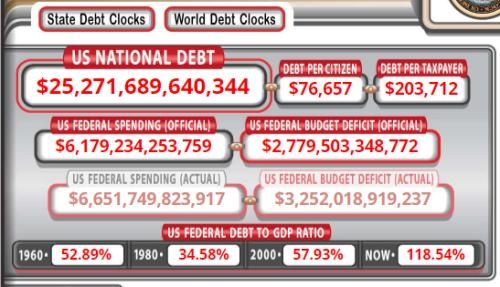

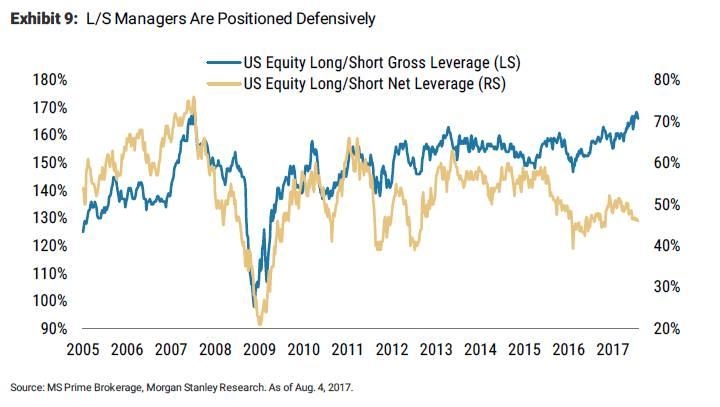

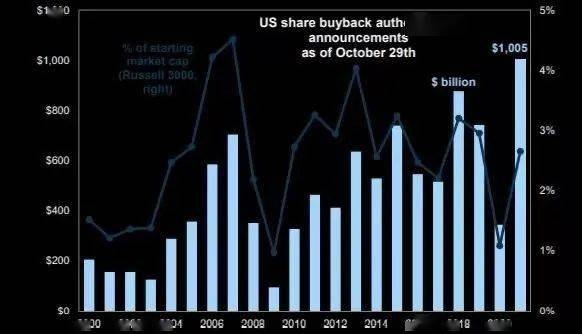

Another macro risk is the potential for an economic slowdown. As the global economy faces challenges such as rising debt levels and slowing growth, the US stock market may be vulnerable to a downturn.

For example, the 2008 financial crisis was a result of a global economic slowdown. While the current economic environment is not as dire as it was during that time, investors should remain vigilant and be prepared for potential risks.

Technological Disruption

Technological disruption is another significant macro risk that could impact the US stock market. As new technologies emerge and disrupt traditional industries, some companies may struggle to keep up, leading to a decrease in their stock prices.

For instance, the rise of renewable energy technologies has threatened the profitability of traditional energy companies. Investors should be aware of these disruptions and consider their impact on their portfolios.

Conclusion

In conclusion, the US stock market outlook is shaped by a variety of macro risks, including inflation, geopolitical tensions, economic slowdowns, and technological disruptions. While these risks can create uncertainty and volatility in the market, they also present opportunities for investors who are willing to do their homework and stay informed.

By understanding and staying prepared for these risks, investors can navigate the US stock market with confidence and potentially achieve long-term success.